Vietnam Warehousing Market Size, Share, Trends and Forecast 2025-2033

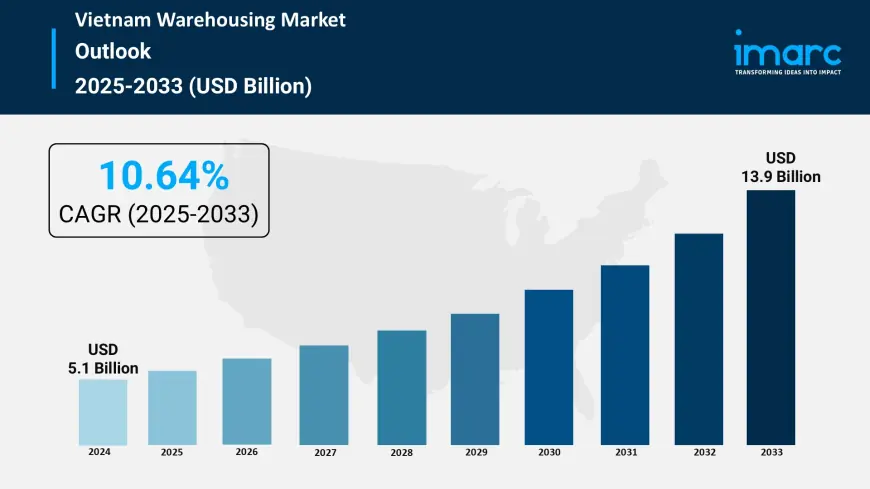

Vietnam warehousing market size reached USD 5.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 13.9 Billion by 2033, exhibiting a growth rate (CAGR) of 10.64% during 2025-2033.

Vietnam Warehousing Market Overview

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Size in 2024:USD 5.1 Billion

Market Forecast in 2033:USD 13.9 Billion

Market Growth Rate (2025-33): 10.64%

Vietnam warehousing market size reached USD 5.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 13.9 Billion by 2033, exhibiting a growth rate (CAGR) of 10.64% during 2025-2033. The integration of advanced technologies such as automation, robotics, and warehouse management systems (WMS) that has improved efficiency, accuracy, and overall operational performance in warehouses, is driving the market.

For an in-depth analysis, you can refer sample copy of the report: https://www.imarcgroup.com/vietnam-warehousing-market/requestsample

Vietnam Warehousing Market Trends and Drivers:

The Vietnamese warehousing sector is undergoing a remarkable transformation, largely thanks to the swift embrace of cutting-edge technologies and automation. We're moving away from traditional storage methods and stepping into the realm of integrated, smart logistics hubs. This shift is fueled by rising labor costs, the relentless demand for speed and accuracy from the e-commerce boom, and the arrival of global third-party logistics (3PL) providers who bring with them high standards. As a result, investors and developers are pouring significant funds into modern solutions. We're seeing a clear transition from basic racking systems to the adoption of warehouse management systems (WMS) and enterprise resource planning (ERP) software, which are quickly becoming the new standard for operations. Additionally, there's a noticeable rise in automated storage and retrieval systems (AS/RS), autonomous mobile robots (AMRs) for picking and sorting, and IoT sensors that enable real-time asset tracking and climate control. This wave of technology isn't just about boosting efficiency; it's also about meeting critical client needs for enhanced inventory visibility, predictive analytics in supply chain management, and noticeably faster order fulfillment times. Warehouses that don't keep up with these advancements are quickly falling behind, as tenants are increasingly favoring tech-savvy facilities that provide data-driven insights and strong scalability. This trend is reshaping leasing choices and property values in key industrial areas, creating a clear divide between modern, high-spec facilities and the older, low-tech options still out there.

Market demand is experiencing a significant transformation, shifting away from the traditional focus on pure manufacturing storage towards a more intricate ecosystem fueled by domestic consumption, cross-border e-commerce, and strategic inventory management. While foreign direct investment (FDI) in manufacturing—especially in sectors like electronics, automotive, and consumer goods—continues to be a major driving force, it’s now merging with the rapid expansion of omnichannel retail and the "just-in-case" inventory strategies that have emerged in the wake of the pandemic. This combination is creating an unprecedented need for high-quality, multi-tenant logistics facilities in key locations close to major consumption centers like Ho Chi Minh City and Hanoi, as well as vital infrastructure points such as Hai Phong port and Dong Nai province. In response, developers are busy building Grade-A and custom-designed warehouses that boast higher clear heights, improved floor loading capacities, advanced fire protection systems, and spacious truck courts to support simultaneous logistics operations. The market is clearly leaning towards quality, with tenants ready to invest more for features that enhance supply chain resilience, minimize operational risks, and offer the flexibility to quickly adjust operations in line with changing market dynamics.

Environmental, Social, and Governance (ESG) principles are quickly shifting from just being a corporate social responsibility trend to becoming a vital business necessity and a major differentiator in the Vietnamese warehousing sector. Nowadays, both international companies and savvy local businesses are insisting on sustainable features in their logistics real estate portfolios as part of their broader commitments to achieving net-zero emissions. This demand is pushing developers and landlords to incorporate green building standards, like LEED or LOTUS certification, into their new projects to attract major tenants. Some of the key sustainable upgrades being considered in designs and renovations include installing rooftop solar panels for operational power, energy-efficient LED lighting with motion sensors, advanced water recycling systems, and using eco-friendly building materials. Beyond just the environmental perks, these features also bring real economic benefits by significantly cutting down long-term operational costs through reduced energy expenses. Plus, a sustainable warehouse is increasingly linked to higher asset values, better tenant retention, and an improved brand reputation, making it a smart investment rather than just a compliance expense. This trend is giving rise to a new class of premium, future-proof assets that align with the global sustainability goals of top manufacturing and logistics companies.

Vietnam Warehousing Market Industry Segmentation:

Product Type Insights:

Type Insights:

- General Warehousing

- Cold Storage Warehousing

- Others

Ownership Insights:

- Bonded Warehouses

- Non-Bonded Warehouses

- Others

End Use Insights:

- Consumer Goods

- Textile and Footwear

- Retail

- Food and Beverage

- Wooden Products

- Healthcare

- Chemicals

- Others

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Ask Our Expert & Browse Full Report with TOC & List of Figure: https://www.imarcgroup.com/request?type=report&id=21654&flag=C

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0