Wound Care Biologics Market Size, Growth, Trends & Opportunity Analysis 2025-2033

The market is experiencing steady growth driven by the rising incidence of chronic wounds, advancements in biotechnology, and a shift towards minimally invasive patient-centric solutions, which is driving demand for innovative biologic therapies in wound management.

Market Overview:

IMARC Group, a leading market research company, has recently released a report titled “Wound Care Biologics Market Report by Product (Biologic Skin Substitutes, Topical Agents), Wound Type (Ulcers, Surgical and Traumatic Wounds, Burns), Application (Acute Wound, Chronic Wound, Surgical Wound), End-User (Hospitals, ASCs, Burn Centres and Wound Clinics), and Region 2025-2033”. The study provides a detailed analysis of the industry, including the global wound care biologics market trends, share, size, and industry growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Report Highlights:

How Big Is the wound care biologics market?

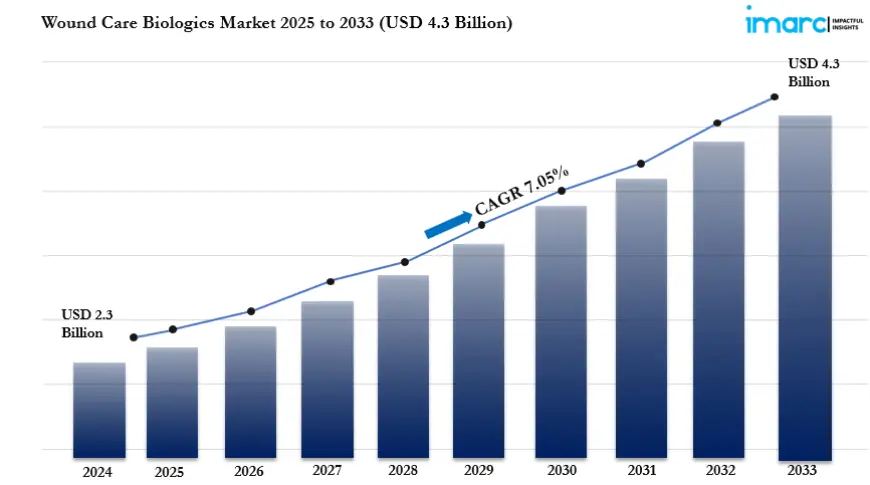

The global wound care biologics market size reached USD 2.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.3 Billion by 2033, exhibiting a growth rate (CAGR) of 7.05% during 2025-2033. The market is experiencing steady growth driven by the rising incidence of chronic wounds, advancements in biotechnology, and a shift towards minimally invasive patient-centric solutions, which is driving demand for innovative biologic therapies in wound management.

Request to Get the Sample Report: https://www.imarcgroup.com/wound-care-biologics-market/requestsample

Market Dynamics in the Wound Care Biologics Market

- Growing Prevalence of Chronic Wounds Accelerating Demand for Biologic Solutions

The rising incidence of chronic wounds, particularly diabetic foot ulcers, pressure ulcers, and venous leg ulcers, is driving the demand for advanced wound care biologics. As the global population ages and the prevalence of lifestyle-related conditions such as diabetes and obesity increases, healthcare systems are witnessing a surge in non-healing wound cases that are resistant to conventional treatment. Traditional wound care therapies often fall short in managing such complex wounds, leading to longer hospital stays and higher medical costs. Biologic therapies—such as growth factors, skin substitutes, and biologically active matrices—are increasingly recognized for their ability to accelerate tissue regeneration, reduce healing time, and lower the risk of infection.

By 2025, the demand for biologics in wound care is projected to grow substantially as medical professionals prioritize effective solutions for managing chronic wounds more efficiently. Furthermore, the expansion of outpatient care and home-based treatment options is contributing to the broader adoption of biologics that offer both clinical effectiveness and ease of use. Government initiatives aimed at improving chronic disease management and wound care standards are also playing a pivotal role in boosting product penetration across both developed and developing healthcare infrastructures. As hospitals and specialty clinics seek cost-effective ways to treat wounds with minimal complications, biologic wound care solutions are becoming a preferred treatment modality.

- Technological Advancements and Product Innovation Driving Market Differentiation

Innovation remains a key differentiator in the wound care biologics market, with companies increasingly investing in next-generation technologies to enhance clinical outcomes and product usability. Breakthroughs in tissue engineering, stem cell therapies, and bioengineered skin substitutes are enabling more targeted and effective wound healing strategies. Companies are focusing on developing products that mimic natural skin regeneration processes while also improving anti-inflammatory responses. These biologics not only promote faster healing but also reduce scarring and the likelihood of wound recurrence. By 2025, technological advancements are expected to create new growth opportunities by expanding the application scope of wound care biologics across acute and surgical wounds, burns, and trauma cases.

