GCC Cyber Insurance Market 2030 Size, Share & Demand

Awareness of cyber threats and their financial implications is increasing among businesses in the GCC, leading to a surge in cyber insurance adoption.

The GCC Cyber Insurance Market is rapidly evolving, driven by increasing digitalization, sophisticated cyber threats, and stricter regulatory standards across the Gulf Cooperation Council (GCC) countries. As digital transformation accelerates, so does the need for robust cybersecurity strategies and comprehensive risk management frameworks. Cyber insurance has emerged as a key solution to mitigate these risks, providing financial protection against a growing number of cyber incidents including data breaches, ransomware attacks, phishing, and business email compromise.

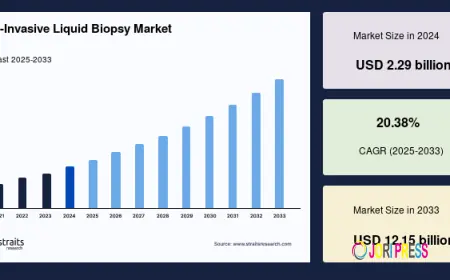

According to TechSci Research, the market was valued at USD 131.66 million in 2024 and is projected to reach USD 159.39 million by 2030, growing at a CAGR of 3.24%. Countries like Saudi Arabia and the UAE are leading in terms of cyber insurance adoption, thanks to stringent national cybersecurity frameworks and high exposure to digital threats.

Industry Key Highlights

- Market Size (2024): USD 131.66 million

- Projected Market Size (2030): USD 159.39 million

- CAGR (2024-2030): 3.24%

- Leading Countries: Saudi Arabia, UAE

- Key Sectors: BFSI, Healthcare, Energy, IT, Retail

- Top Insurance Types: Standalone, Tailored

- Main Coverage Types: First-party, Liability

The rise in cyberattacks across the GCC is no longer just a possibility—it's an inevitability. As a result, cyber insurance has moved from being a niche offering to a strategic necessity. Government mandates, digital banking, fintech innovation, and cloud adoption are shaping this market's trajectory.

Download Free Sample Report: https://www.techsciresearch.com/sample-report.aspx?cid=27661

Emerging Trends in the GCC Cyber Insurance Market

1. AI-Driven Risk Assessment

Artificial intelligence and machine learning are enabling insurers to perform real-time risk assessment. Predictive analytics helps in evaluating potential threats and tailoring premiums accordingly.

2. Integration with Cybersecurity Services

Cyber insurance providers are collaborating with cybersecurity firms to offer value-added services such as real-time threat monitoring, incident response, and breach coaching. This bundled approach enhances risk mitigation.

3. Increased Demand Among SMEs

While large corporations have traditionally been the primary consumers of cyber insurance, small and medium enterprises (SMEs) are increasingly adopting it. This shift is attributed to growing awareness and cyberattacks targeting smaller, less-protected entities.

4. Sector-Specific Coverage

Tailored insurance products for different sectors are becoming common. For instance, coverage designed for healthcare institutions includes protection for patient data breaches and HIPAA violations.

5. Ransomware Protection on the Rise

Given the dramatic rise in ransomware attacks, insurers are developing specialized policies that cover ransom payments, legal consultations, and recovery services.

6. Regulatory-Driven Market Growth

Regulatory bodies such as Saudi Arabia’s National Cybersecurity Authority (NCA) and UAE’s DESC are enforcing strict data protection and cybersecurity laws, increasing the demand for compliant cyber insurance policies.

Market Drivers

A. Accelerating Digital Transformation

The digitization of essential services such as banking, healthcare, and retail is increasing cyber exposure, making insurance a crucial risk mitigation strategy.

B. Growing Cyber Threat Landscape

Ransomware, DDoS attacks, and insider threats are evolving in complexity and frequency. The financial repercussions of these attacks drive enterprises to seek insurance protection.

