What Does the Latest Analysis Reveal About the Latin America Logistics Market Outlook?

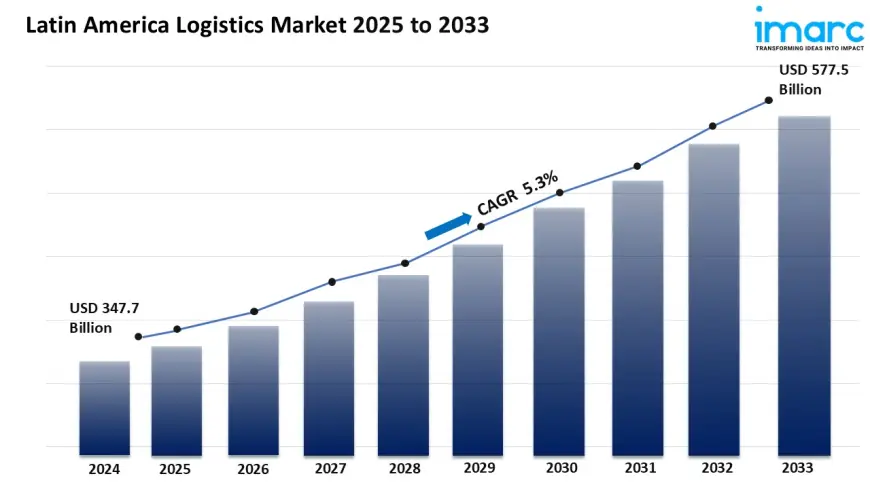

The Latin America logistics market size reached USD 347.7 billion in 2024, and it is expected to reach USD 577.5 billion by 2033, exhibiting a growth rate (CAGR) of 5.3% during 2025-2033.

Latin America Logistics Market Overview:

Market Size in 2024: USD 347.7 Billion

Market Forecast in 2033: USD 577.5 Billion

Market Growth Rate 2025-2033: 5.3%

The Latin America logistics market size reached USD 347.7 billion in 2024, and it is expected to reach USD 577.5 billion by 2033, exhibiting a growth rate (CAGR) of 5.3% during 2025-2033.

Latin America Logistics Industry Trends & Growth Drivers:

Near-Shoring Warehouse Gold-Rush: $4 bn Flows into Mexico’s Hinterland

USMCA tariff certainty is turning central Mexico into a land of mega-sheds. The Secretariat of Economy reports 180 new 3PL warehouses currently under construction in Nuevo León and Guanajuato - a record. Prologis alone delivered 2.1 million m² in Monterrey during July 2025 and pre-leased 90% of the space to Tesla and Amazon within 60 days. Smaller players are chasing the same wave: Mexican start-up Caxxor broke ground on a 300,000 m² rail-linked park in Silao in August 2025, betting on automotive component flows. Inter-American Development Bank data show intra-regional exports up 1.3% year-on-year, and every extra percentage point adds an estimated 800,000 m² of warehouse demand. Even traditional ports are pivoting; the Port of Veracruz announced a $350 m inland dry-port cluster in July 2025 to capture near-shoring overflow.

Digital Freight Matching Erases Empty-Truck Miles

Brazilian cloud platform Kestraa raised an extra $15 million in Series B funding in August 2025 to scale its AI freight-matching engine. The software now connects 42,000 daily loads across Mercosur, slashing average empty-backhaul distance by 220 km per truck. Maersk’s Latin America update shows pilot customers cut logistics costs by 8% and CO₂ emissions by 11% in the first quarter of deployment. Colombia’s government joined the party in June 2025, subsidising 5,000 small carriers to join digital platforms; early data reveal a 15% drop in spot-market volatility.

Green Bonds Power Electric Truck Fleets

Chile’s Ministry of Transport issued $500 m in sovereign green bonds in June 2025, earmarked for 8,000 electric trucks. DHL Express Chile will deploy 600 Volvo FM Electric units on Santiago-Valparaíso corridors by December 2025, eliminating 2.3 million litres of diesel annually. Meanwhile, Brazil’s BNDES approved $120 m in low-interest loans for e-truck leasing in August 2025; early adopters include Ambev and Carrefour, signalling mass-market pull. Costa Rica-labelled “most lucrative” segment by analysts, pledged to electrify 30 % of its freight fleet by 2027, adding urgency to OEM production schedules.

Download a sample copy of the report: https://www.imarcgroup.com/latin-america-logistics-market/requestsample

Latin America Logistics Market Segmentation:

Model Type Insights:

- 2 PL

- 3 PL

- 4 PL

Transportation Mode Insights:

- Roadways

- Seaways

- Railways

- Airways

End Use Insights:

- Manufacturing

- Consumer Goods

- Retail

- Food and Beverages

- IT Hardware

- Healthcare

- Chemicals

- Construction

- Automotive

- Telecom

- Oil and Gas

- Others

Country Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Latin America Logistics Market News:

- 12 Aug 2025 - Maersk inaugurates a 45,000 m² cold-chain hub in Panama City to serve Central America fruit exporters.

- 11 Aug 2025 - Brazil’s Santos port pilots blockchain bills of lading, cutting document processing time by 28 %.

- 10 Aug 2025 - MercadoLibre opens a 90,000 m² robotic fulfilment centre in Bogotá, its largest in Latin America.

- 9 Aug 2025 - Colombian airline Avianca Cargo adds a weekly freighter to Seoul to meet near-shoring demand for Asian components.

- 8 Aug 2025 - Peru’s Callao port begins 24-hour customs clearance for e-commerce cargo, shaving 12 hours off dwell time.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0