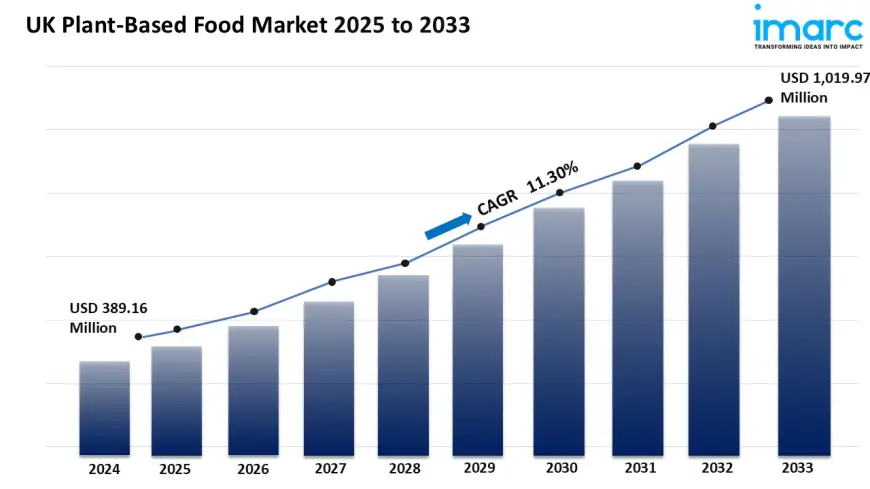

UK Plant-Based Food Market to Reach USD 1,019.97 Million by 2033, Growing at 11.3% CAGR

UK Plant-Based Food Market Overview

Market Size in 2024: USD 389.16 Million

Market Forecast in 2033: USD 1,019.97 Million

Market Growth Rate (2025-2033): 11.30%

The UK plant-based food market size reached USD 389.16 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,019.97 Million by 2033, exhibiting a growth rate (CAGR) of 11.30% during 2025-2033.

UK Plant-Based Food Market Trends and Drivers:

The UK plant-based food market is growing quickly. More health-focused consumers are choosing plant-based diets. Many people want to eat less meat. They worry about health issues like cholesterol, heart disease, and obesity. So, they are looking for plant-based options. Flexitarianism is growing. More people are eating less meat, so the demand for meat substitutes is rising. It also boosts the demand for dairy-free items and healthy plant-based snacks.

Environmental and Ethical Considerations Fueling Demand:

More people are realizing the environmental harm of traditional animal farming. This includes issues like carbon emissions and deforestation. As a result, consumers are looking for more sustainable food choices. Plant-based food production typically requires fewer natural resources, making it more environmentally friendly. Also, growing worries about animal welfare are affecting food choices. This trend is especially strong among younger people and those in cities.

Product Innovation and Greater Retail Penetration:

Food tech and ingredient sourcing are changing plant-based products. They now taste and feel more like traditional animal foods. Big food brands and startups are launching new plant-based options. These include meat, dairy, and ready-to-eat meals. This means more variety and better quality for consumers. Supermarkets, specialty stores, and foodservice in the UK are expanding their plant-based sections. This change makes these products easier for consumers to access.

Government Support and Favorable Regulations:

Government-backed health campaigns and sustainable development policies are encouraging plant-based consumption. Some efforts to reduce carbon footprints are also promoting meat and dairy alternatives. Clear product labels and nutrition information build consumer trust. This, in turn, helps the market grow.

UK Plant-Based Food Market News

July 2025: Tesco expands its plant-based range

Tesco has unveiled an extensive new plant-based range, including over 50 new items across meat alternatives, dairy substitutes, and ready meals. The supermarket chain's plant-based section now accounts for 15% of its overall food sales, as it responds to growing consumer demand for plant-based options.

May 2025: Oatly launches new oat-based yogurt flavors

Oatly introduced a new line of dairy-free yogurt in innovative flavors like Passionfruit & Mango and Chocolate Hazelnut. The new products are part of Oatly's strategy to expand its presence in the growing plant-based dairy sector in the UK.

February 2025: Beyond Meat and McDonald's UK partnership

Beyond Meat announced a new partnership with McDonald's UK to supply plant-based alternatives for its McPlant burger. Following the success of the trial run, this collaboration is set to expand to more locations nationwide by late 2025.

November 2024: Plant-based cheese brand Violife reaches milestone sales

Violife, one of the UK’s leading plant-based cheese brands, reported a 40% growth in sales in 2024. The brand now holds a significant share in the plant-based dairy segment, with new flavor innovations such as Spicy Jalapeño and Cheddar Block being particularly popular.

Request Free Sample Report:

https://www.imarcgroup.com/uk-plant-based-food-market/requestsample

UK Plant-Based Food Market Segmentation

Type Insights:

- Dairy Alternatives

- Meat Alternatives

- Egg Substitutes and Condiments

- Others

Source Insights:

- Soy

- Wheat

- Almond

- Others

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Ask Our Expert & Browse Full Report with TOC & List of Figures:

https://www.imarcgroup.com/request?type=report&id=29907&flag=C

Key highlights of the Report:

- Market Performance

- Market Outlook

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0