C. Regulatory Compliance Requirements

New data protection laws and cybersecurity regulations require businesses to implement risk mitigation measures, including cyber insurance.

D. Public and Private Sector Collaboration

Government partnerships with private insurers are fostering trust and increasing cyber insurance adoption through awareness campaigns and policy incentives.

E. Reputational Risk Management

Reputation damage following a cyber breach can be devastating. Cyber insurance not only covers financial losses but also public relations and crisis management services.

Competitive Analysis

The GCC cyber insurance market is moderately consolidated with several global players competing for market share. Major firms are emphasizing innovation, partnerships, and regional compliance to offer differentiated products.

Leading Companies:

- American International Group, Inc.

- Chubb Limited

- AXA XL

- Allianz SE

- Zurich Insurance Company Ltd

- Marsh LLC

- Aon plc.

- Beazley Plc

- Qatar Insurance Company Q.S.P.C.

- Saudi Arabian Insurance Company (SAIC)

These firms are focusing on integrating advanced analytics, sector-specific products, and customer education to expand their market presence.

Country-Wise Insights

Saudi Arabia

- Dominates the market due to regulatory enforcement by the National Cybersecurity Authority.

- Vision 2030 fuels digitalization and cyber risk awareness.

- Heavy cyber exposure in sectors like oil & gas, BFSI, and public services.

United Arab Emirates (UAE)

- Fastest-growing country in the region.

- Cybersecurity Strategy and DESC drive insurance adoption.

- Fintech and e-commerce boom propels demand.

Qatar, Oman, Bahrain, Kuwait

- These countries are gradually increasing cyber insurance adoption.

- Government-backed cybersecurity initiatives are underway.

- Awareness campaigns and insurance education are key to growth.

Market Segmentation

- By Insurance Type: Standalone, Tailored

- By Coverage: First-party, Liability Coverage

- By End User: BFSI, Healthcare, Retail, IT, Others

- By Country: Saudi Arabia, UAE, Qatar, Oman, Bahrain, Kuwait

10 Benefits of This Research Report

- Accurate Market Forecasting: Get in-depth projections up to 2030.

- Country-Wise Analysis: Evaluate opportunities and threats by geography.

- Industry-Specific Insights: Understand key drivers in BFSI, healthcare, and more.

- Competitive Benchmarking: Identify top players and their strategies.

- Regulatory Landscape Overview: Stay informed about compliance trends.

- Investment Insights: Uncover profitable investment avenues.

- Technology Impact Assessment: Learn how AI and big data are shaping the sector.

- Consumer Behavior Analysis: Gauge end-user needs and expectations.

- Segmentation Intelligence: Pinpoint growth across insurance types and coverage models.

- Customization Availability: Request tailored insights with up to 10% free customization.

Future Outlook

The GCC cyber insurance market is set for sustained growth, propelled by technological evolution, increasing cybersecurity awareness, and regulatory maturity. With rising data privacy concerns and expanding digital ecosystems, the region is prioritizing proactive risk management.

Looking ahead, cyber insurance will become an integral component of enterprise cybersecurity frameworks. Insurers will innovate with AI-driven underwriting, behavioral risk scoring, and blockchain-based claims processing. Cross-border partnerships and public-private collaborations will further solidify the market's foundation. The incorporation of cybersecurity consulting, audits, and training as part of insurance packages will redefine the industry's value proposition.

As cyber threats become increasingly unpredictable, resilience through insurance will no longer be optional but essential. The GCC’s forward-thinking regulatory environment, coupled with digital transformation agendas like Saudi Arabia’s Vision 2030 and UAE's Smart Government initiative, ensures that the cyber insurance market will remain at the forefront of regional risk mitigation strategies.

Contact Us-

Mr. Ken Mathews

708 Third Avenue,

Manhattan, NY,

New York – 10017

Tel: +1-646-360-1656

Email: [email protected]

Website: www.techsciresearch.com

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0