Automotive Brake Components Market 2030 Key Highlights

Key trends in the market include the integration of advanced braking technologies like autonomous emergency braking (AEB) and the use of composite materials to reduce weight and enhance performance.

The Global Automotive Brake Components Market is undergoing a remarkable transformation. Valued at USD 53.81 billion in 2023, the market is projected to reach USD 73.71 billion by 2029, growing at a CAGR of 5.44% during the forecast period. This growth is driven by several converging forces: the surge in demand for fuel-efficient vehicles, the transition toward sustainable and lightweight materials, the rise of electric and hybrid mobility, and increasingly stringent safety and emission regulations.

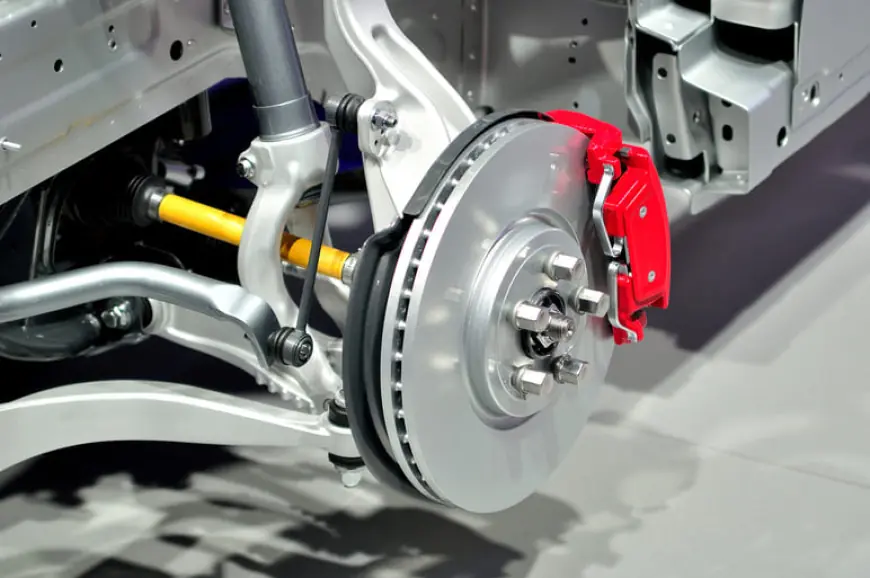

Brake components are not just functional elements of vehicles—they are critical to safety, performance, and sustainability. From brake pads and rotors to advanced brake-by-wire systems, the global market is evolving rapidly to keep pace with new vehicle technologies, consumer preferences, and regulatory mandates.

Industry Key Highlights

- Market Value: USD 53.81 billion in 2023, projected to reach USD 73.71 billion by 2029.

- CAGR: Expected growth rate of 5.44% during 2025–2029.

- Dominant Segment: Passenger cars, due to growing urbanization, rising disposable incomes, and vehicle electrification.

- Fastest-Growing Region: North America, led by advanced safety regulations, EV adoption, and technological innovation.

- Key Drivers: Vehicle electrification, sustainability, safety mandates, and lightweight design.

- Major Players: Brembo N.V., Continental Automotive, ZF Friedrichshafen AG, Akebono Brake Industry, Bosch, Mando, TMD Friction, AISIN, and others.

Download Free Sample Report: https://www.techsciresearch.com/sample-report.aspx?cid=3790

Emerging Trends in the Automotive Brake Components Market

1. Sustainability and Eco-Friendly Materials

One of the most prominent trends shaping the industry is the shift toward green manufacturing. Automakers and brake manufacturers are under pressure to lower carbon footprints and align with global sustainability goals. This has led to the adoption of recycled metals, ceramics, and bio-based composites in brake systems. These innovations are designed not only to reduce environmental impact but also to improve braking performance and longevity.

2. Rise of Electric and Hybrid Vehicles (EVs/HEVs)

The electrification of mobility is redefining braking systems. Unlike traditional internal combustion engine (ICE) vehicles, EVs require regenerative braking systems that recover kinetic energy and store it in the battery. This has sparked innovation in regenerative braking technologies, brake-by-wire systems, and electronic stability controls, transforming the functionality of brake components.

3. Integration of Smart and Automated Braking Systems

As vehicles become smarter, braking systems are evolving alongside. Advanced Driver Assistance Systems (ADAS) are increasingly being integrated with automated braking solutions capable of real-time decision-making. Features like autonomous emergency braking (AEB) and collision avoidance systems are becoming standard in many regions, further accelerating the demand for intelligent brake components.

4. Lightweighting and Performance Efficiency

Lightweight vehicles are central to achieving higher fuel efficiency and reduced emissions. Brake component manufacturers are developing carbon-ceramic discs, aluminum calipers, and composite rotors that offer both durability and reduced weight. This ensures vehicles maintain performance standards while complying with emission regulations.

