Marine Engine Market: The Role of Sustainable Practices in Shaping the Industry

Marine Engine Market

Overview

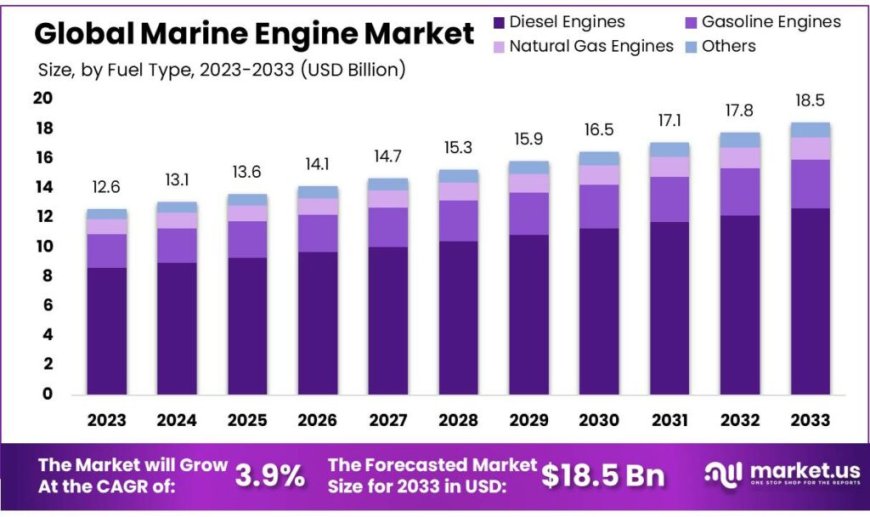

Marine Engine Market size is expected to be worth around USD 18.5 billion by 2033, from USD 12.6 Bn in 2023, growing at a CAGR of 3.9% during the forecast period from 2023 to 2033.

The marine engine market encompasses the sector involved in the production, distribution, and maintenance of engines used in various types of marine vessels. This includes engines for commercial ships, recreational boats, and industrial marine applications. Marine engines are crucial for powering vessels and ensuring they operate efficiently on water, whether for transportation, fishing, or leisure activities. These engines come in different types, such as inboard, outboard, and stern drive, each tailored to specific marine needs.

The market for marine engines is influenced by several factors, including global trade growth, rising demand for recreational boating, and advancements in technology. As international shipping continues to expand, there is a greater need for powerful and reliable engines to support large commercial vessels. Additionally, innovations such as fuel-efficient and environmentally friendly engines are driving market growth. Manufacturers are focusing on improving engine performance while meeting stricter emission regulations and enhancing fuel efficiency.

Recent trends in the marine engine market show a growing emphasis on sustainability and technological advancements. The development of hybrid and electric marine engines is gaining traction as the industry seeks to reduce its environmental footprint. Moreover, ongoing advancements in digital technology are enhancing engine monitoring and management systems, making marine engines more efficient and easier to maintain. Overall, the marine engine market is evolving rapidly with a focus on efficiency, innovation, and environmental responsibility.

Market Key Segments

By Fuel Type

-

Diesel Engines

-

Gasoline Engines

-

Natural Gas Engines

-

Others

By Capacity

-

0 – 10000 HP

-

10000 – 20000 HP

-

20000 – 30000 HP

-

30000 – 40000 HP

-

40000 – 50000 HP

-

More than 50000 HP

By Stroke

-

2 Strokes

-

4 Strokes

By RPM

-

Less than 1,000 RPM

-

1,000 – 2,000 RPM

-

Above 2,000 RPM

By Ship Type

-

Oil Tankers

-

Bulk Carriers

-

Cargo Ships

-

Gas Carriers

-

Tankers

-

Support Vessel

-

Ferriers and Passenger ships

-

Others

Download a sample report in MINUTES@https://market.us/report/marine-engine-market/request-sample/

In 2023, diesel engines led the marine engine market with a commanding 68.4% share, reflecting their widespread use due to their reliability, durability, and fuel efficiency across various marine applications. The 0-10,000 HP engine segment held a significant 22.4% share, highlighting its popularity for small boats, yachts, and some commercial vessels due to its versatility and affordability. Two-stroke engines also dominated, capturing 62.3% of the market, favored for their simplicity and high power-to-weight ratio. Additionally, engines operating at less than 1,000 RPM accounted for 46.5% of the market, being the preferred choice for large, heavy-duty vessels like cargo ships and tankers due to their high torque output. Cargo ships specifically held a notable 21.6% market share, underscoring their critical role in global goods transportation and the demand for powerful, reliable engines.

Market Key Players

-

Cummins Inc.

-

Hyundai Heavy Industries Co., Ltd

-

MAN Energy Solutions

-

Mitsubishi Heavy Industries Ltd

-

Rolls Royce plc

-

Volvo Penta

-

Wartsila

-

Yanmar Holdings Co., Ltd

-

Mahindra Powerol

-

Daihatsu Diesel Mfg., Ltd

-

Deutz AG

-

WinGD

-

Siemens Energy

-

Volkswagen Group

Drivers: The marine engine market is driven by increased global trade, which requires efficient and reliable ships for transporting goods, food, and energy resources. Innovations in engine technology, including fuel-efficient and low-emission systems, are also fueling market growth. Additionally, stricter environmental regulations are pushing for cleaner engines, while the rise in offshore energy exploration and recreational boating creates further demand for advanced marine propulsion systems.

Restraints: High costs of upgrading to new, efficient engines pose a significant barrier, especially for owners of older vessels or those with limited budgets. Economic fluctuations and reduced trade can lead to delayed engine purchases. Compliance with stringent environmental regulations requires costly investments in new technologies, and limited availability and high costs of alternative fuels and propulsion systems can slow market adoption.

Opportunities: The growing demand for sustainable marine propulsion presents opportunities for manufacturers to develop innovative technologies such as hybrid systems, alternative fuels, and electric engines. The expansion of offshore renewable energy projects and increasing digitalization in the maritime industry also offers new avenues for growth, including smart, IoT-enabled engines and specialized engines for new maritime sectors like aquaculture and marine tourism.

Challenges: Strict environmental regulations and emission standards impose significant costs for engine upgrades and compliance. The marine industry’s cyclic nature and economic uncertainties can lead to reduced demand for new engines. Technical and logistical challenges related to alternative fuels and propulsion systems, along with geopolitical tensions and trade disruptions, can impact market stability and growt.