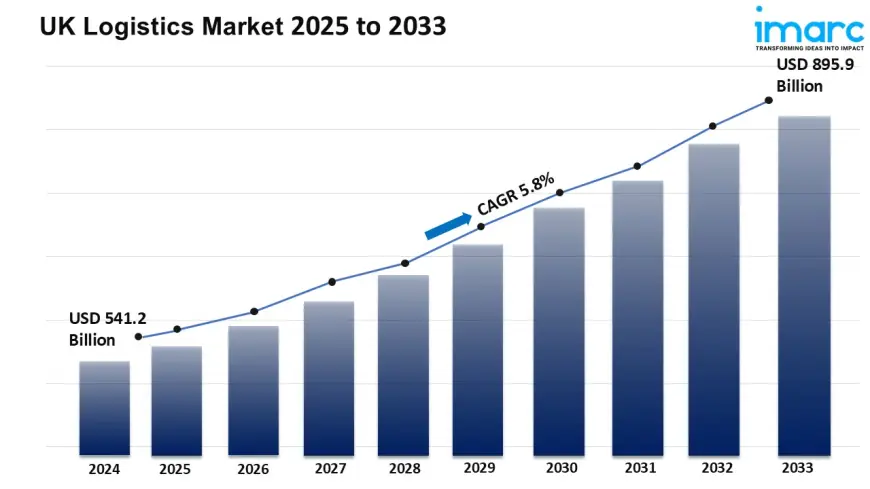

UK Logistics Market to Reach USD 895.9 Billion by 2033

UK Logistics Market Overview

Market Size in 2024: USD 541.2 Billion

Market Forecast in 2033: USD 895.9 Billion

Market Growth Rate 2025-2033: 5.8%

The UK logistics market size reached USD 541.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 895.9 Billion by 2033, exhibiting a growth rate (CAGR) of 5.8% during 2025-2033.

UK Logistics Market Trends and Drivers:

The UK's strong global trade network and post-Brexit agreements are boosting import-export activity. As global trade grows, the need for efficient and scalable logistics also increases. Ports, airports, and rail freight corridors are getting upgrades. Both government and private investments are helping cargo move smoothly.

The domestic logistics network is modernizing. There are investments in road infrastructure, smart warehouses, and intermodal hubs. Fulfillment centers are growing in the Midlands and South East. This shows the need to improve supply chains near consumers. These changes are boosting the UK's role as a logistics hub. They help manage more shipments and meet tighter delivery times.

E-commerce and Last-Mile Delivery Revolutionizing Logistics

The explosive growth of e-commerce has fundamentally altered logistics priorities. Consumers want next-day or same-day delivery, free returns, and full shipment tracking. This puts pressure on logistics providers to change quickly. Companies are now using last-mile delivery solutions. These solutions are faster, more flexible, and cost-effective. This includes working with third-party logistics (3PL) providers. It also uses micro-fulfillment centers in cities. Plus, it employs AI for route optimization.

Retailers and logistics firms are rethinking how they handle product returns. They are facing more returns than ever. Efficient return processing is now a key competitive edge. Companies must invest in tracking tech, inventory checks, and customer communication tools. As online shopping increases, logistics companies are enhancing digital innovation. They are also expanding capacity to remain competitive.

Technological Advancements and Green Logistics Taking Center Stage

Automation, data analytics, and IoT are changing logistics. They turn traditional operations into smart, connected systems. Real-time shipment tracking, predictive maintenance for fleets, and robotic warehouse automation boost efficiency. They also cut down on human errors.

Sustainability is now a key priority. This change comes from new rules and growing consumer demand for green logistics. Companies are investing in electric delivery vehicles, carbon-neutral warehouses, and low-emission transportation options. More businesses are planning routes to save mileage. They are also using energy-efficient packaging. Plus, many are offsetting emissions with carbon credits. Green logistics boosts environmental responsibility, strengthens brand reputation, and increases long-term profits.

For an in-depth analysis, you can refer sample copy of the report:

https://www.imarcgroup.com/uk-logistics-market/requestsample

UK Logistics Market Trends

Several key trends are shaping the future of the UK logistics market. The rise of same-day and on-demand delivery is prompting innovations in hyperlocal warehousing and autonomous delivery vehicles. The expansion of omnichannel retailing is blurring the lines between B2B and B2C logistics, requiring flexible, integrated fulfillment solutions. Meanwhile, the digitization of customs and border clearance processes is streamlining international shipments, reducing delays, and improving transparency.

Collaborative logistics models wherein multiple companies share transport and warehouse infrastructure are gaining popularity to reduce costs and environmental impact. Additionally, the logistics-as-a-service (LaaS) model is emerging, allowing businesses to outsource their entire logistics operation to tech-enabled third-party providers. These trends reflect the increasing complexity and strategic importance of logistics in today’s fast-paced, digitally connected economy.

UK Logistics Market News

July 2025 – Amancio Ortega’s Pontegadea Inversiones acquired a 49% stake in PD Ports, a major UK logistics operator with 11 terminals including Teesport and Hartlepool, signaling increased global investment in UK port infrastructure.

July 2025 – UK manufacturers, backed by Make UK and Barclays, called for reviving the northern leg of HS2 to boost rail freight capacity and reduce road congestion, warning that current rail infrastructure can't meet growing logistics demands.

May 2025 – InPost, following its acquisition of Yodel, launched a next-day out‑of‑home delivery service in partnership with ASOS, leveraging its 12,800 parcel locker and PUDO points to accelerate UK logistics growth. InPost’s market share is projected to rise to ~8%.

April 2025 – DHL partnered with Evri, taking a minority stake to merge e‑commerce logistics operations. The combined entity is expected to handle over 1 billion parcels annually, strengthening DHL’s UK parcel market position.

April 2025 – DHL opened a £230 million e‑commerce hub in Coventry, capable of processing up to 1 million parcels daily, creating 600 jobs, and integrating EV charging and solar energy infrastructure.

Yesterday (July 2025) – Nissan launched the UK's first private shared electric truck charging station at its Sunderland plant to support electric heavy goods vehicles. The facility is part of the EV36Zero consortium and aims to cut 1,500 tonnes of CO₂ annually.

Ask Our Expert & Browse Full Report with TOC & List of Figure:

https://www.imarcgroup.com/request?type=report&id=6258&flag=C

UK Logistics Market Industry Segmentation:

Breakup by Model Type:

- 2PL

- 3PL

- 4PL

Breakup by Transportation Mode:

- Roadways

- Railways

- Airways

- Waterways

Breakup by End Use:

- Manufacturing

- Consumer Goods

- Retail

- Food and Beverages

- IT Hardware

- Healthcare

- Chemicals

- Construction

- Automotive

- Telecom

- Oil and Gas

- Others

Breakup by Region:

- North West England

- Yorkshire and the Humber

- West Midlands

- East of England

- South West England

- South East England

- East Midlands

- North East England

- Greater London

- Others

Key highlights of the Report:

- Market Performance

- Market Outlook

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. IMARC’s information products include major market, scientific, economic, and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0