Vietnam Imports by Country 2025: Key Data, Trade Partners & Insights

For businesses and analysts worldwide, understanding Vietnam import data is not only insightful but essential for strategic planning and market entry.

In today’s fast-evolving global marketplace, Vietnam has emerged as a vital hub for both exports and imports. As the country experiences rapid economic growth, expanding industries, and a rising middle class, Vietnam imports have seen a steady surge year after year. For businesses and analysts worldwide, understanding Vietnam import data is not only insightful but essential for strategic planning and market entry.

In 2024, Vietnam's total import value reached a substantial $379 billion, marking a 7.2% year-on-year increase from 2023. This upward trend has continued into the first five months of 2025, with import values hitting $175.56 billion, up 17.4% from the same period last year. This growth is driven largely by the country’s demand for production materials, which accounted for 93.8% of the total import value.

Let’s dive deep into the dynamics of Vietnam imports, highlighting top imported products, key source countries, and the biggest import companies shaping the economy.

Top Imported Products into Vietnam (2025)

Vietnam’s import portfolio is diverse, catering to industrial needs, consumer demand, and high-tech development. According to Vietnam import data, the leading product categories in 2025 include:

-

Electrical Machinery & Equipment (HS Code 85): Valued at $116.54 billion, this sector contributes nearly 35% of Vietnam’s total imports. Components such as semiconductors, integrated circuits, and telecommunications equipment dominate this segment, underpinning the country’s high-tech manufacturing boom.

-

Nuclear Reactors, Boilers & Machinery (HS Code 84): At $29.10 billion, these imports are vital to powering Vietnam’s growing industrial infrastructure.

-

Plastics & Articles (HS Code 39): With imports worth $16.48 billion, plastics are a cornerstone for packaging, construction, and electronics manufacturing.

-

Mineral Fuels & Oils (HS Code 27): These imports, valued at $16.03 billion, support Vietnam’s transportation and power generation sectors.

-

Iron & Steel (HS Code 72): At $12.21 billion, these materials are key to urban development and infrastructure projects.

Other notable import categories include vehicles, medical instruments, cereals, cotton, and textile inputs—each reflecting both industrial and consumer demand.

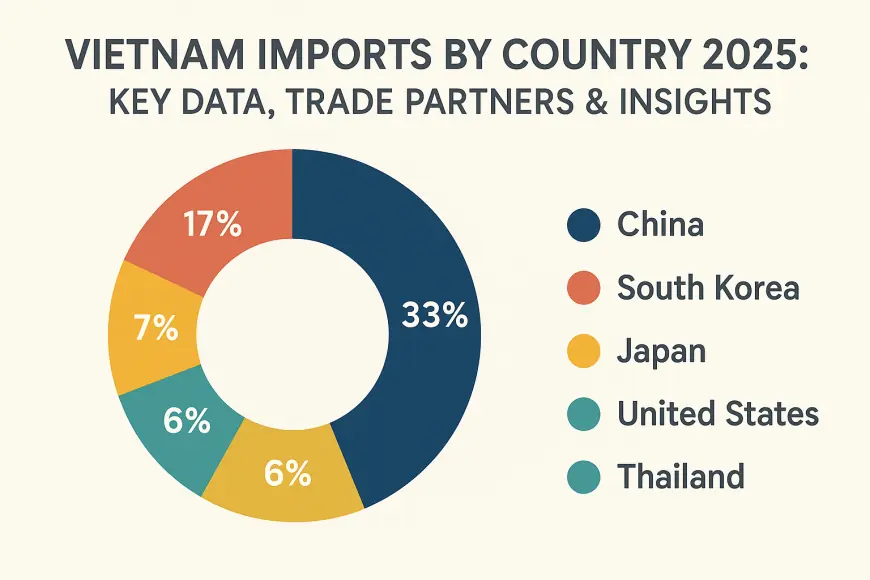

Vietnam Imports by Country: Top 10 Trade Partners

Vietnam’s global trade relationships are a major influence on its economic performance. According to recent Vietnam imports by country data, the top 10 source countries are:

-

China – $144.3 billion (37.9%)

As Vietnam's largest trade partner, China supplies electronics, textiles, and machinery critical to Vietnam’s manufacturing supply chain. -

South Korea – $79.7 billion (20.9%)

South Korea remains essential for Vietnam’s electronics sector, providing semiconductors, micro-assemblies, and display panels. -

