Global Automotive Aluminum Market 2030 Forecast Report

One of the most significant drivers of the Global Automotive Aluminum market is the industry's persistent pursuit of lightweighting to enhance fuel efficiency.

Introduction

The Global Automotive Aluminum Market has become one of the most transformative and dynamic segments of the automotive industry. Valued at USD 28.46 billion in 2023, the market is projected to reach nearly USD 39.90 billion by 2029, growing at a CAGR of 5.85%. The demand is propelled by the automotive sector’s relentless pursuit of lightweighting, efficiency, sustainability, and enhanced vehicle performance.

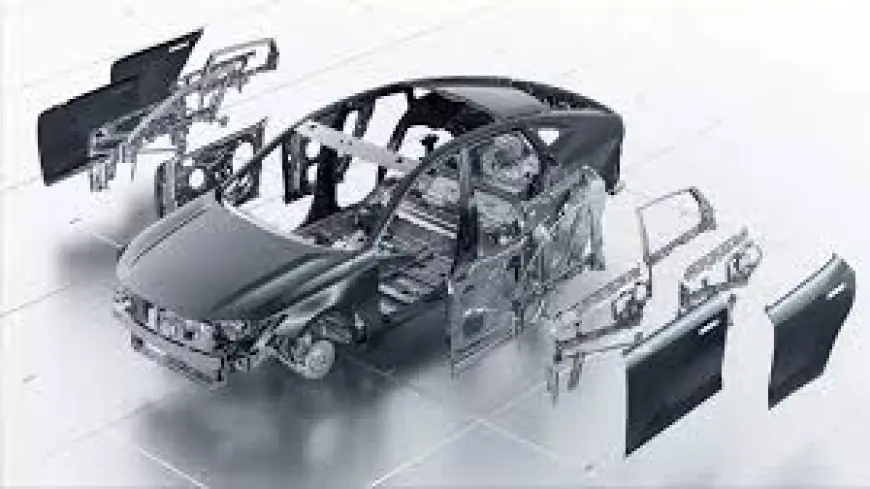

Aluminum, thanks to its lightweight nature, corrosion resistance, recyclability, and strength-to-weight ratio, has emerged as the preferred material for structural and functional applications across the automotive value chain. From engine components to body panels, chassis, and electric vehicle battery housings, aluminum alloys are reshaping how vehicles are designed and manufactured.

As the industry shifts towards electrification, stricter emissions standards, and advanced mobility solutions, aluminum is no longer just a substitute for steel — it is a strategic enabler of innovation and compliance in the automotive industry.

Industry Key Highlights

- Market Size: USD 28.46 Billion in 2023, expected to hit USD 39.90 Billion by 2029.

- CAGR: Strong growth at 5.85% during 2024–2029.

- Primary Growth Drivers: Lightweighting initiatives, EV adoption, sustainability focus, and regulatory compliance.

- Dominant Segment: Passenger cars lead demand due to consumer preference for fuel-efficient, high-performance vehicles.

- Material Applications: Widespread use in powertrains, chassis & suspension, body panels, and EV battery enclosures.

- Competitive Landscape: Global giants like Alcoa, Hindalco, Rio Tinto, and Norsk Hydro dominate with advanced alloys and R&D investments.

- Future Outlook: Integration of recycled aluminum, advanced alloys, and mixed-material architectures will define the next era of automotive manufacturing.

Download Free Sample Report: https://www.techsciresearch.com/sample-report.aspx?cid=21295

Market Drivers

1. Lightweighting for Fuel Efficiency

One of the most powerful drivers is the industry-wide shift toward lightweight vehicles. Automakers face stringent fuel efficiency and carbon emission norms. By incorporating aluminum, vehicles reduce overall mass, improve fuel economy, and meet global emission mandates without compromising safety or performance.

2. Rise of Electric and Hybrid Vehicles

Electric vehicles (EVs) and hybrid electric vehicles (HEVs) are energy-intensive due to heavy battery packs. Aluminum’s lightweight nature offsets this additional weight, ensuring longer driving range and optimized energy consumption. EV battery enclosures, structural reinforcements, and cooling systems heavily rely on aluminum.

3. Sustainability and Circular Economy Push

Aluminum is infinitely recyclable without losing its properties. Automakers are increasingly integrating recycled aluminum into vehicle designs to reduce their carbon footprint and support circular economy initiatives. This not only enhances brand sustainability but also helps in regulatory compliance.

4. Performance and Safety Enhancements

Beyond efficiency, aluminum alloys contribute to structural strength and crash safety. Modern vehicles use aluminum in chassis, suspension, and body panels, enabling high safety standards while maintaining low weight. Luxury and high-performance cars especially benefit from aluminum-intensive architectures.

5. Technological Advancements in Alloys

Research in advanced aluminum alloys and joining techniques has expanded aluminum’s usability across more automotive applications. Extruded, rolled, and cast aluminum products allow complex designs, while innovations in bonding ensure compatibility with steel, carbon fiber, and composites.

Emerging Trends in the Automotive Aluminum Market

1. Mixed-Material Vehicle Structures

Automakers are increasingly combining aluminum with carbon fiber, high-strength steel, and composites. These multi-material structures balance cost, weight, and performance, maximizing design flexibility while reducing total vehicle mass.

