B2B Payments Industry Analysis: Market Expansion, Automation, and Cross-Border Payment Innovations

Market Overview

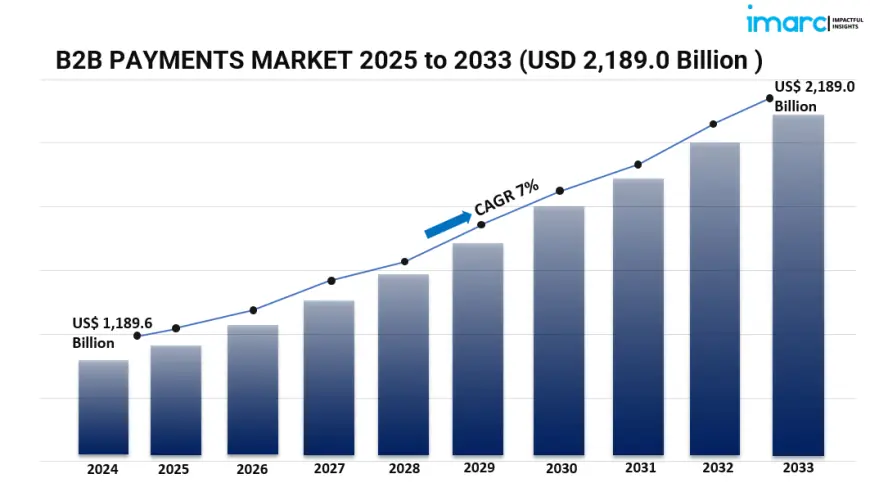

The global B2B payments market is experiencing robust growth, propelled by the widespread adoption of digital payment solutions, automation, and cloud-based financial systems. In 2024, the market was valued at USD 1,189.6 billion and is projected to reach USD 2,189.0 billion by 2033, exhibiting a CAGR of 7% during the forecast period. Key drivers include the rapid expansion of e-commerce, increasing demand for efficient cross-border transactions, and advancements in data security and fraud prevention technologies.

Study Assumption Years

-

Base Year: 2024

-

Historical Years: 2019–2024

-

Forecast Years: 2025–2033

B2B Payments Market Key Takeaways

-

Market Size and Growth: Valued at USD 1,189.6 billion in 2024, the B2B payments market is expected to reach USD 2,189.0 billion by 2033, growing at a CAGR of 7%.

-

Regional Dominance: Asia-Pacific leads the market, holding a 36.7% share in 2024, driven by rapid digitalization and a burgeoning e-commerce sector.

-

Payment Type: Domestic payments represent the largest segment, attributed to high transaction volumes and simplicity in local business transactions.

-

Payment Mode: Traditional payment methods currently dominate, owing to established processes and familiarity within businesses.

-

Enterprise Size: Large enterprises lead the market, driven by complex payment needs and the ability to invest in advanced payment technologies.

-

Industry Vertical: The manufacturing sector holds the largest share, due to complex supply chain networks requiring efficient B2B payment processes.

Request for a sample copy of this report : https://www.imarcgroup.com/b2b-payments-market/requestsample

Market Growth Factors

1. Digital Transformation and Technological Advancements

B2B payments are in for a wild ride, as digital technology is quickly changing the landscape. Today's businesses are using electronic payments (electronic funds transfers (EFT), virtual credit cards and mobile payment solutions) as a way to streamline their finances. Fintech services are allowing for easier, more user-friendly and cost-effective B2B payments. Cryptocurrency solutions and smart contracts will also continue to increase security and fraud prevention among companies offering payments.

2. Regulatory Initiatives and Compliance

Regulatory frameworks are fundamentally shaping the B2B payments industry. Governments and regulatory bodies are working on regulatory guidelines to encourage digital payments and financial transparency. For example, the Single Euro Payments Area (SEPA) – which has been adopted across Europe – allows for cross-border B2B payment solutions. Compliance with regulatory standards, such as PSD2 and secure API integration, helps promote trust and innovation in B2B payment solutions.

3. Demand for Efficient Cross-Border Transactions

The rising number of businesses operating globally has driven an increase in demand for effective cross-border B2B payment solutions. Businesses want faster, more secure and cheaper payment options to fulfil more diverse and evolving needs. With increased focus on cost recovery and efficient cash flow management, market expansion further speeds up. Meanwhile, increasing data analytics and insights into B2B payment solutions have begun becoming more critical in decision-making and strategic planning.

Market Segmentation

By Payment Type

-

Domestic Payments: Transactions conducted within a single country, offering simplicity and high transaction volumes.

-

Cross-Border Payments: Transactions between businesses in different countries, requiring efficient and secure payment solutions.

By Payment Mode

-

Traditional: Established payment methods such as cheques and wire transfers, prevalent due to familiarity and established processes.

-

Digital: Modern payment solutions including electronic funds transfers, virtual cards, and mobile payment apps, offering speed and efficiency.

By Enterprise Size

-

Large Enterprises: Organizations with complex payment needs and high transaction volumes, capable of investing in advanced payment technologies.

-

Small and Medium-sized Enterprises: Businesses seeking cost-effective and streamlined payment solutions to enhance operational efficiency.

By Industry Vertical

-

BFSI: Financial institutions requiring secure and efficient payment systems for various transactions.

-

Manufacturing: Industries with complex supply chains necessitating efficient B2B payment processes.

-

IT and Telecom: Companies focusing on digital solutions and requiring rapid, secure payment methods.

-

Metals and Mining: Sectors dealing with large transactions and requiring robust payment systems.

-

Energy and Utilities: Industries necessitating reliable and timely payment solutions for continuous operations.

-

Others: Various other sectors engaging in B2B transactions requiring efficient payment systems.

Breakup by Region

-

North America (United States, Canada)

-

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

-

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

-

Latin America (Brazil, Mexico, Others)

-

Middle East and Africa

Regional Insights

Asia-Pacific dominates the B2B payments market, holding a 36.7% share in 2024. This dominance is attributed to rapid digitalization, a burgeoning e-commerce sector, and a large number of SMEs embracing digital B2B payment platforms. Countries like China, India, and Japan are leading the charge due to favorable government initiatives, increased smartphone penetration, and improvements in internet infrastructure. Additionally, the region’s focus on fintech adoption and seamless cross-border trade continues to drive growth in the market.

Recent Developments & News

The B2B payments market is witnessing major innovations and collaborations. For instance, key market players are forming strategic alliances to improve cross-border transaction efficiency and reduce settlement time. Additionally, businesses are investing heavily in automation tools, AI, and blockchain to optimize accounts payable and receivable. Another prominent trend is the rising popularity of embedded finance, allowing businesses to integrate payment solutions directly into their platforms. These developments are reshaping the competitive landscape and enhancing the user experience for B2B financial operations.

Key Players

-

American Express Company

-

Bank of America Corporation

-

Capital One

-

Citigroup Inc.

-

JPMorgan Chase & Co.

-

Mastercard Inc.

-

Payoneer Inc.

-

PayPal Holdings Inc.

-

Paystand Inc.

-

Stripe Inc.

-

Visa Inc.

-

Wise Payments Limited

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=5143&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0