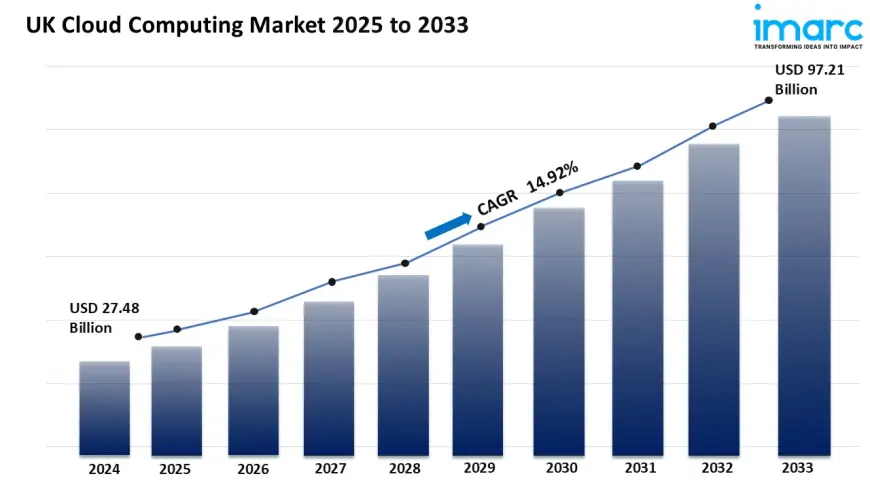

UK Cloud Computing Market to Reach USD 97.21 Billion by 2033

UK Cloud Computing Market Overview

Market Size in 2024: USD 27.48 Billion

Market Forecast in 2033: USD 97.21 Billion

Market Growth Rate 2025-2033: 14.92%

The UK cloud computing market size was valued at USD 27.48 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 97.21 Billion by 2033, exhibiting a CAGR of 14.92% from 2025-2033.

UK Cloud Computing Market Trends and Drivers:

The UK cloud computing market is experiencing great momentum as organizations an increasing number of transition to bendy virtual frameworks that beautify efficiency, scalability, and fee management. Organizations are adopting cloud-first techniques to modernize legacy structures and assist agile operations, in particular as faraway paintings will become a long-time period norm. Enterprises are deploying cloud-primarily based totally answers for information storage, software-as-a-provider catastrophe recovery, and collaborative equipment to enhance overall performance at the same time as decreasing bodily IT overhead. The upward thrust of hybrid and multi-cloud environments is permitting companies to tailor infrastructure primarily based totally on unique workload requirements, seamlessly balancing overall performance, protection, and regulatory compliance. Meanwhile, cloud-local technology together with containerization, DevOps, and serverless computing are gaining traction, permitting quicker utility improvement and deployment. As cloud adoption deepens throughout industries, from finance to manufacturing, organizations are reinforcing virtual resilience and developing area for non-stop innovation.

In the UK, local leaders, especially in London, help boost cloud computing adoption. London continues to thrive as a tech hub. It has strong data center infrastructure. It also boasts a dense business ecosystem and a growing pool of digital skills. The economic offerings region is seeing more middle offerings moving to the cloud. This shift boosts data processing speeds, enhances customer engagement, and streamlines compliance workflows. Both public bodies and academic institutions are using cloud systems. They aim to centralize operations and improve service delivery. Government-funded projects and investments in virtual transformation are boosting cloud ecosystems. They enhance infrastructure and offer incentives for SMEs to use these technologies. The UK is boosting global information safety rules. This helps with teamwork across borders and cloud integration. The cloud computing marketplace is changing. It is now a key factor in helping the UK achieve its digital goals. This shift also helps the UK stay competitive in the global digital economy.

Emerging technologies are boosting cloud computing in the UK. AI, edge computing, and IoT are merging with cloud systems. This mix unlocks new capabilities. Businesses are using AI-as-a-service for predictive analytics, smart automation, and personalized customer experiences. This is all made possible by cloud scalability. The demand for area-cloud synergies is increasing. This is especially true in industries like logistics, healthcare, and retail. In these fields, real-time processing is crucial. Cloud vendors are stepping up. They are adding more local availability zones. They are also boosting security protocols. Plus, they offer unique solutions for different regions. This helps meet changing business needs. The United Kingdom is speeding up its virtual plans. Cloud computing is not just the backbone of digital infrastructure. It supports new business models. It encourages innovation and prepares the economy for the future. This is done through a connected IT landscape.

Recent News

July 2025: The UK Competition and Markets Authority (CMA) expressed concerns over the dominance of Amazon Web Services (AWS) and Microsoft in the cloud computing market. The CMA highlighted issues such as low customer switching rates, high data egress fees, and licensing practices that deter the use of software on rival clouds. Both companies hold significant market share, with each controlling 30–40% of the market, leading to calls for regulatory intervention to enhance competition.

June 2025: The UK government launched the Cyber Growth Action Plan, investing €16 million into cybersecurity programs. This initiative aims to strengthen the country's cyber resilience, enhance innovation, and support startups, significantly boosting the UK's cloud security sector and fostering long-term growth in the market.

May 2025: The UK cloud computing market generated a revenue of USD 47.24 billion in 2024 and is expected to reach USD 135.24 billion by 2030, growing at a CAGR of 18.4% from 2025 to 2030. Software as a Service (SaaS) was the largest revenue-generating service in 2024, while Infrastructure as a Service (IaaS) is projected to be the fastest-growing segment during the forecast period.

April 2025: The UK public cloud market generated a revenue of USD 7.84 billion in 2023 and is expected to reach USD 19.71 billion by 2030, growing at a CAGR of 14.1% from 2024 to 2030. SaaS remains the dominant segment, while IaaS is anticipated to register the fastest growth.

March 2025: The UK cloud migration market is witnessing a substantial inclination towards hybrid and multi-cloud strategies. The adoption of these models is projected to rise from 19% in 2024 to 26% within the next three years, driven by the demand for cost-efficiency, seamless data integration, and improved security.

For an in-depth analysis, you can refer sample copy of the report:

https://www.imarcgroup.com/uk-cloud-computing-market/requestsample

UK Cloud Computing Market Industry Segmentation:

Analysis by Service:

- Infrastructure as a Service (IaaS)

- Platform as a Service (PaaS)

- Software as a Service (SaaS)

Analysis by Deployment:

- Public

- Private

- Hybrid

Analysis by Workload:

- Application Development and Testing

- Data Storage and Backup

- Resource Management

- Orchestration Services

- Others

Analysis by Enterprise Size:

- Large Enterprises

- Small and Medium Enterprises

Analysis by End-Use:

- BFSI

- IT and Telecom

- Retail and Consumer Goods

- Manufacturing

- Energy and Utilities

- Healthcare

- Media and Entertainment

- Government and Public Sector

- Others

Regional Analysis:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Ask Our Expert & Browse Full Report with TOC & List of Figure:

https://www.imarcgroup.com/request?type=report&id=24887&flag=C

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0