2. Aluminum in Electric Vehicle Batteries

The growing demand for EVs has led to aluminum becoming the material of choice for battery enclosures due to its excellent thermal conductivity, shielding capabilities, and lightweight profile. Aluminum supports thermal management, safety, and crash protection for high-voltage EV batteries.

3. Increased Use in Autonomous and Connected Vehicles

Autonomous and connected vehicles require additional sensors, computing systems, and electrical architectures. Lightweight aluminum ensures these advanced technologies do not add excessive weight, maintaining efficiency while supporting integration.

4. Recycling and Secondary Aluminum Growth

Secondary aluminum (recycled aluminum) is seeing increased adoption due to its lower cost and smaller environmental footprint. Automakers are forming partnerships with recycling companies to ensure sustainable sourcing of raw materials.

5. Regional Manufacturing Expansion

Global suppliers are setting up manufacturing bases closer to major automotive hubs, particularly in Asia-Pacific, to meet growing demand and reduce logistics costs. Localization is becoming a key competitive advantage.

Market Segmentation

By Vehicle Type

- Passenger Cars: Largest segment, driven by regulatory pressure for fuel efficiency, consumer demand for high performance, and preference for luxury vehicles with advanced aluminum components.

- Light Commercial Vehicles (LCVs): Increasingly adopting aluminum for fuel-efficient fleet operations and lower total cost of ownership.

- Medium & Heavy Commercial Vehicles (M&HCVs): Using aluminum in chassis and trailers for weight reduction, improving payload capacity and logistics efficiency.

By Product Type

- Cast Aluminum: Widely used in engine components, housings, and structural parts.

- Rolled Aluminum: Dominant in body panels, exterior components, and trims.

- Extruded Aluminum: Used in chassis, crash management systems, and suspension systems for enhanced strength.

By Application

- Powertrain: Engine blocks, cylinder heads, and transmission cases.

- Chassis & Suspension: Control arms, frames, and subframes.

- Car Body: Hoods, doors, roofs, and body panels.

- Others: EV battery enclosures, wiring systems, and crash protection systems.

Regional Insights

- North America: Strong growth driven by EV adoption, stringent regulations, and major OEM presence.

- Europe: Leadership in lightweighting due to aggressive carbon neutrality targets and luxury car manufacturing.

- Asia-Pacific: Fastest-growing region; China, Japan, and India dominate production and consumption due to large-scale automotive manufacturing.

- Latin America & Middle East: Emerging demand as vehicle ownership and industrialization increase.

Competitive Analysis

The global automotive aluminum market is highly competitive, with established players leveraging innovation, strategic partnerships, and capacity expansions to maintain leadership.

Key Market Leaders:

- Alcoa Corporation – Pioneer in advanced aluminum alloys and recycling.

- Hindalco Industries Ltd. – A leader in rolled products, serving global OEMs.

- Rio Tinto Group – Strong focus on sustainable aluminum production.

- Constellium Group – Specializes in lightweight solutions for body-in-white applications.

- Norsk Hydro ASA – Prominent in green aluminum solutions and low-carbon production.

- UACJ Corporation – Expertise in rolled and extruded products for automotive.

- Dana Incorporated – Supplies lightweight aluminum driveline components.

- PWO AG – Focused on precision aluminum parts for lightweight vehicles.

- Kaiser Aluminum Corporation – Strong in aerospace-grade aluminum entering auto applications.

- AMG Critical Materials N.V. – Supplies specialty alloys for performance vehicles.

Competitive strategies include:

- Development of high-strength aluminum alloys.

- Expansion of low-carbon aluminum production to align with sustainability.

- Joint ventures with automakers to develop next-generation vehicle structures.

- Heavy investment in EV-specific aluminum solutions.

Future Outlook

The automotive aluminum market is poised for sustained growth and innovation:

- By 2029, EV penetration will significantly accelerate demand for aluminum-intensive architectures.

- Recycled aluminum will account for a larger share, aligning with sustainability goals.

- Technological innovations in alloys, joining methods, and mixed-material platforms will expand applications.

- Growth in emerging economies will create new opportunities for global suppliers.

- By 2030, aluminum’s role will go beyond lightweighting — it will be a core enabler of electrification, safety, and sustainability.

10 Benefits of the Research Report

- Provides accurate market size and forecast up to 2029.

- Identifies key growth drivers, restraints, and opportunities.

- Offers in-depth segmentation by vehicle, product, and application.

- Delivers regional insights across North America, Europe, Asia-Pacific, and more.

- Highlights emerging trends shaping future demand.

- Profiles major players and their strategies for competitive benchmarking.

- Assesses the impact of EV adoption and emissions regulations.

- Supports investment decisions with data-backed insights.

- Evaluates supply chain dynamics and raw material trends.

- Equips stakeholders with strategic recommendations for growth.

Conclusion

The Global Automotive Aluminum Market is entering a transformative phase. The convergence of lightweighting, electrification, sustainability, and advanced manufacturing technologies has positioned aluminum as a cornerstone material for the automotive industry.

Passenger cars will remain the largest consumers, but the rise of EVs, hybrid vehicles, and green regulations ensures expanding applications across all vehicle types. The market will be shaped by technological innovations, recycling initiatives, and global OEM collaborations.

Contact Us-

Mr. Ken Mathews

708 Third Avenue,

Manhattan, NY,

New York – 10017

Tel: +1-646-360-1656

Email: [email protected]

Website: www.techsciresearch.com

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0