What Makes Offshore Bookkeeping a Smarter Move Than Hiring?

For many business owners, managing finances is one of the most time-consuming and stressful parts of running a company. Accurate bookkeeping is essential for tracking cash flow, staying compliant, and making informed decisions—but deciding how to handle it is a challenge. Should you hire an in-house bookkeeper or outsource the work to an offshore team?

In recent years, offshore bookkeeping services have emerged as the preferred solution for businesses of all sizes. Why? Because they offer flexibility, cost savings, and expertise that are often hard to match with a full-time hire. Let’s break down why offshore bookkeeping is becoming a smarter move than hiring in-house staff.

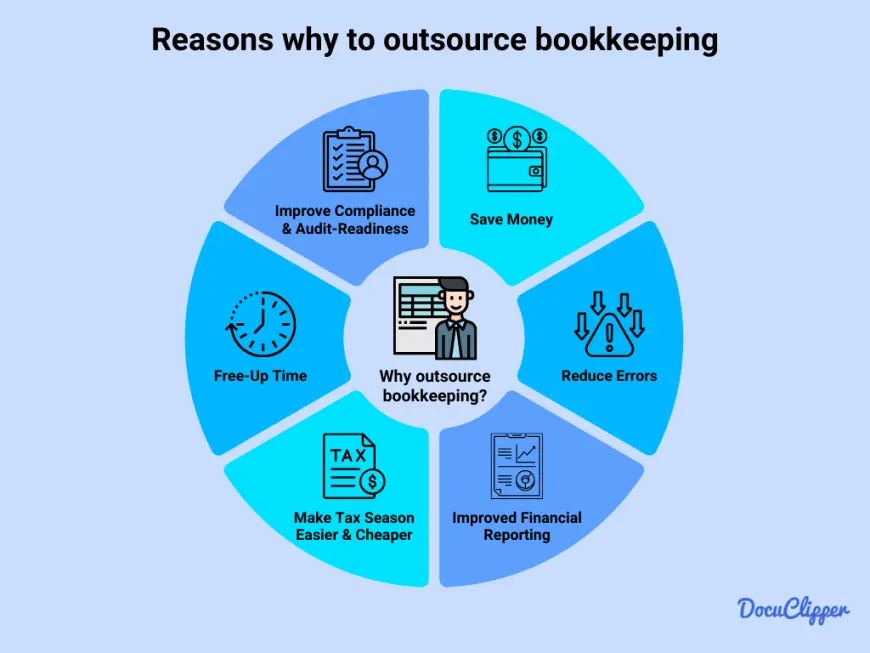

1. Significant Cost Savings

Hiring an in-house bookkeeper comes with a long list of expenses: salary, benefits, training, payroll taxes, office space, and software costs. Even a part-time bookkeeper can add up when you consider these overheads.

Offshore bookkeeping services, on the other hand, can cut bookkeeping costs by 40–60% while still delivering the same quality and accuracy. You pay only for the services you need, without committing to a fixed salary or benefits. This makes it easier for businesses—especially small and mid-sized ones—to manage finances without straining their budgets.

2. Pay for What You Need (Scalability)

Bookkeeping needs aren’t static. During tax season, holiday sales, or periods of rapid growth, businesses often need extra help. But during quieter months, that full-time bookkeeper may not have enough work to justify their salary.

Offshore bookkeeping gives you scalability—the ability to ramp up or reduce your bookkeeping support based on your business cycle. You get all the help you need during busy times and scale back when things slow down, without layoffs or wasted payroll.

3. Access to Skilled Professionals

When hiring locally, small businesses often face two challenges: limited talent pools and high salary demands for experienced bookkeepers. Offshore bookkeeping firms solve this by offering access to highly skilled professionals trained in global accounting standards and experienced with platforms like QuickBooks Online, Xero, and Zoho Books.

These offshore experts can handle not just basic data entry, but also complex tasks like reconciliations, accounts payable/receivable, and financial reporting, all while keeping your books compliant and accurate.

4. No Recruitment or Training Hassles

Hiring a new employee means recruiting, interviewing, training, and sometimes replacing them if they leave. This process costs time and money—resources that many small and growing businesses can’t afford to waste.

With offshore bookkeeping, the service provider handles recruitment and training. You’re assigned a ready-to-go professional (or team) who already understands bookkeeping best practices and the tools you use. This eliminates onboarding headaches and reduces disruption to your operations.

5. Focus on Core Business Activities

When you outsource your bookkeeping, you’re not just delegating data entry—you’re buying back time. Offshore bookkeepers handle the routine, repetitive financial tasks so you and your in-house team can focus on what truly grows your business:

-

Sales and marketing

-

Customer relationship management

-

Strategic decision-making

-

Expanding into new markets

Rather than drowning in spreadsheets, you can dedicate your energy to revenue-driving activities.

6. Real-Time Financial Insights

Many offshore bookkeeping providers use cloud-based accounting systems, allowing you to access your financial data anytime, from anywhere. This means you can:

-

View updated reports on demand

-

Check cash flow and profit margins in real time

-

Collaborate with your offshore team as if they were in-house

This level of transparency helps you make faster, more informed decisions—something a single in-house bookkeeper, working on local systems, may not always provide.

7. Lower Risk of Disruption

When you rely on one in-house bookkeeper, your entire financial system can grind to a halt if they quit, fall sick, or go on leave. Offshore bookkeeping services, however, operate with teams and backup resources, ensuring continuity of work even during absences.

This reliability helps businesses avoid missed deadlines, cash flow problems, or compliance issues due to staff turnover.

8. Enhanced Security and Compliance

Many business owners worry about sharing financial data offshore. But reputable bookkeeping firms follow strict data security protocols, encryption standards, and international compliance regulations (like GDPR) to keep your information safe. In fact, some offshore teams have more robust security systems than small businesses can afford to implement on their own.

9. The Bottom-Line Advantage

When you add up all these benefits—lower costs, flexibility, expert talent, no recruitment hassle, and reduced risks—offshore bookkeeping clearly comes out ahead of hiring for most businesses. It’s not just a cheaper alternative; it’s a more efficient, scalable, and future-ready solution for handling your finances.

Is Offshore Bookkeeping Right for You?

Offshore bookkeeping is ideal if your business:

-

Wants to cut operational costs without losing accuracy

-

Experiences seasonal or fluctuating workloads

-

Struggles to hire or retain skilled bookkeepers locally

-

Wants to free up time for growth and strategy

-

Uses (or is open to using) cloud-based accounting software

If these points resonate, outsourcing your bookkeeping offshore could be the smarter choice for your company.

How to Get Started

-

Identify Your Needs – Determine which tasks (reconciliations, AP/AR, payroll, reporting) you want to outsource.

-

Find a Reputable Provider – Look for a firm experienced with your industry, preferred accounting tools, and security compliance.

-

Start Small – Test the waters with a few services or accounts before scaling up.

-

Communicate Clearly – Set expectations for timelines, deliverables, and reporting formats.

-

Leverage Cloud Tools – Ensure you have real-time visibility into your finances, no matter where your team is located.

Final Thoughts

Hiring an in-house bookkeeper might seem like the traditional route, but it’s no longer the most practical or cost-effective choice for many businesses. Offshore bookkeeping offers flexibility, cost savings, expert support, and continuity that an individual hire often can’t match.

By outsourcing, you gain a scalable financial partner who keeps your books accurate and up to date—while you focus on growing your business. In 2025, it’s not just about outsourcing to save money; it’s about building a smarter, leaner, and more agile way to manage your finances.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0