Miniaturized delivery mechanisms, sprayable gels, and smart biomaterials that adapt to wound conditions in real time are capturing the attention of clinicians and researchers alike. As regulatory bodies provide faster approval pathways for innovative wound healing products, the time-to-market for new biologics is shortening, encouraging further R&D investments. Strategic collaborations between biotech firms, academic institutions, and clinical researchers are accelerating the commercialization of high-performance wound care solutions. These technological developments are reshaping competitive dynamics in the market, encouraging companies to differentiate through innovation, efficacy, and patient-centric design.

- Increasing Healthcare Expenditure and Favorable Reimbursement Policies Enhancing Accessibility

The global rise in healthcare expenditure and evolving reimbursement structures are playing a crucial role in making wound care biologics more accessible and commercially viable. With healthcare providers under pressure to improve patient outcomes while managing costs, biologic wound therapies that offer long-term healing benefits are gaining favor. Countries across North America and Europe are leading in adopting reimbursement frameworks that support the use of advanced biologics, especially for chronic and non-healing wounds. By 2025, favorable insurance coverage and value-based healthcare models are expected to further accelerate product adoption, particularly in outpatient and long-term care settings.

Emerging economies are also beginning to introduce public health policies and subsidies that encourage the use of biologic wound treatments, particularly for populations with limited access to surgical interventions. Hospitals and wound care centers are increasingly evaluating the cost-to-benefit ratio of biologics and realizing their potential to reduce overall treatment costs through faster recovery, reduced readmissions, and lower rates of complications. As policymakers recognize the economic burden of chronic wounds, funding allocations for biologics are expected to increase, creating an ecosystem that supports innovation and widespread utilization. This financial and policy support is proving essential in driving market momentum and expanding treatment access across various patient demographics.

Get Discount On The Purchase Of This Report: https://www.imarcgroup.com/checkout?id=1489&method=1670

Wound Care Biologics Market Report Segmentation:

Breakup by Product:

- Biologic Skin Substitutes

- Human Donor Tissue-Derived Products

- Acellular Animal-Derived Products

- Biosynthetic Products

- Topical Agents

The report has provided a detailed breakup and analysis of the market based on the product. This includes biologic skin substitutes (human donor tissue-derived products, acellular animal-derived products, and biosynthetic products) and topical agents. According to the report, biologic skin substitutes represented the largest segment.

Breakup by Wound Type:

- Ulcers

- Diabetic Foot Ulcers

- Venous Ulcers

- Pressure Ulcers

- Others

- Surgical and Traumatic Wounds

- Burns

A detailed breakup and analysis of the market based on the wound type have also been provided in the report. This includes ulcers (diabetic foot ulcers, venous ulcers, pressure ulcers, and others), surgical and traumatic wounds, and burns.

Breakup by Application:

- Acute Wound

- Chronic Wound

- Surgical Wound

The report has provided a detailed breakup and analysis of the market based on the application. This includes acute wound, chronic wound, and surgical wound. According to the report, chronic wound represented the largest segment.

Breakup by End-User:

- Hospitals

- ASCs

- Burn Centres and Wound Clinics

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes hospitals, ASCs, and burn centres and wound clinics. According to the report, hospitals represented the largest segment.

Breakup by Region:

- Asia Pacific

- Europe

- North America

- Middle East and Africa

- Latin America

Competitive Landscape with Key Players:

The competitive landscape of the wound care biologics market size has been studied in the report with the detailed profiles of the key players operating in the market.

Some of These Key Players Include:

- Anika Therapeutics, Inc.

- Convatec Inc.

- Integra LifeSciences Corporation

- Kerecis

- MIMEDX Group, Inc.

- Molnlycke AB

- Organogenesis Inc.

- Skye Biologics Holdings, LLC

- Smith & Nephew

- Stryker Corporation

Ask Analyst for Customized Report: https://www.imarcgroup.com/request?type=report&id=1489&flag=C

Key Highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- Market Trends

- Market Drivers and Success Factors

- Impact of COVID-19

- Value Chain Analysis

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us:

IMARC Group

134 N 4th St

Brooklyn, NY 11249, USA

Website: imarcgroup.com

Email: [email protected]

United States: +1-201971-6302

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0