5. Digital Manufacturing and Customization

Innovations in 3D printing and additive manufacturing are revolutionizing production processes. Brake components can now be customized for specific models at reduced costs and shorter lead times. This is particularly valuable for EVs, performance cars, and luxury segments that demand specialized solutions.

Market Drivers

1. Regulatory Push for Safety

Governments worldwide are enforcing stricter safety regulations. Mandates for systems like ABS (Anti-lock Braking Systems), ESC (Electronic Stability Control), and AEB have significantly boosted demand for advanced brake components.

2. Vehicle Electrification

The global transition toward EVs and HEVs has created an urgent need for specialized braking technologies that work seamlessly with regenerative systems, boosting market opportunities.

3. Consumer Demand for Advanced Safety Features

Rising consumer awareness and preference for vehicles equipped with cutting-edge safety technologies is driving the uptake of intelligent braking systems across vehicle categories.

4. Urbanization and Rising Disposable Incomes

With rapid urbanization and increasing income levels, the demand for passenger vehicles is soaring. This, in turn, fuels demand for brake components—particularly in high-growth regions like Asia-Pacific and Latin America.

5. Technological Innovations in Material Science

Advances in nanotechnology, ceramics, and metallurgy are enabling brake components that are lighter, more durable, and resistant to wear, directly supporting fuel efficiency and performance.

Regional Insights

- North America is the fastest-growing region due to EV adoption, government incentives, safety mandates, and autonomous driving innovations.

- Europe remains a stronghold for sustainability-driven innovation, with a focus on lightweight materials and carbon-ceramic technologies.

- Asia-Pacific dominates in terms of volume, driven by China, India, and Japan’s massive automotive industries, urbanization, and rising middle-class consumers.

- Latin America and Middle East & Africa are emerging markets where growth is spurred by increasing vehicle sales and gradual adoption of advanced braking technologies.

Segmentation Insights

- By Type: Brake pads, rotors, calipers, master cylinders, lines, shoes, and brake fluid.

- By Vehicle Type: Passenger cars, commercial vehicles, two-wheelers.

- By Demand Type: OEMs dominate, but the aftermarket segment is expanding rapidly due to frequent replacements.

- By Region: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa.

Competitive Analysis

The global automotive brake components market is highly competitive, with established giants and regional players vying for market share.

- Brembo N.V.: Known for high-performance braking solutions, especially in premium and motorsport segments.

- Continental Automotive: A leader in safety systems, focusing on intelligent braking technologies.

- ZF Friedrichshafen AG: Strong presence in OEM supply chains, integrating lightweight and advanced materials.

- Akebono Brake Industry Co., Ltd: Specializes in ceramic-based brake technologies.

- Robert Bosch GmbH: A pioneer in ABS, ESC, and regenerative braking solutions.

- Mando Corp: Expanding in EV braking technologies.

- TMD Friction: A key aftermarket supplier with diverse product offerings.

- AISIN Corporation: Strong in both OEM and aftermarket segments with a focus on reliability.

Competitive strategies include R&D investments, partnerships with automakers, and product diversification into sustainable and EV-compatible components.

Future Outlook

The future of the automotive brake components market is closely tied to the evolution of the broader automotive sector. With electrification, sustainability, and safety as central themes, the market will increasingly shift toward intelligent, lightweight, and eco-friendly braking solutions.

- By 2030, brake-by-wire and regenerative braking systems are expected to become mainstream across both passenger and commercial vehicles.

- The aftermarket segment will expand significantly as global vehicle fleets age, creating continuous demand for replacement components.

- Advancements in AI-driven predictive maintenance could redefine how brake components are monitored and replaced, boosting efficiency.

Overall, the market will remain on a growth trajectory, fueled by innovation, regulation, and consumer demand.

10 Benefits of the Research Report

- Provides accurate market size estimations for 2023–2029.

- Identifies key growth drivers, restraints, and opportunities.

- Offers segmentation insights by type, vehicle type, demand type, and region.

- Analyzes emerging trends such as EV adoption and sustainability.

- Benchmarks leading players with detailed competitive intelligence.

- Delivers regional breakdowns for targeted investment strategies.

- Supports strategic decision-making with forecast data.

- Highlights innovation opportunities in materials and manufacturing.

- Examines aftermarket growth potential across global regions.

- Provides actionable insights for automakers, suppliers, and investors.

Conclusion

The Global Automotive Brake Components Market is more than a supporting industry—it is a cornerstone of automotive innovation, safety, and sustainability. Driven by electrification, regulatory frameworks, and consumer expectations, the industry is on a trajectory of steady growth and transformation.

With key players investing in advanced technologies, lightweight materials, and eco-friendly solutions, the market is expected to witness significant developments by 2029. Companies that can balance innovation, cost efficiency, and regulatory compliance will be best positioned to thrive in this evolving landscape.

Contact Us-

Mr. Ken Mathews

708 Third Avenue,

Manhattan, NY,

New York – 10017

Tel: +1-646-360-1656

Email: [email protected]

Website: www.techsciresearch.com

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0