Explosion-Proof Equipment Market Dynamics: Forecasts and Trends

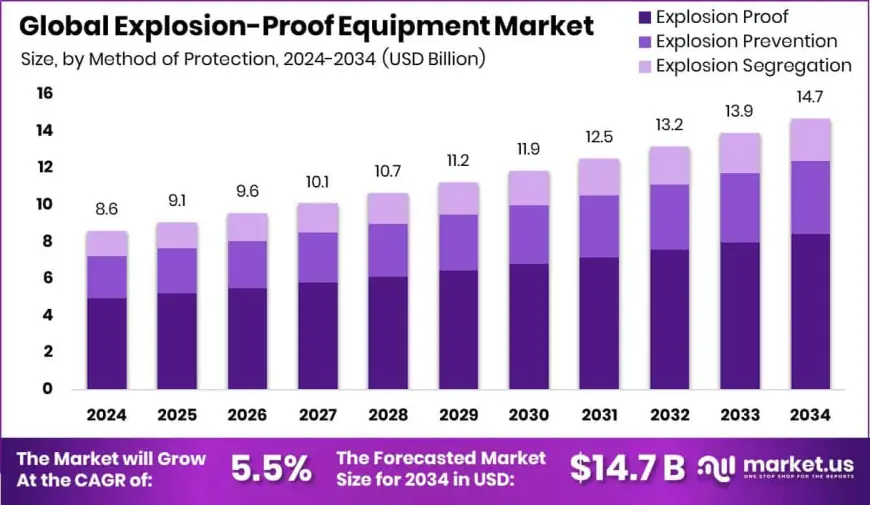

The Global Explosion-Proof Equipment Market is expected to be worth around USD 14.7 billion by 2034, up from USD 8.6 billion in 2024, and grow at a CAGR of 5.5% from 2025 to 2034. With a 34.8% share, the North America Explosion-Proof Equipment market stood at USD 2.9 Bn.

Report Overview:

The global explosion-proof equipment market is projected to climb from USD 8.6 billion in 2024 to USD 14.7 billion by 2034, posting a steady CAGR of 5.5 % during the 2025–2034 period. The “explosion-proof” method dominated by sturdy enclosures and protective housings holds the largest method segment share at 57.4 %, credited to widespread trust in its reliability across hazardous industries. Within zoned hazard classifications, Zone 1 leads, representing 31.2 % of market share, reflecting frequent usage in areas where explosive atmospheres are common. Among end-use sectors, oil & gas accounts for 29.3 % of global demand in 2024, underscoring the heavy reliance on explosion‑proof gear in upstream and downstream operations. Geographically, North America dominates with a 34.8 % share (USD 2.9 billion) in 2024, driven by stringent safety standards and heavy industrial infrastructure.

This market is fueled by industries where safety is non-negotiable such as mining, chemicals, pharmaceuticals, and especially oil & gas where any ignition source can be catastrophic. The dominance of the explosion-proof method signals industries' preference for tried-and-tested protective measures. Zone 1 dominance highlights continual demand in moderately high-risk areas. Growth is strongest in North America, yet Asia-Pacific is also emerging due to expanding energy and manufacturing sectors. The next decade looks bright, with equipment manufacturers focused on compliance with global standards (ATEX, IECEx, NEC/CEC) and with R&D pushing forward innovations in materials, design, and integration with smart monitoring systems. Operational efficiency and safety regulations remain key drivers, as companies invest in capital projects requiring high-specification, certified gear. Spillover from heightened environmental, health, and safety (EHS) policies further reinforces the market’s long-term stability and visibility.

Key Takeaways

-

Market size growing from USD 8.6 billion to USD 14.7 billion (2024–2034), a 5.5 % CAGR.

-

Explosion‑proof protection leads method share at 57.4 %, chosen for robustness.

-

Zone 1 applications capture 31.2 % of the market, reflecting frequent use in moderately hazardous settings.

-

Oil & gas sector is the top end-user with 29.3 % share.

-

North America is the largest region at 34.8 %, worth USD 2.9 billion.

Download Exclusive Sample Of This Premium Report:

https://market.us/report/global-explosion-proof-equipment-market/free-sample/

Key Market Segments:

By Method of Protection

- Explosion Proof

- Explosion Prevention

- Explosion Segregation

By Zone

- Zone 0

- Zone 20

- Zone 1

- Zone 21

- Zone 2

- Zone 22

By End-use

- Oil and Gas

- Pharmaceutical

- Chemical and Petrochemical

- Energy and Power

- Mining

- Others

DORT Analysis

Drivers

-

Stringent regional safety regulations (NEC, IECEx, ATEX) demand certified equipment.

-

High growth in oil & gas, mining, and petrochemical industries requiring explosion-safe assets.

-

Rising industrial automation increases need for reliable protective enclosures and certified devices.

-

Greater awareness around workplace safety and large-scale CAPEX investments pushing upgrades.

Opportunities

-

Expansion in APAC regions (e.g., India, China) amid rising energy and manufacturing investments.

-

Digitization wave: integrating sensors and predictive maintenance into explosion-proof solutions.

-

Retrofit demand from aging plants seeking modern, certified upgrades.

-

Customization prospects in sectors like pharmaceuticals and food processing with unique safety needs.

Restraints

-

High upfront costs and long certification cycles hamper adoption, especially in smaller projects.

-

Complex international standards and certification timelines slow product rollouts.

-

Competition from alternative safety techniques (e.g., intrinsic safety, segregation methods).

-

Global supply chain disruptions may delay delivery of specialized components and raw materials.

Trends

-

Growing inclination toward “smart explosion-proof” devices with IoT-enabled monitoring.

-

Use of lighter, high-performance materials to reduce weight without compromising safety.

-

Modular and scalable explosion‑proof enclosures tailored for diverse industrial needs.

-

Shift toward integrated solutions (lighting, control systems) that simplify installation and maintenance.

-

Sustainability push driving interest in energy-efficient, eco-friendly explosion-proof systems.

Market Key Players:

- Adalet

- Siemens

- Honeywell International Plc.

- Rockwell Automation Inc.

- ABB

- Eaton Corporation

- Emerson Electric Co.

- Warom Technology Inc.

- WorkSite Lighting

- Extronics Ltd.

- Alloy Industry Co., Ltd

- Tomar Electronics Inc

- Potter Electric Signal Co. LLC

- Federal Signal Corporation

- Pepperl+Fuchs SE

Conclusion:

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0