Vietnam Oil and Gas Market Size, Share, Top Companies, Forecast 2025-2033

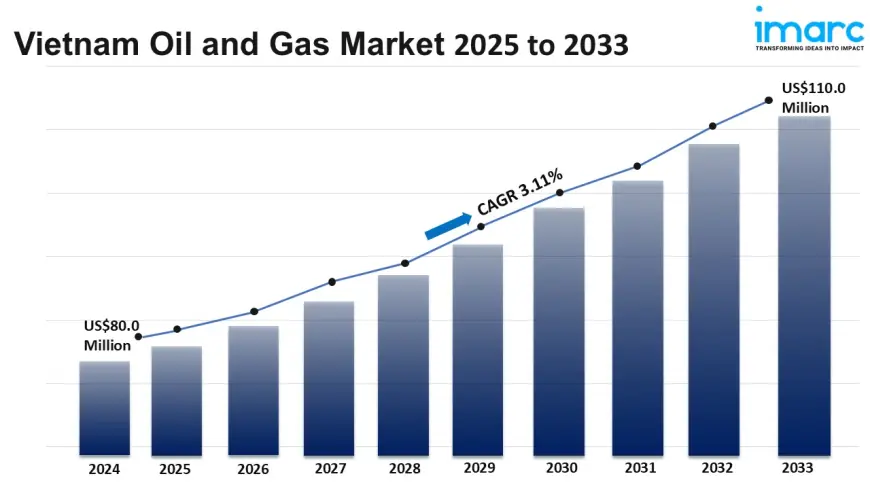

Vietnam oil and gas market size reached USD 80.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 110.0 Million by 2033, exhibiting a growth rate (CAGR) of 3.11% during 2025-2033.

Vietnam Oil and Gas Market Overview

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Size in 2024: USD 80.0 Million

Market Forecast in 2033: USD 110.0 Million

Market Growth Rate (2025-33): 3.11%

Vietnam oil and gas market size reached USD 80.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 110.0 Million by 2033, exhibiting a growth rate (CAGR) of 3.11% during 2025-2033. The increasing demand for energy, rapid industrialization, rising economic growth, and the growing demand for oil and gas as essential fuels for industries, transportation, and infrastructure development are some of the key factors driving the market.

For an in-depth analysis, you can refer sample copy of the report: https://www.imarcgroup.com/vietnam-oil-gas-market/requestsample

Vietnam Oil and Gas Market Trends and Drivers:

Vietnam's upstream sector is experiencing a significant resurgence, primarily fueled by the critical need to bolster domestic energy security and meet surging power demand. The government is actively incentivizing exploration and production (E&P) through revised regulatory frameworks, including the Petroleum Law and Power Development Plan VIII (PDP8), which explicitly prioritize natural gas as a transition fuel. Major international players (ExxonMobil, SK Earthon, Petronas) are re-engaging, particularly in strategic offshore blocks, attracted by improved fiscal terms and clarity. Key projects like Block B-O Mon and developments in the Nam Con Son and Cuu Long basins are advancing, aiming to offset declining production from mature fields like Bach Ho. Enhanced Oil Recovery (EOR) techniques are gaining traction to maximize existing reserves. Crucially, the focus has shifted decisively towards natural gas, recognized as essential for base-load power generation to support industrialization and complement intermittent renewables. This dynamic is characterized by intensified exploration activities, final investment decisions (FIDs) on long-delayed gas projects, and a concerted push to reverse the recent decline in proven reserves through new discoveries and accelerated appraisal. The success of this upstream revival is paramount for ensuring stable feedstock for power plants and reducing reliance on imported fuels.

A transformative dynamic is the rapid development of critical midstream infrastructure, essential for unlocking Vietnam's gas potential and facilitating market liberalization. The centerpiece is the aggressive build-out of LNG import capacity to supplement domestic production and ensure fuel diversification. Multiple large-scale LNG terminals are progressing, notably Thi Vai (operational, expanding), Son My (multiple phases), and projects in the North, aiming for a combined capacity exceeding 20 MTPA within this decade. Simultaneously, significant investments are flowing into expanding and modernizing the domestic gas pipeline network, including the crucial Nam Con Son 2 pipeline expansion and new trunk lines to connect power hubs and industrial zones to both domestic fields and LNG reception points. This infrastructure push is intrinsically linked to the ongoing gas market liberalization under Decision 2235/QD-BCT, fostering the development of a competitive wholesale market and enabling third-party access (TPA) to pipelines. The emergence of new players, including private power producers and industrial consumers seeking direct gas access, is reshaping the market landscape previously dominated by PetroVietnam (PVN) and EVN. This dynamic creates opportunities for integrated gas-to-power solutions but also necessitates robust regulatory oversight and transparent pricing mechanisms.

Vietnam's downstream sector is undergoing a multi-faceted transformation, balancing capacity expansion, value addition, and environmental imperatives. While the focus remains on ensuring domestic fuel supply security through existing refineries (Dung Quat, Nghi Son), significant investments are being directed towards refinery upgrades to meet increasingly stringent Euro V fuel standards and enhance operational flexibility to process diverse crude slates. The most pronounced shift is the strategic pivot towards petrochemicals, driven by strong domestic demand from manufacturing and export industries. Major expansions at Dung Quat and Nghi Son refineries are integrating new petrochemical complexes, producing essential feedstocks like polypropylene (PP), polyethylene (PE), and aromatics, reducing import dependence. Concurrently, the sector faces mounting pressure to decarbonize. Refineries are investing in energy efficiency, exploring carbon capture utilization and storage (CCUS) feasibility, and integrating bio-feedstocks. Petrochemical producers are increasingly focusing on circular economy models, including advanced recycling technologies. This dynamic reflects a move beyond basic fuel production towards higher-value, diversified product portfolios while proactively addressing sustainability challenges through technological innovation and process optimization.

Vietnam Oil and Gas Market Industry Segmentation:

Sector Insights:

- Upstream

- Downstream

- Midstream

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Ask Our Expert & Browse Full Report with TOC & List of Figure: https://www.imarcgroup.com/request?type=report&id=13178&flag=C

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0