URA generates UGX19.26 Trillion in FY 2020/21. Registers a 14.99% Net Revenue growth.

URA’s performance is attributed to a number of factors including debt recovery of Shs1.024 trillion, mainly attributed to Alternative dispute resolution (ADR) which contributed over Shs365 billion, the voluntary disclosure initiative, close monitoring of Memorandum of Understanding (MOUs) for installment payment, and enforcement mechanisms, Digital Tracking Solutions (DTS) and the Electronic Fiscal Receipting Solution (EFRIS), online taxpayer education campaigns ( KAKASA), improved contact center (IVR), faster clearance of refunds, introduction of a bonded warehouse information management system (BWIMS), simplification of the TIN application process, automation of the WHT exemption and Tax clearance certificate (TCC) issuance and many others

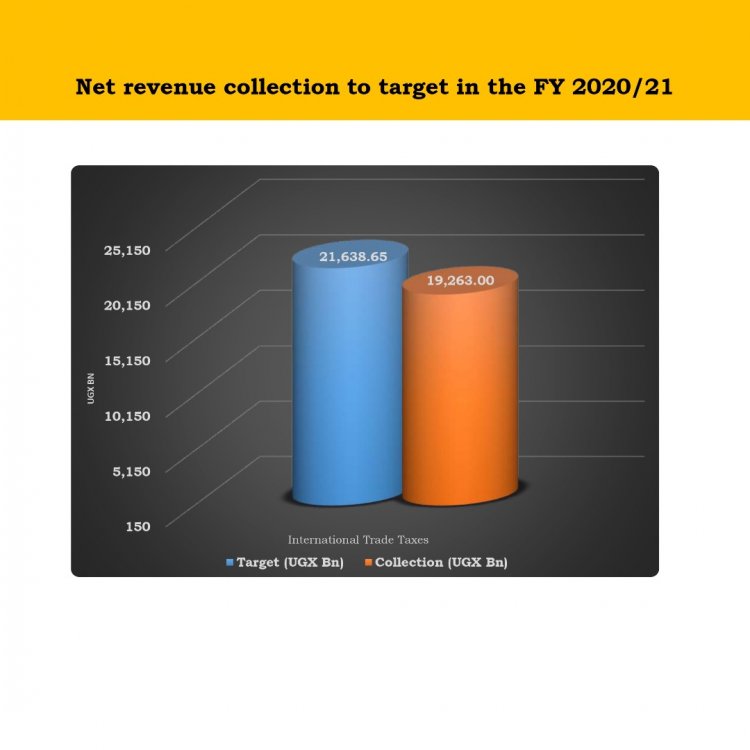

The overall revenue performance of Uganda Revenue Authority (URA) for FY 2020/21 has indicated a collection of net revenue of UGX 19.263 Trillion compared to comparison to the FY 2019/20 and an estimated tax to GDP ratio of 12.99 percent. The outturn of the FY 2020/21 is short of the target of Shs21.638 Billion by Shs2.37 Trillion as indicated in table below:

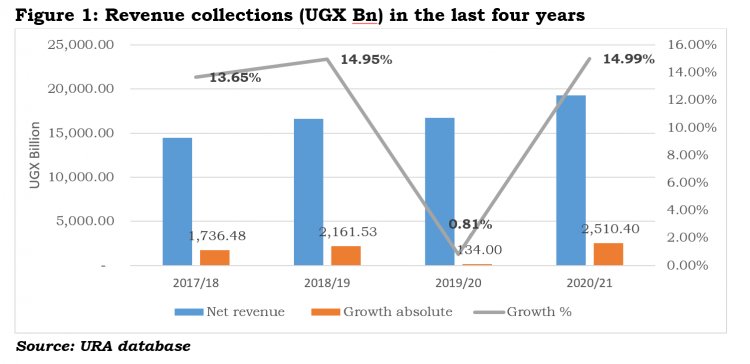

During the annual press briefing held at URA headquarters in Kampala on 15th July 2021, The Commissioner General John R. Musinguzi said that “In real terms, this reflects a growth in revenue of UGX 2,511.36 Billion and a growth in the Tax to GDP ratio by 1%. This the highest growth registered in the last four years as shown in the graph below”

