Features to Look for in an E-Invoicing System

Explore the top features of an e-invoicing system, including automation, compliance, real-time tracking, and secure data management.

Therefore, e-invoicing has become an important instrument for companies of all industries, including those experiencing growing demands on their part, like the ones in Saudi Arabia. The government has worked hard to increase the transparency of the handling of the country’s finances and to improve efficiency in finance and accounting, and e-invoicing is one of the most prominent examples of this drive towards digitalisation. The Kingdom’s drive towards digitization implies not only the need to integrate novel technologies into the business processes but also check compliance with the requirements of the authorities. This is especially the case with accounting e-invoicing in Saudi Arabia where the market has its own rules that firms need to follow.

E-invoicing has an important role in the development of efficient billing procedures, data quality maintenance, and general control of financial flows in companies. An ideal e-invoicing system will also eliminate the need for repeating the same task over and over, compliance and accounting errors. This blog will explore the main aspects that every business should take into account when choosing an e-invoicing solution with references to accounting e-invoicing in Saudi Arabia to assist companies in meeting legal requirements and avoiding problems in a rapidly transforming market environment.

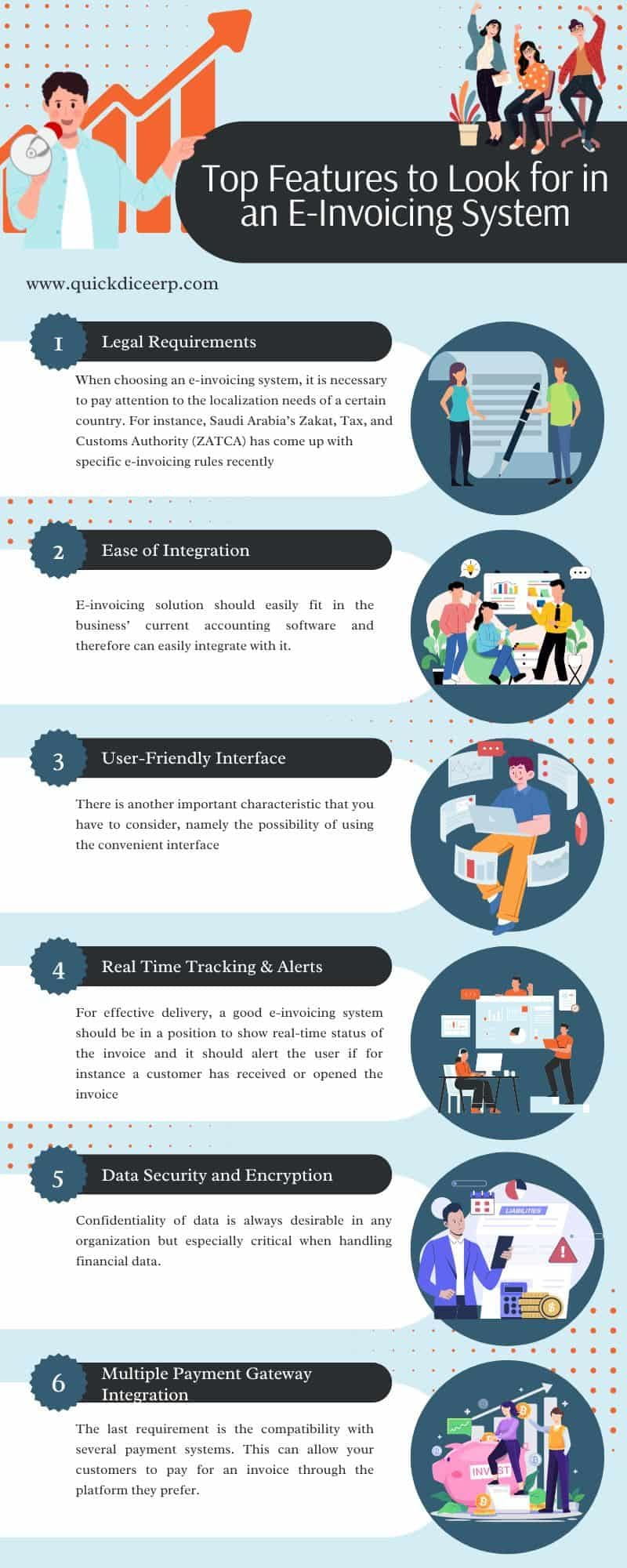

Here are the Top Features to Look for in an E-Invoicing System

1. Legal Requirements

When choosing an e-invoicing system, it is necessary to pay attention to the localization needs of a certain country. For instance, Saudi Arabia’s Zakat, Tax, and Customs Authority (ZATCA) has come up with specific e-invoicing rules recently. It is important for the system to accommodate all the following e-invoice formats and data should be stored in accordance with E-invoicing in Saudi Arabia. This helps to avoid penalties while making sure your business is as conforming as is possible.

