Bromine Market Outlook 2033: Strategic Research Insights Every Seller and Buyer Must Know

The bromine market is expanding steadily on the back of rising demand for flame retardants across electronics, automotive, construction, and textiles, alongside broader use in water treatment, pharmaceuticals, and agrochemicals.

MARKET OVERVIEW

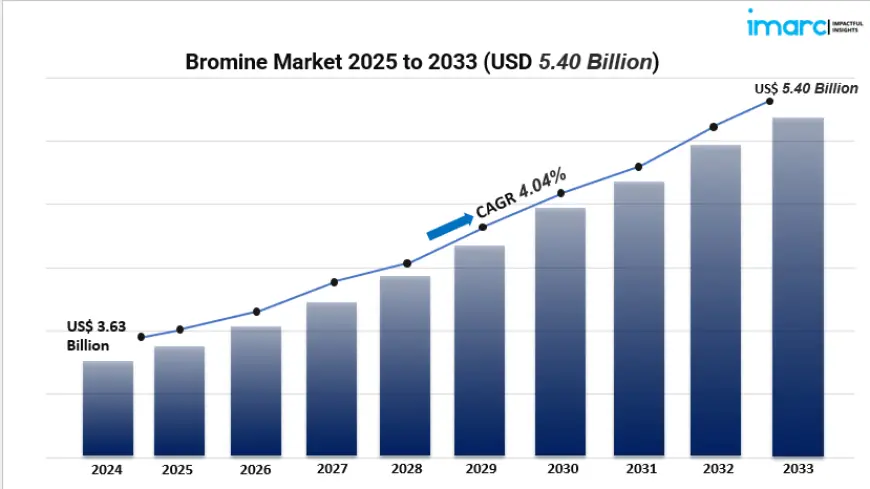

The bromine market is expanding steadily on the back of rising demand for flame retardants across electronics, automotive, construction, and textiles, alongside broader use in water treatment, pharmaceuticals, and agrochemicals. Valued at USD 3.63 Billion in 2024, the market is projected to reach USD 5.40 Billion by 2033 at a 4.04% CAGR (2025–2033). Asia-Pacific leads with a 37%+ share, supported by strong industrial growth and compliance-driven fire-safety adoption.

STUDY ASSUMPTION YEARS

- BASE YEAR: 2024

- HISTORICAL YEAR: 2019–2024

- FORECAST YEAR: 2025–2033

BROMINE MARKET KEY TAKEAWAYS

- Size, forecast & growth: USD 3.63B (2024) → USD 5.40B (2033) at 4.04% CAGR (2025–2033).

- Regional leader: Asia-Pacific holds 37%+ share (2024), driven by electronics, automotive, and construction fire-safety adoption.

- Top derivative: Organ bromine compounds dominate due to extensive use in flame retardants and specialty chemicals.

- Leading application: Flame retardants command the largest application share (~30% in 2024).

- End user spotlight: Chemicals remains the largest end-use segment as bromine underpins biocides, intermediates, and treatment chemicals.

- Production hubs: The U.S. hosts major facilities (Arkansas) and active innovation across flame retardants, water treatment, and pharma intermediates.

MARKET GROWTH FACTORS

1) Safety-driven demand for flame retardants

The global push for stricter fire-safety standards in consumer electronics, vehicles, building materials, and textiles has made brominated flame retardants a necessity. Recent product launches, like Sirmax North America’s bromine-based FR PP compounds with V0/5VA ratings and ICL’s VeriQuel R100, showcase ongoing research and development aimed at enhancing performance while also improving sustainability. The rising demand for smartphones, laptops, electric vehicle components, and advanced insulation is driving up production volumes, and regulators are tightening compliance across OEM supply chains. These trends highlight a consistent, cross-industry demand for organ bromine derivatives and related flame retardant systems throughout the forecast period.

2) Advancing derivative innovation and cleaner chemistries

Manufacturers are actively developing bromine derivatives to boost effectiveness and environmental performance in flame retardants, water treatment, and industrial applications. Clariant’s new halogen-free flame retardant facility in Huizhou and Archean Chemical’s expansion of bromine derivative production in Gujarat are prime examples of investments aimed at supporting Asia’s component manufacturers and meeting global specialty demands. Enhanced process efficiency and recyclability features enable customers to achieve sustainability goals without compromising on fire resistance or biological control performance. As the pressure from regulators and customers for greener chemistry intensifies, the range of derivative products is expanding—covering next-generation flame retardants, advanced biocides, and treatment agents—allowing for premium pricing and deeper market penetration.

