Uganda Financial Literacy Association celebrates 1st anniversary as strategic plan is launched.

The Uganda Financial Literacy Association (UFLA), an umbrella body that brings together stakeholders in the financial literacy field for promoting, including, and providing financial education, has celebrated its first anniversary.

The event was also marked by launching it's strategic plan at a glamour function that attracted layers in the financial sector, including, the World Bank, Bank of Uganda, Ministry of Finance, Planning and Economic Development, and Equity Bank among others.

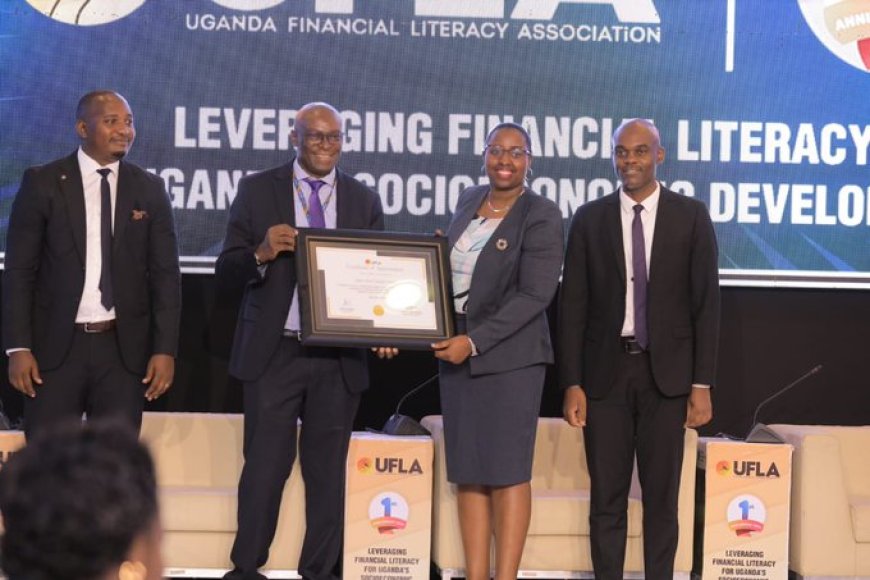

During the celebration held on 30th May 2024 at Serena Hotel in Kampala, key to note was the recognition of outstanding players including Equity Bank which was awarded for promoting inclusion and providing financial education, especially the support the bank has rendered to UFLA in leveraging financial literacy for Uganda's socio-economic development.

While receiving the award, The Equity Bank, Executive Director, Elizabeth Mwerinde Kasedde, emphasized the bank’s dedication to providing integrated financial services that drive social and economic empowerment for individuals, businesses, and communities.

"Through our financial literacy programs, Equity Bank has enhanced access to affordable unsecured credit, disbursing over 89 billion UGX to 32,021 individuals and MSMEs in the past three years," she said

Executive Director, Elizabeth Mwerinde Kasedde receives the award

The ED also said that Equity Bank is partnering with churches to enhance our outreach, but added that there's a greater opportunity, especially launching a widespread campaign involving multiple churches to educate people on financial literacy and personal finance management.

The theme was: “Leveraging Financial Literacy for Uganda’s Social Economic Development."

The CEO of Uganda Institute of Banking & Financial Services (UIBFS) Mrs. Goret Masade highlighted that UIBFS’s training initiative is to reduce the financial literacy gap in Uganda. She said that through partnerships with stakeholders and member institutions, they have championed financial literacy together.

“During COVID-19, we launched the Banking and Financial Services Awareness Month to promote financial inclusion, especially as many Ugandans advocated accessing their NSSF contributions,” she said

Group photo