Seamless API Integration for Face Verification in Digital Platforms

Integrate Meon’s Face Verification API to enable real-time identity checks with liveness detection. Secure, scalable, and RBI-compliant solution for banking, fintech, telecom, and digital platforms.

Introduction

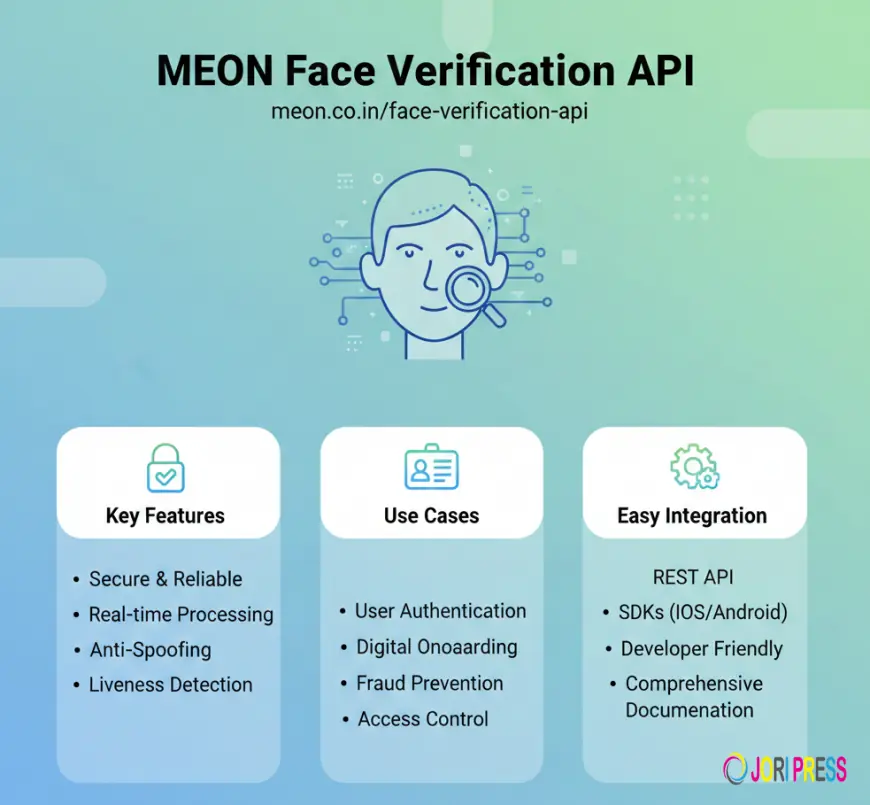

In the era of digital transformation, businesses need identity verification solutions that are not only secure but also easy to integrate. Face verification APIs allow organizations to implement real-time identity checks without rebuilding their systems from scratch. Meon’s Face Verification API provides a robust, scalable, and developer-friendly solution to streamline digital onboarding and authentication.

Why API Integration Matters

Modern digital platforms rely on APIs to connect different systems and services efficiently. APIs allow developers to add features like face verification without disrupting existing workflows.

By using an API, businesses can:

-

Reduce development time and costs

-

Maintain consistent user experience across platforms

-

Automate verification processes

-

Scale easily as user demand grows

Face verification via API enables businesses to integrate secure identity checks directly into mobile apps, web portals, and enterprise systems, providing a seamless experience for both users and internal teams.

How Meon’s Face Verification API Works

Meon’s API offers a simple yet powerful workflow:

-

Live Capture: Users take a selfie through the platform’s app or website.

-

Liveness Detection: The system ensures the user is physically present and not attempting spoofing with photos, videos, or masks.

-

Face Matching: The live image is compared to a reference image from a government ID or internal database.

-

Verification Result: The API returns an immediate result, allowing the platform to approve or deny access.

This process is fully automated, reducing errors and eliminating manual verification tasks.

Technical Benefits of Meon’s API

The API is designed with developers and businesses in mind. Key technical advantages include:

-

Easy Integration: Clear documentation, SDKs, and sample code make implementation straightforward.

-

Cross-Platform Support: Compatible with web, Android, and iOS applications.

-

High Accuracy: Advanced algorithms minimize false positives and negatives.

-

Real-Time Processing: Users receive instant verification results, enhancing experience and operational efficiency.

-

Scalability: Handles high volumes of verification requests without affecting performance.

-

Security and Compliance: Encrypted data transmission and adherence to regulatory standards like RBI-compliant KYC.

These features make Meon’s API suitable for organizations of all sizes and industries, from fintech startups to large enterprises.

Use Cases Across Industries

Banking and Fintech: Quickly verify new accounts, loan applicants, and high-risk transactions.

Telecom: Enable secure SIM activation and prevent subscriber fraud.

Insurance: Streamline policy issuance, claims processing, and identity verification.

Digital Platforms: E-commerce, online education, and healthcare portals can verify users securely during registration or login.

The API allows businesses to provide a seamless and secure experience for users while maintaining operational efficiency and compliance.

Security and Compliance Considerations

Security is critical when handling sensitive identity information. Meon’s Face Verification API uses encryption and access controls to ensure data is protected at every stage. Automated verification reduces the risk of human error and data breaches.

Additionally, the API supports audit trails and regulatory reporting, helping organizations meet compliance standards such as RBI KYC guidelines. This combination of security, transparency, and regulatory alignment is crucial for maintaining trust with customers and regulators alike.

The Future of API-Driven Verification

As digital services grow, businesses will require verification solutions that are flexible, fast, and secure. API-driven face verification allows platforms to adopt the latest identity technologies without disrupting their systems.

Organizations that integrate face verification APIs now will be better prepared for increasing digital adoption, evolving fraud techniques, and stricter regulatory requirements.

Conclusion

API integration is the key to implementing efficient, scalable, and secure identity verification. Meon’s Face Verification API provides developers and businesses with a reliable, real-time solution for onboarding, authentication, and fraud prevention.

By leveraging the API, organizations can enhance security, improve user experience, maintain regulatory compliance, and scale their digital platforms effectively.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0