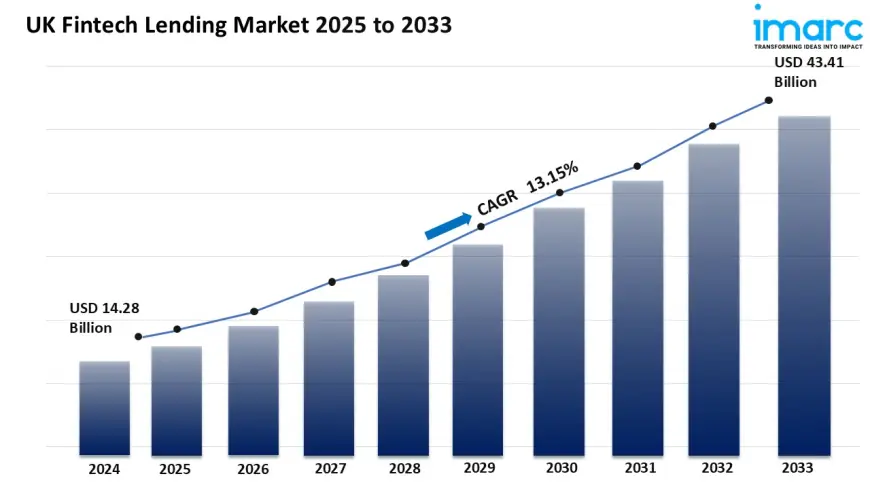

UK Fintech Lending Market to Reach USD 43.41 Billion by 2033

UK Fintech Lending Market Overview

Market Size in 2024: USD 14.28 Billion

Market Forecast in 2033: USD 43.41 Billion

Market Growth Rate 2025-2033: 13.15%

The UK fintech lending market size reached USD 14.28 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 43.41 Billion by 2033, exhibiting a growth rate (CAGR) of 13.15% during 2025-2033.

UK Fintech Lending Market Landscape

Digital Innovation Accelerating Market Disruption

Fintech lenders are getting clever with it they’re not just looking at your credit score anymore. Now they’re snooping stuff like your social media habits, what you’re buying, even how you use your phone. Wild, right? Turns out, this actually helps a ton, especially for folks or small businesses who don’t have much of a credit history on paper.

And get this: with all the fancy automation, you could get approved for a loan in, like, five minutes flat. No more weeks of waiting and endless forms. They’ve thrown in digital ID checks, e-signatures, and these open banking thingamajigs, which basically means you can get set up without leaving the couch. Honestly, makes regular banks look like they’re stuck in the Stone Age.

SME Financing and BNPL Segments Leading Growth

Alright, here’s the deal: SMEs (yeah, those scrappy small and medium businesses) are basically the lifeblood of fintech lending right now. Traditional banks? They make folks jump through flaming hoops collateral this, paperwork that, approval that drags on forever. Forget it. Fintech swoops in with the vibe of “Need cash? Here you go. No collateral, faster process, chill repayment schedules.” Suddenly, these businesses can actually breathe, pay the bills, maybe even expand a little.

And don’t even get me started on buy-now-pay-later. Gen Z and millennials are all over it. Why bother with clunky old-school credit when you can split your online sneaker splurge into four easy payments, zero interest, no drama? Fintechs are totally riding that wave, teaming up with online shops and big retailers to make point-of-sale loans just... happen. It’s like, you blink, and now you’ve financed your cart. Wild.

Regulatory Oversight and Consumer Protection Reinforcing Market Maturity

Honestly, the UK’s all-in attitude toward fintech thanks to the FCA leading the charge has been a real game changer. They’re all about shaking things up, but not at the expense of people getting screwed over. The rules around stuff like consumer credit, data privacy (yeah, GDPR is still haunting everyone), and fair lending are getting tighter. It’s not just about ticking boxes; they actually want folks to know what they’re signing up for and keep risky nonsense in check.

Lately, everyone’s buzzing about ethical lending and helping people actually understand their money. So, fintech platforms are stepping up laying things out clearer, talking to customers like they’re humans, not just account numbers, and putting in some real guidelines for lending responsibly. And honestly? As all this regulatory stuff keeps shifting, the companies that can keep up (without losing their minds) are the ones that’ll stick around for the long haul.

Request Free Sample Report:

https://www.imarcgroup.com/uk-fintech-lending-market/requestsample

UK Fintech Lending Market Trends

Honestly, the market’s changing faster than you can say “fintech.” Embedded finance is everywhere now suddenly your favorite shopping app wants to lend you cash, right when you’re eyeing those sneakers. Super sneaky, but also kinda convenient? AI is doing its thing too, making credit scores and loan approvals way less of a headache (unless you’re still rocking a flip phone, then, uh, good luck).

And get this: everyone’s obsessed with being green now. Loans tied to sustainability and all that ESG jazz are popping up left and right, which is great if you’re into saving the planet or just want to look good doing it.

Cross-border loans? Multi-currency platforms? Yeah, the UK’s got its hands in all sorts of international pots. Makes sense with all the trade going on. And let’s not forget the collabs: fintechs and old-school banks are teaming up more than Marvel superheroes these days. Sometimes it’s white-label stuff, sometimes it’s just a straight-up partnership, but the point is, everyone wants a piece of that big, regulated financial pie.

UK Fintech Lending Market News

- Abound’s Rapid Ascent (Mid-2025): London-based fintech Abound reported revenue growth of 151%, reaching £66.8M and profits soaring to £7.5M, driven by its AI-powered lending platform. The company has issued around £900M in loans, demonstrating strong traction in underserved personal credit segments.

- Post Office Relaunches Loans via Lendable (July 2025): The Post Office has partnered with the lending fintech Lendable to offer unsecured personal loans (£1K–25K) online. Using AI-based credit scoring via open banking, the new platform aims for rapid approval timelines and expanded access beyond traditional providers.

- Regulatory Clash over Revolut (July 2025): Tensions between Chancellor Rachel Reeves and BoE Governor Andrew Bailey surfaced after Bailey blocked meetings with Revolut aimed at accelerating its full banking license. The regulatory impasse may delay Revolut’s ability to offer UK lending and impacts fintech credit expansion.

Ask Our Expert & Browse Full Report with TOC & List of Figure:

https://www.imarcgroup.com/request?type=report&id=25435&flag=C

UK Fintech Lending Market Industry Segmentation:

Service Type Insights:

- Consumer Lending

- Small Business Lending

- Real Estate Lending

Business Model Insights:

- Peer-to-Peer (P2P) Lending

- Marketplace Lending

- Direct Lending

- Crowdfunding

- Hybrid Models

Technology Type Insights:

- Artificial Intelligence (AI) and Machine Learning (ML)

- Blockchain

- Mobile Technology

- Big Data Analytics

End-User Insights:

- Individuals

- Businesses

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

Key Highlights of the Report:

- Market Performance

- Market Outlook

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic, and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0