2. Ease of Integration

E-invoicing solution should easily fit in the business’ current accounting software and therefore can easily integrate with it. These are necessary to sustain integration in order to minimize or avoid entries and procedures duplication. It should also easily interface with your ERP, CRM, or accounting solution for one place for data to make your work easier. To firms that operate in Saudi Arabia, increased compatibility with the domestic accounting systems is advantageous in achieving the desired compliance with the accounting e-invoicing regulations in Saudi Arabia.

3. User-Friendly Interface

There is another important characteristic that you have to consider, namely the possibility of using the convenient interface. Clear and concise organization of the dashboard helps to reduce the time it takes to get your team oriented. It also should also be convenient to your staff to create and edit invoices without going through extensive training. This ensures that even individuals with low computer literacy can be able to operate on the e-invoicing system.

4. Real Time Tracking & Alerts

For effective delivery, a good e-invoicing system should be in a position to show real-time status of the invoice and it should alert the user if for instance a customer has received or opened the invoice. This feature improves the visibility of cash flows thus enables the business operating in Saudi Arabia to monitor their payments to meet the local requirement of E-invoicing in Saudi Arabia.

5. Data Security and Encryption

Confidentiality of data is always desirable in any organization but especially critical when handling financial data. It is therefore important that the e-invoicing system should use the best security measures that will prevent third parties from intercepting your data. Ensure that the e-invoicing system that you use in your business is in line with the Saudi Arabia’s data protection legal frameworks so that you do not lose your business to cyber threats and cyber breaches.

6. Automated Invoice Generation and Reporting

Automation is one of the most significant attributes that can improve the effectiveness of the work. The e-invoicing system needs to be able to generate invoices for you and give you statistical reports at least at intervals to help you make evaluation of your financial position. In particular, this feature is very useful for Saudi Arabia companies regarding the documentation in terms of compliance with the established rules on accounting e-invoicing in Saudi Arabia.

7. Customization Capabilities

Another advantage is that there are choices you can make to put your company logo and other details on the invoices. This is what makes the customization features possible: the option to add logos, terms and conditions or a different language, for instance. This is particularly useful for the KSA companies which have clients from other countries because it makes it professional when doing the work.

8. Scalability

E-invoicing should also be capable of growing with your business because your company’s plan should be able to grow with it. Another is the ability to scale up for the ever growing number of invoices and the growth of the business. Select an e-invoicing system that will be able to integrate with new rules since those organization that will be planning to be compliant with E-invoicing in Saudi Arabia will be influenced by new rules and regulations.

9. Multiple Payment Gateway Integration

The last requirement is the compatibility with several payment systems. This can allow your customers to pay for an invoice through the platform they prefer. Another aspect that is well understood is that the clients are most beneficiaries when they are given multiple payment options, a move that also increases cash flow productivity. The convenience standards that are anticipated in accounting ‘e-invoicing’ in Saudi Arabia also justify the idea of having payment integration for the e-invoicing system.

10. Audit Trail

When businesses choose a solution, it must comply with Zakat, Tax, and Customs Authority (ZATCA) regulations to avoid penalties and tax filing issues. It should maintain record of which personnel has made the changes and when and a record history of each invoice. This is particularly relevant for the Saudi Arabian companies because they do not want to fall afoul of their tax laws and also in case of auditors’ check they have to have everything in order.

Conclusion:

The selection of the e-invoicing system depends on the business needs that want to improve productivity, stay on top of the regulatory requirements, and keep costs low. Saudi Arabia companies should understand the significance of the compliance and especially when it comes to the accounting e-invoicing in Saudi Arabia. Thus, when businesses select the solution, it can be seen that the solution must fit the regulation of the Zakat, Tax, and Customs Authority (ZATCA) to avoid penalties or complexities in record keeping and tax filing. The aspects described in this blog post: compliance and integration, scalability and security are crucial for any company that plans to use e-invoicing technology.

For a company in today’s dynamic environment, a proper management of e-invoices is not only a compliance issue but also a competitive advantage. Implementing the right features allows businesses to boost invoicing efficiency, solve cash flow issues, and improve client communication. For enterprises in Saudi Arabia, choosing a system satisfying the accounting e-invoicing needs in Saudi Arabia can help the enterprises run effectively, save time and effort, and facilitate the development. If companies opt for a solution that meets such requirements, it shall be possible to play a role in realizing the Kingdom’s vision of a digital and transparent economy.