Japan – $35.8 billion (9.4%)

Japan focuses on automotive parts, electronics, and machinery, reinforcing industrial cooperation between the two nations. -

Taiwan – $32 billion (8.4%)

Taiwan plays a key role in supplying electronics and telecommunications equipment. -

United States – $14.3 billion (3.8%)

The U.S. exports agricultural products, technology, and machinery to Vietnam. Despite tariff tensions in early 2025, trade remains robust. -

Thailand – $11.6 billion (3.1%)

A fellow ASEAN member, Thailand supplies agricultural commodities, machinery, and processed foods. -

Malaysia – $7.3 billion (1.9%)

Electronics and chemicals dominate Malaysia’s exports to Vietnam. -

Indonesia – $5.8 billion (1.5%)

Vietnam relies on Indonesia for energy and mineral imports. -

India – $5.7 billion (1.5%)

India supplies pharmaceuticals, textiles, and engineering products. -

Australia – $4.5 billion (1.2%)

Agriculture and mineral exports from Australia remain key for Vietnam.

This wide network of partners reflects Vietnam’s strategic effort to diversify its import sources, reducing over-reliance on any single country—particularly China.

Top Importing Companies in Vietnam (2024–25)

A significant portion of Vietnam imports is driven by foreign-invested enterprises (FIEs) operating in the electronics and ICT sectors. The top 10 importers are tech giants and suppliers, reflecting the country’s role as a global electronics assembly hub.

-

Intel Vietnam – $9.9 billion

-

Hanyang Vina – $8.5 billion

-

Samsung Thai Nguyen – $7.9 billion

-

Samsung HCMC – $5 billion

-

Compal Vietnam – $2.9 billion

-

FuyU Tech – $2.1 billion

-

Luxshare Van Trung – $1.7 billion

-

Fukang Tech – $1.7 billion

-

Hana Micron – $1.6 billion

-

Wistron Vietnam – $1.6 billion

These companies primarily import semiconductors, circuits, and electronic components from China, South Korea, and Taiwan, powering Vietnam’s growing export-led electronics industry.

Key Trends in Vietnam Import Data (2024–25)

-

Electronics surge: Vietnam’s booming tech manufacturing sector continues to import more integrated circuits and chips to meet global demand.

-

Infrastructure investment: Imports of machinery and construction materials are rising, reflecting Vietnam’s push to expand energy, transport, and industrial infrastructure.

-

Tariff developments: In early 2025, the U.S. imposed and later partially rolled back tariffs on Vietnamese goods. Despite this, trade flows have remained resilient.

-

Diversification strategies: Vietnam is actively shifting its sourcing strategies toward ASEAN, India, and Europe to reduce dependency on Chinese supply chains.

-

Intermediate goods boom: Imports of parts and sub-assemblies are increasing, signaling Vietnam’s deepening role as a global assembly and re-export hub.

Vietnam Imports: Historical Growth Overview (2014–2025)

| Year | Vietnam Import Value ($ Billion) |

|---|---|

| 2014 | 147.83 |

| 2015 | 165.77 |

| 2016 | 174.97 |

| 2017 | 213.21 |

| 2018 | 236.86 |

| 2019 | 253.44 |

| 2020 | 261.30 |

| 2021 | 330.75 |

| 2022 | 358.78 |

| 2023 | 325.44 |

| 2024 | 379.00 |

| 2025 (5 mo) | 175.56 |

Why Vietnam Import Data Matters for Businesses

Accessing accurate and updated Vietnam import data helps businesses:

-

Identify top importers and market players

-

Track product-specific import trends

-

Analyze sourcing strategies and supplier countries

-

Explore new trade opportunities in Vietnam

-

Evaluate risk exposure to tariffs and trade policy shifts

If your business is planning to export to Vietnam or align with major importers, tapping into a reliable Vietnam import-export database is invaluable.

Conclusion

Vietnam's import landscape is more dynamic and diverse than ever. The rise in high-tech imports, expanding trade networks, and ongoing infrastructure development all point toward continued growth. Understanding Vietnam imports, the Vietnam imports by country, and the evolving demand patterns is essential for businesses aiming to enter or expand in the Vietnamese market.

For live access to shipment records, top importers, and HS code-specific insights, consider using tools like VietnamExportData, which provides curated Vietnam import data to help you stay ahead in global trade.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0