3) Expanding role in pharmaceuticals, agrochemicals, and energy uses

Bromine is proving to be a versatile player in the world of active pharmaceutical ingredients (APIs), biocides, and agrochemicals, driving demand from healthcare and food security, especially in rapidly growing regions. The increasing investments in battery technology and energy sectors—think bromine-based batteries and clear brine fluids for oil and gas—are broadening the market landscape and helping to smooth out the ups and downs. Companies like TETRA are making strategic moves with their vertical integration plans, while U.S. producers are focusing on product development to enhance supply reliability and application diversity. As the manufacturing base in the Asia-Pacific region expands and the need for water treatment grows due to scarcity, bromine solutions are becoming increasingly important across the chemicals, pharmaceuticals, agriculture, and energy sectors.

Request for a sample copy of this report: https://www.imarcgroup.com/bromine-market/requestsample

MARKET SEGMENTATION

By Derivative

- Hydrogen Bromide — Used as a reagent and intermediate in synthesizing specialty chemicals and pharma actives; valued for efficient bromination and compatibility in multiple downstream processes, including catalysis and fine chemicals.

- Organ bromine Compounds — Largest derivative; indispensable in flame retardants for electronics, textiles, and construction, and as versatile intermediates in pharma, agrochemicals, and water treatment formulations.

- Bromine Fluids — Employed in applications such as clear brine fluids and heat-transfer media; appreciated for density, stability, and performance in demanding industrial and energy settings.

- Others — Encompasses niche or emerging derivatives tailored to specialized performance, sustainability, or processing needs across industrial and high-value chemical uses.

By Application

- Biocides — Bromine-based biocides deliver broad-spectrum efficacy and stability, supporting cooling water, industrial circuits, and sanitation needs where robust microbial control is required.

- Flame Retardants (FR) — Largest application; reduces material flammability and spread of fire in electronics, automotive parts, building materials, textiles, and furniture while meeting strict safety standards.

- Bromine-Based Batteries — Utilized in energy storage systems that benefit from bromine’s electrochemical properties, supporting grid stability and industrial back-up applications.

- Clear Brine Fluids (CBF) — High-density drilling and completion fluids enhance well control and operational efficiency in oil and gas extraction.

- Others — Additional uses spanning specialty synthesis, treatment agents, and emerging electrochemical or industrial solutions aligned to performance and sustainability targets.

By End User

- Chemicals — Largest end-use; bromine is foundational for producing flame retardants, biocides, and intermediates that feed pharma, agrochemicals, and treatment markets globally.

- Oil and Gas — Uses bromine compounds in drilling/completion fluids and treatment chemistries that improve extraction efficiency and reliability.

- Pharmaceuticals — Relies on brominated intermediates in API synthesis and process chemistry to meet efficacy and quality standards.

- Agriculture — Deploys bromine-derived actives and intermediates in crop protection and post-harvest treatment to support yields and quality.

- Textiles — Incorporates flame retardant solutions and auxiliaries to achieve stringent safety and performance criteria in fabrics and composites.

- Electronics — Integrates brominated FRs in circuit boards, housings, and components to ensure safety compliance without compromising material properties.

- Others — Diverse industrial users requiring specialized performance in processing, protection, or treatment applications.

Breakup by Region

• North America (United States, Canada)

• Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

• Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

• Latin America (Brazil, Mexico, Others)

• Middle East and Africa

REGIONAL INSIGHTS

In 2024, the Asia-Pacific region is set to dominate with over 37% market share, thanks to its vast industrial base, booming chemical manufacturing, and rising demand for brominated flame retardants in electronics, automotive, and construction industries in countries like China, India, and Japan. The ongoing industrialization and stricter fire safety regulations are solidifying the region's leading position through 2033.

RECENT DEVELOPMENTS & NEWS

Recent developments are focused on increasing capacity, integration, and innovative flame-retardant solutions. Albemarle is merging its Energy Storage and Specialties divisions to optimize bromine operations; Archean Chemical is set to introduce new bromine derivatives (like CBF) for the fiscal year 2025; and TETRA Technologies is advancing its Arkansas bromine project, with a feasibility study suggesting a 40-year operational lifespan. The growth in upstream and specialty expansions, along with greener chemistry and innovations related to batteries, are shaping the near-term outlook for the industry.

KEY PLAYERS

- Albemarle Corporation

- Chemada Industries Ltd.

- Gulf Resources Inc.

- Hindustan Salts Limited

- Honeywell International Inc.

- ICL Group Ltd.

- Jordan Bromine Company Limited

- Lanxess AG

- Solaris Chemtech Industries Limited (Agrocel Industries Pvt. Ltd.)

- Tata Chemicals Limited

- TETRA Technologies Inc.

- Tosoh Corporation

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=460&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include a thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0