What Are the Benefits of Automating Accounts Payable?

, accounts payable automation transforms finance teams from reactive to strategic. Whether you're ready to implement a cloud based accounts payable solution, integrate with NetSuite, or even outsource accounts payable, automation is the future of efficient, scalable financial operations.

In today’s business world, efficiency and accuracy are non-negotiable. That’s why more companies are turning to accounts payable automation to optimize their finance operations. But what are the real benefits of automating accounts payable? And how can this shift improve everything from vendor relationships to your bottom line? In this blog, we’ll explore the powerful advantages of automated accounts payable solutions, walk through how automation fits into the end to end process of accounts payable, and answer some common questions to help you make a more informed decision.

What Is Accounts Payable Automation?

Before we dive into the benefits, let’s quickly define it.

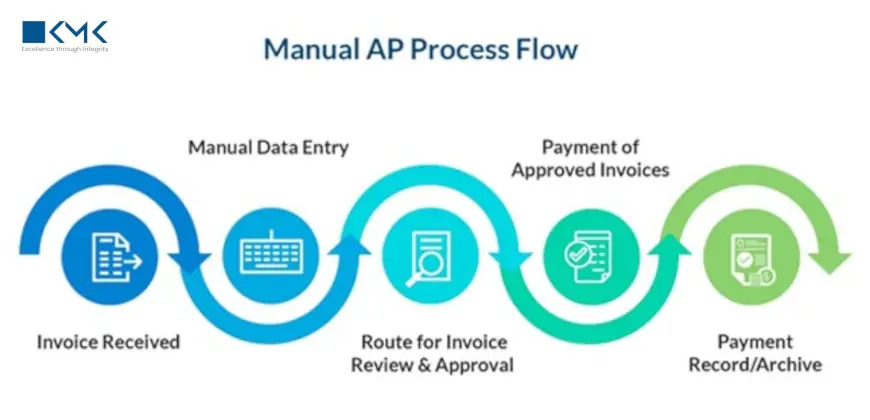

Accounts payable automation is the use of technology to digitize and streamline invoice processing, approvals, and payments. Rather than relying on spreadsheets, paper invoices, and manual data entry, automation tools use intelligent workflows, OCR (optical character recognition), and integrations with ERP systems to manage the accounts payable process more efficiently.

Popular platforms like NetSuite accounts payable automation offer end-to-end solutions for managing every step of the P2P (procure-to-pay) cycle.

Why Should You Automate Accounts Payable?

Let’s explore the core benefits—each backed by real operational improvements and cost-saving opportunities.

1. Time-Saving Efficiency

One of the most immediate benefits of automation is the time it saves. Manual AP processes involve a lot of repetitive tasks:

-

Data entry from paper or emailed invoices

-

Chasing down approvals

-

Manual matching of invoices, POs, and receipts

With automated accounts payable solutions, these steps are completed in minutes. Invoices are scanned or emailed, automatically extracted, routed to the right approver, and pushed through the system without human error or delay.

2. Lower Costs and Better ROI

Labor costs for AP teams can add up quickly, especially when dealing with high invoice volumes. Automating your AP process reduces:

-

Processing time per invoice

-

Paper and printing costs

-

Costs from late payments or duplicate payments

-

Manual labor hours

According to industry studies, businesses can save up to 80% per invoice with automation. That’s a direct improvement to your bottom line.

3. Improved Accuracy and Fewer Errors

Mistakes in invoice processing—such as incorrect entries or missed payments—can be expensive and time-consuming to fix.

Accounts payable automation reduces human error through features like:

-

Automatic data extraction and validation

-

3-way invoice matching (invoice, PO, and receipt)

-

Duplicate invoice detection

-

Custom business rule enforcement

Accurate processing not only reduces rework but also builds trust with your vendors.

4. Enhanced Visibility and Control

Automating your AP process gives finance leaders a real-time view into cash flow, pending approvals, and liabilities. With dashboard reporting and analytics, you can:

-

Track invoice status at any time

-

Identify bottlenecks in the process

-

Forecast cash flow more accurately

-

Ensure compliance with internal controls

This level of insight is especially valuable when using cloud based accounts payable solutions, where data is updated in real-time and accessible across departments.

5. Stronger Vendor Relationships

Vendors care about two things: timely payments and clear communication. When your AP process is disorganized, delays happen—and so do strained relationships.

With automation, you can:

-

Pay vendors on time, every time

-

Eliminate lost or misplaced invoices

-

Provide payment status updates through vendor portals

Some companies even use NetSuite accounts payable automation tools to offer early payment discounts or optimize payment scheduling for better terms.

6. Scalability for Growth

Manual processes don’t scale easily. As your business grows and invoice volume increases, your AP team will struggle to keep up.

Automated systems handle growing workloads without requiring additional staff. Whether you process 500 or 5,000 invoices per month, the automation process remains consistent and efficient.

This is especially helpful for businesses looking to outsource accounts payable while maintaining transparency and control.

7. Tighter Compliance and Audit Readiness

Financial audits require detailed records and clear approval trails. AP automation tools create digital logs of every action taken, including:

-

Who approved what and when

-

Invoice versions and changes

-

Payment confirmations

This ensures compliance with accounting standards and simplifies the audit process significantly.

8. Seamless Integration with Existing Tools

Modern AP solutions integrate easily with popular ERPs like NetSuite, QuickBooks, or SAP. This eliminates duplicate data entry and keeps your financial systems fully synced.

Whether you're running an in-house ERP or relying on a partner to outsource accounts payable, integration ensures consistent and reliable operations.

How Does Automation Fit into the P2P Accounts Payable Process?

The P2P (procure-to-pay) cycle includes:

-

Purchase order creation

-

Vendor fulfillment

-

Invoice generation

-

Invoice matching and approval

-

Payment

With accounts payable automation, each step is connected and streamlined. For example, purchase orders are matched automatically to invoices, and approval workflows are predefined based on your business rules.

This end to end process of accounts payable becomes faster, more accurate, and less dependent on manual touchpoints.

Frequently Asked Questions

Q: What are automated accounts payable solutions?

A: These are software tools that digitize and automate invoice capture, processing, approvals, and payment.

Q: Can cloud based accounts payable solutions be used by small businesses?

A: Yes, cloud-based platforms are flexible and scalable, making them ideal for small to mid-sized companies looking to reduce overhead.

Q: Is NetSuite accounts payable automation worth it?

A: If your business already uses NetSuite, its AP automation features integrate seamlessly and offer deep insights, faster processing, and better compliance.

Q: What’s the ROI of AP automation?

A: Businesses typically save 60–80% in processing costs per invoice, with added benefits in accuracy, compliance, and scalability.

Q: How do I start automating my AP process?

A: Begin by assessing your current AP workflow, identifying pain points, and evaluating AP automation tools that align with your ERP and growth plans.

Final Thoughts

The benefits of automating accounts payable go far beyond faster invoice approvals. From cost savings and improved accuracy to stronger vendor relationships and better decision-making, accounts payable automation transforms finance teams from reactive to strategic. Whether you're ready to implement a cloud based accounts payable solution, integrate with NetSuite, or even outsource accounts payable, automation is the future of efficient, scalable financial operations.

Ready to unlock the full potential of your AP process?

Explore your automation options today and position your business for smarter, more agile financial management.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0