UK Automotive Market Forecast to 2033: EV Adoption, Regulations & Growth Drivers

UK Automotive Market Overview

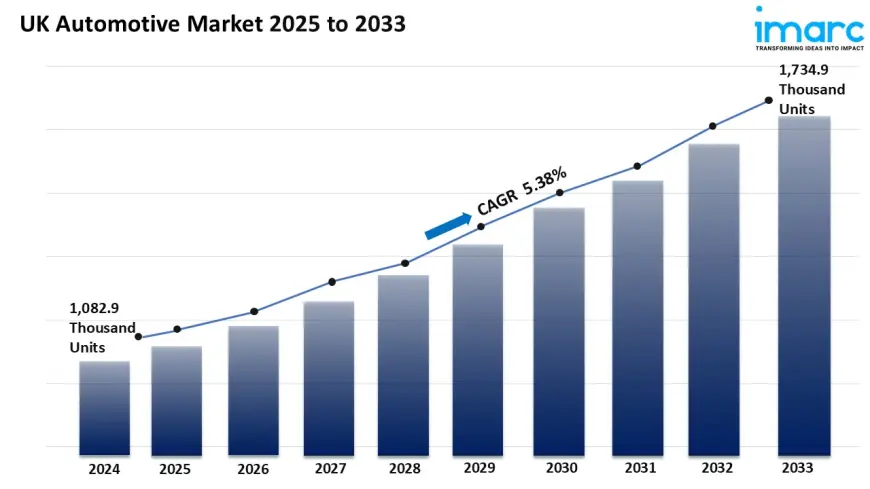

Market Size in 2024: 1,082.9 Thousand Units

Market Forecast in 2033: 1,734.9 Thousand Units

Market Growth Rate 2025-2033: 5.38%

The UK automotive market size reached 1,082.9 Thousand Units in 2024. Looking forward, IMARC Group expects the market to reach 1,734.9 Thousand Units by 2033, exhibiting a growth rate (CAGR) of 5.38% during 2025-2033.

UK Automotive Market Trends and Drivers:

The UK Automotive Market is evolving rapidly, pushed through technological innovation, environmental priorities, and virtual transformation. The growing penetration of electrical cars is gambling a critical function on this expansion, as improvements in battery performance, variety capability, and fast-charging networks are encouraging extensive purchaser adoption. Automakers are accelerating investments in EV structures, leveraging light-weight substances and shrewd structures to decorate strength performance and using performance. Simultaneously, authorities incentives, easy mobility desires, and emission policies are reinforcing call for for opportunity propulsion structures, such as hybrid and absolutely electric powered drivetrains. As public cognizance grows round sustainability and gas economy, customers are prioritising cars that provide each environmental advantages and superior virtual features. The upward push of automobile connectivity, infotainment upgrades, and independent using abilities is in addition reshaping expectations, positioning motors as incorporated clever mobility answers instead of standalone machines.

In the United Kingdom, a marketplace boom is happening. This is due to changing choices in car types and how people buy them. Passenger cars still attract the most buyers. However, business fleets and two-wheelers are rising in popularity. This change is needed for better last-mile delivery, city transport, and fuel efficiency. They want to meet green fleet goals and lower operational costs. Dealerships are changing how they operate. They are adding digital features like online showrooms, configurators, and easy financing options. Online car income channels are growing quickly. They let customers research, compare, and buy cars more easily and transparently. Direct-to-purchaser fashions are growing as alternatives. This is especially true for electric car makers. They want to streamline operations and control the customer experience. Product variety and omnichannel retailing increase engagement, lower friction, and broaden marketplace reach.

The UK car market is focusing on digitalization, AI, and smart infrastructure. These changes aim to improve mobility experiences and boost supply chain flexibility. Manufacturers now use AI in processes like manufacturing, predictive maintenance, and customer support. This helps them innovate faster and gain insights from data. Related car technology is boosting safety, navigation, and diagnostics. It also helps pave the way for self-driving vehicles. Urban centers are investing in smart delivery systems and EV charging networks. This boosts the environment needed for smooth electric mobility. The UK is becoming a leading car hub. It supports new transport options and builds strong public-private partnerships. With a strong engineering background and a bold vision, the marketplace is gaining momentum. It is also opening new opportunities for gamers across the entire car price chain.

UK Automotive Market News

July 2025 – Jaguar Land Rover announced plans to cut up to 500 UK management jobs (≈1.5% of workforce) amid falling sales, particularly in North America, driven by U.S. tariffs; UK sales dropped 25.5% as JLR readies for electric model launches in 2026.

July 2025 – Leapmotor introduced the UK’s cheapest EV, the T03, by internally matching government EV grants (£1,500 discount) although it does not qualify for official subsidies, triggering aggressive competition in EV pricing.

July 2025 – Honda confirmed that the iconic Civic Type R will be discontinued in the UK and Europe by 2026 but hinted at an electric performance version in development.

July 2025 – Chinese automaker Chery set to launch in the UK with its Tiggo 8 Super Hybrid SUV, and alongside Xpeng, Geely, and others continues reshaping the competitive landscape with new EV and hybrid entries.

July 2025 – UK automakers are on track to nearly meet the 2025 Zero Emission Vehicle (ZEV) mandate, with EVs accounting for 21.6% of sales in H1; the government relaxed mandate terms under lobbying pressure.

April–May 2025 – The government launched a £650 million EV subsidy offering up to £3,750 off for qualifying models but complex “green” eligibility rules sparked industry confusion and concern over used‑EV values.

For an in-depth analysis, you can refer sample copy of the report:

https://www.imarcgroup.com/uk-automotive-market/requestsample

UK Automotive Market Industry Segmentation:

Type Insights:

- Passenger Vehicles

- Commercial Vehicles

- Two Wheelers

Propulsion Type Insights:

- Gasoline

- Diesel

- Electric

- Others

Sales Channel Insights:

- Dealerships

- Online Sales

- Direct Sales

- Others

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Ask Our Expert & Browse Full Report with TOC & List of Figure:

https://www.imarcgroup.com/request?type=report&id=24819&flag=C

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0