Bank of Uganda breaks silence, Clarifies Fraud Incident, Denies IT Systems Hack as UGX 30 billion is recovered

Bank of Uganda has clarified that they were not involved in initiating the over 51 billion shillings that was paid into fraudsters' accounts in the United Kingdom and Japan.

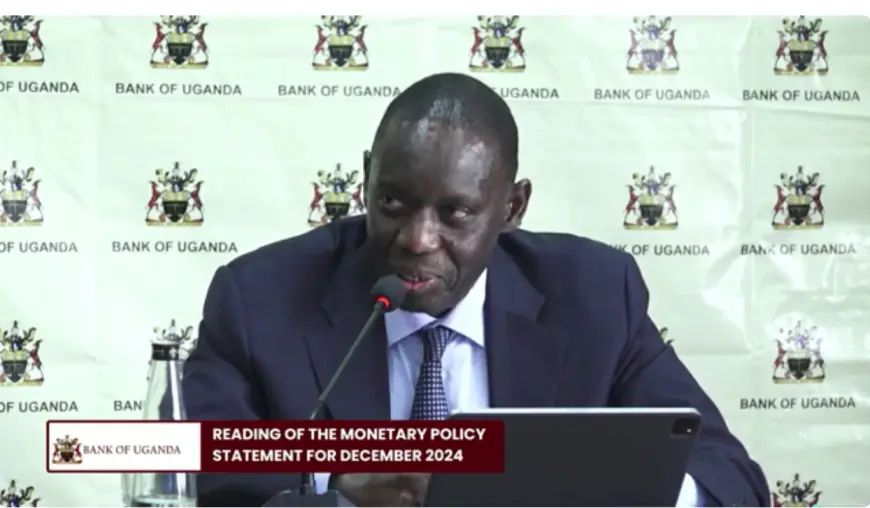

Addressing the media at the Bank of Uganda's head office in Kampala, Deputy Governor Michael Atingi-Ego stated that they have recovered 8.205 million dollars, or approximately 30 billion shillings, so far.

The Deputy Governor further mentioned that they are devising means to recover the remaining 6.2 million dollars, about 21 billion shillings, but noted that the Japanese government has not been cooperative. Sudhir Byaruhanga reports

The Deputy Governor of the central bank, during the reading of the Monetary Policy Statement for December 2024, responded to questions concerning the recent claims of a hack into BoU's payment systems.

Claims on Hacking:

He said that it is not correct to say that the BOU IT systems were hacked because hacking is the act of gaining unauthorized access to computer systems or networks, and to date, there is no evidence of unauthorized access to the BOU IT systems to divert funds.

“The fraud incidents were initiated outside the BOU IT systems and instructions were received by BOU to pay wrong beneficiaries leading to the subsequent diversion of funds. Where the diversion took place, how, and who were involved, is the subject matter of the ongoing investigation. Be rest assured the Bank's IT systems remain fully operational, secure, and uncompromised” he said

Amounts Involved.

BOU revealed that the payment transactions in question included a payment to the World Bank of US$6,134,137.75, which was instead paid to Roadway Co. Limited through MUFG Bank of Japan on 12th September 2024. Additionally, a payment to the African Development Fund of $8,596,824.26 was mistakenly paid to MJS International, London, UK on 28th September 2024.

Steps Taken to Recover the Funds:

Upon discovering that the payments had not reached the intended beneficiaries World Bank and African Development Fund, BoU immediately commenced internal investigations and reported the matter to relevant government agencies, including the Uganda Police, and Financial Intelligence Authority.

BOU is also cooperating with the Office of the Auditor General. BoU also took necessary steps to recover the funds, instructing our Correspondent Bank, Citibank N.A., and the banks where the funds had been sent to freeze the said funds due to suspected fraud.

“We have since recovered US$8,205,133.84 of the funds sent to MJS International, London, UK, which has been credited to the Consolidated Fund. We are also pursuing the balance of US$391,660.45 through our Correspondent Bank. However, BoU has not yet recovered the amount paid to Roadway Co. Ltd through MUFG Bank of Japan. While MUFG Bank has not been very cooperative, we continue to work with our domestic and international partners to pursue the recovery of these funds. We also expect ongoing investigations to support our recovery efforts and help us understand the full extent of these fraudulent transactions” he said

Staff Involvement:

The Bank of Uganda is cooperating with relevant authorities to provide the information needed to conclude the investigations. To our knowledge, no BoU staff member has been implicated thus far.

Bank of Uganda has urged the public to remain patient and allow the relevant government agencies to conclude their investigations as they will issue a comprehensive report on the incident once the investigations are complete.

“For now, we recommend sourcing any information related to ongoing investigations from the relevant government investigative agencies to avoid misinformation” he said