Foreign Exchange Market Growth, Investment Opportunities, and Future Outlook

Market Overview

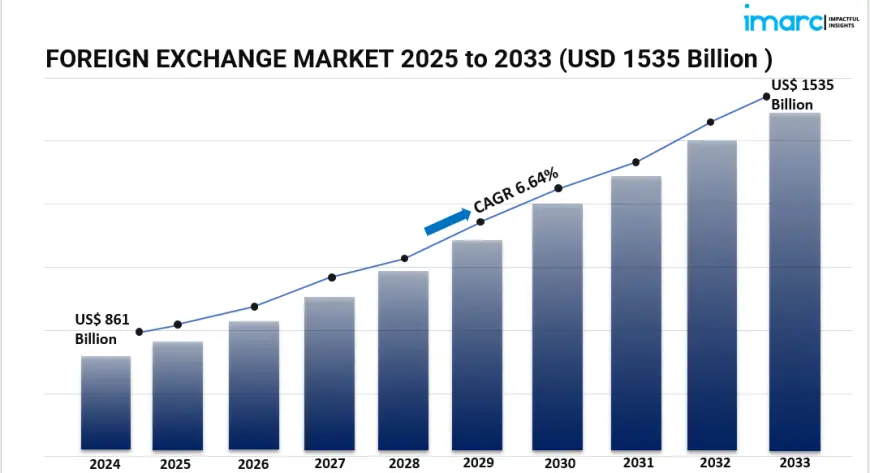

The global foreign exchange market reached a size of USD 861 Billion in 2024 and is poised for sustained growth. According to IMARC Group, the market is expected to climb to USD 1,535 Billion by 2033, advancing at a CAGR of 6.64% during 2025–2033. This robust expansion is being propelled by a surge in international trade, the rising demand for instant currency conversion, and the emergence of AI-powered as well as algorithmic trading platforms. Furthermore, the growing role of emerging markets and the widespread adoption of digital trading solutions are enhancing accessibility for both retail and institutional participants.

Study Assumption Years

-

Base Year: 2024

-

Historical Years: 2019–2023

-

Forecast Years: 2025–2033

Market Key Takeaways

-

The global foreign exchange market is set to expand at a CAGR of 6.64% between 2025 and 2033.

-

Currency swap continues to represent the most traded transaction type.

-

Reporting dealers dominate the counterparty landscape.

-

Asia Pacific is experiencing the fastest growth, while North America and Europe maintain strong positions.

-

Advanced technologies, including AI, blockchain, and cloud-based systems, are accelerating structural changes in the forex sector.

? Request a sample report here:

https://www.imarcgroup.com/foreign-exchange-market/requestsample

Market Growth Factors

1. Rise in Global Trade and Cross-Border Transactions

With the continuous expansion of international trade and investment flows, the demand for efficient and secure currency exchange mechanisms is on the rise. Multinational corporations and financial institutions rely heavily on forex markets for risk management, driving sustained demand.

2. Integration of AI and Automated Trading

Artificial intelligence and automated trading platforms are reshaping the forex market by enabling faster, more secure, and more accurate transactions. These technologies support risk assessment, predictive modeling, and improved efficiency, meeting the growing needs of global investors.

3. Regulatory Evolution and Digital Advancements

Global regulators are introducing progressive frameworks that foster transparency and enhance investor confidence. Simultaneously, the expansion of user-friendly, secure digital trading platforms is broadening market access for both institutional and retail investors worldwide.

Market Segmentation

Breakup by Counterparty:

-

Reporting Dealers

-

Other Financial Institutions

-

Non-Financial Customers

Breakup by Type:

-

Currency Swap

-

Outright Forward and FX Swaps

-

FX Options

Breakup by Region:

-

North America (United States, Canada)

-

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

-

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

-

Latin America (Brazil, Mexico, Others)

-

Middle East and Africa

Regional Insights

The Asia Pacific region is emerging as the fastest-growing hub in the foreign exchange market, supported by strong digital infrastructure, rising disposable income, and increasing participation from retail traders. North America and Europe, on the other hand, remain dominant players owing to their mature financial systems, high liquidity levels, and advanced trading environments. Meanwhile, Latin America and the Middle East are witnessing steady progress with evolving regulatory frameworks and stronger global trade connections.

Recent Developments & News

-

Financial institutions are embracing blockchain technology to improve transaction security and reduce settlement times.

-

The adoption of central bank digital currencies (CBDCs) is gaining momentum, reshaping how currency exchange functions globally.

-

AI-powered analytics tools are increasingly being deployed for real-time risk management and forecasting in FX trading.

Key Players

-

Barclays

-

BNP Paribas

-

Citibank

-

Deutsche Bank

-

Goldman Sachs

-

HSBC Holdings plc

-

JPMorgan Chase & Co.

-

The Royal Bank of Scotland

-

UBS AG

-

Standard Chartered PLC

-

State Street Corporation

-

XTX Markets Limited

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

? Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=1976&flag=C

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us :

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

\

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0