He said that the domestic revenue collections in the FY 2020/21 were UGX 12,144.01 Bn, registering a growth of 13.71% (UGX 1,464.19 Bn in real terms) in comparison to FY 2019/20. However, the collections were below the target of UGX 14,038.18 billion by UGX 1,894.18 Bn

“It is important to note that this was the target approved by Parliament before the impact of Covid-19 set in and macroeconomic variables that affect revenue such as GDP growth were projected at 6% yet by the end of the financial year GDP growth was at 3%.” he said

Musingusi attributed URA’s performance to a number of factors including debt recovery of Shs1.024 trillion, mainly attributed to Alternative dispute resolution (ADR) which contributed over Shs365 billion, the voluntary disclosure initiative, close monitoring of Memorandum of Understanding (MOUs) for installment payment, and enforcement mechanisms among others.

“The implementation of the Digital Tracking Solutions (DTS) and the Electronic Fiscal Receipting Solution (EFRIS) boosted performance. DTS contributed to the 16.89 percentage growth in Excise Duty collections by aiding the enforcement and tracking of locally manufactured and imported goods. EFRIS contributed to the 14.73 percentage growth in VAT collections, through relaying real-time taxpayer transaction details to URA, thereby minimizing underreporting of VAT collected from consumers. It should be noted that both technologies are still being rolled out and not yet fully enforced,” he said.

Domestically the revenue collections in the FY 2020/21 were Shs12.14 Trillion, registering a growth of 13.71% (Shs1.46 trillion in real terms) in comparison to the FY 2019/20. However, the collections were below the target of Shs14.038 Trillion by Shs1.894 Trillion.

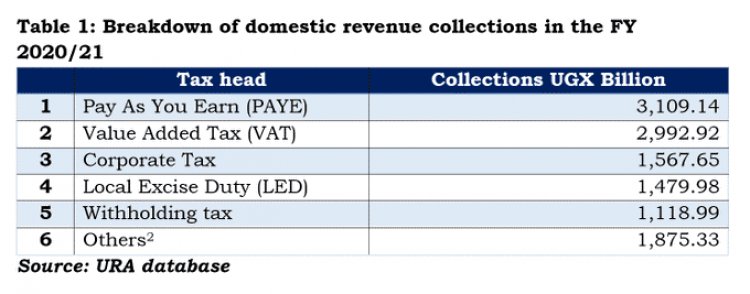

Pay As You Earn (PAYE) contributed Shs3.109 trillion, Value Added Tax (VAT) Shs2.992 trillion, Corporate Tax Shs1.567 trillion, Local Excise Duty (LED) Shs1.479 trillion and Withholding tax Shs1.118 trillion.

Rental income tax , tax on bank interest, treasury bills, casino tax , individual income tax , presumptive, non-tax revenue (NTR) contributed Shs1.875 trillion to domestic revenue.

shown in graph below:

The customs performance indicated that In the FY 2020/21, customs revenue collections were Shs7.505 Trillion against a target of Shs8.001 Trillion, registering a significant growth of 16.43% (Shs1.059 Trillion) in comparison to FY 2019/20. However, the collections were Shs495.48 billion below target.

VAT on Imports contributed Shs2.832 trillion, Petroleum Duty Shs2.453 trillion and Import Duty Shs1.403 trillion. Others such as Excise duty, withholding tax, temporary road licenses, infrastructure levy, hides & skin levy contributed Shs816.89 billion.

Sectors revenue collection showed that in FY 2020/21, 71% of the revenue was generated from the top 4 sectors. The wholesale and retail trade sector had the biggest contribution, which amounted to Shs5.783 trillion (29.43%). The manufacturing sector followed with a contribution of Shs4.461 trillion (22.70%). The Information and communication sector contributed Shs2.059 trillion (10.48%), while Shs1.643 trillion (8.39%) was generated from the financial and insurance services sector.

There was a growth in revenue from key sectors like manufacturing which grew by 27.52%, Information and communication by 25.73%, wholesale and retail by 19.13% and financial and insurance services by 5.55%.