Silage Film Market Competitive Landscape

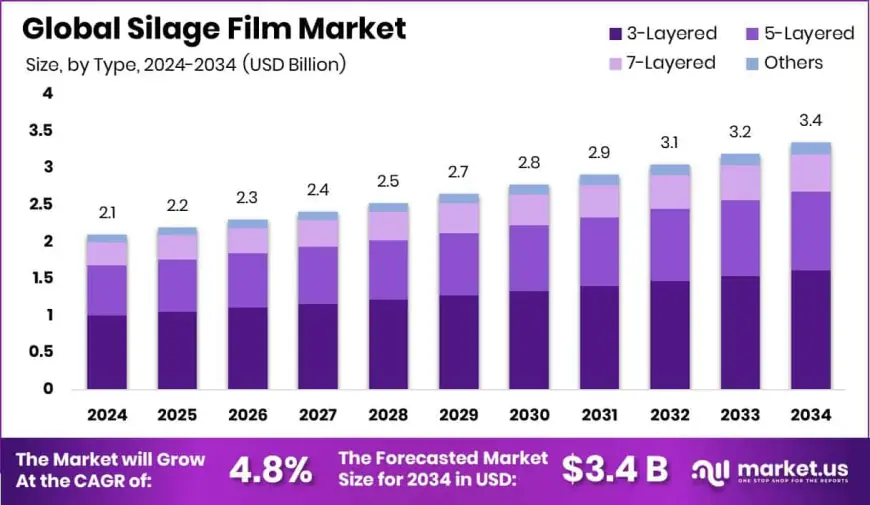

Global Silage Film Market is expected to be worth around USD 3.4 billion by 2034, up from USD 2.1 billion in 2024, and grow at a CAGR of 4.8% from 2025 to 2034. With a 49.3% share, North America leads the Silage Film Market in 2024.

Report Overview:

In 2024 the global silage film market was valued at approximately USD 2.1 billion and is projected to grow to around USD 3.4 billion by 2034, at a solid compound annual growth rate (CAGR) of 4.8% from 2025‑2034. Silage films stretchable plastics used to wrap feed like grass or corn help ensure airtight preservation, key to maintaining nutritional quality for livestock year‑round. Demand is strongest in regions with large dairy and cattle operations, with North America alone representing nearly half (49.3%) of the global market share in 2024. Among film types, three‑layered products dominate with a 48.1% share due to their durability and cost‑effectiveness, while resin analysis shows LLDPE and LDPE holding about 62.5% of use, prized for their flexibility and tear resistance. Grass silage applications lead usage at 56.9%, driven by the importance of forage preservation in livestock care.

The silage film market is steadily growing as livestock producers increasingly prioritise efficient feed storage systems. By wrapping silage in multi‑layer films, farmers can safeguard nutritional value through better oxygen and moisture control, which is especially vital during seasonal variability. Three layered films stand out as market leaders providing optimum protection while being cost‑effective accounting for nearly half of all film type usage in 2024. Material choices matter: LLDPE and LDPE dominate with a combined 62.5% share, favored for their strong tensile and sealing properties in demanding farm conditions. Regionally, North America leads the charge supported by extensive dairy and cattle operations and holds roughly half the global market in 2024. Grass silage remains the most common application, contributing 56.9% of demand, as farmers in major regions seek reliable feed preservation to boost livestock health and farm economics

Key Takeaways

-

Market size is expected to reach about USD 3.4 billion by 2034, up from USD 2.1 billion in 2024, at a 4.8% CAGR (2025–2034).

-

Three‑layered silage films dominate with 48.1% market share, valued for durability and cost.

-

The most used materials are LLDPE and LDPE resins, together holding 62.5% share due to their flexibility, strength, and sealing performance.

-

Grass silage applications hold 56.9% of usage, as preserving nutrient‑rich forage remains critical for livestock operations.

-

North America leads the global silage film market with a 49.3% share in 2024, driven by strong dairy and cattle farming sectors.

Download Exclusive Sample Of This Premium Report: https://market.us/report/global-silage-film-market/

Key Market Segments:

By Type

- 3-Layered

- 5-Layered

- 7-Layered

- Others

By Resin

- LLDPE and LDPE

- HDPE

- Ethylene Vinyl Acetate (EVA)

- Others

By Application

- Grasses Silage

- Corn Silage

- Vegetables Silage

- Others

DORT Analysis

Drivers

-

Rising demand for preserved livestock feed year-round boosts silage film adoption.

-

Growth of dairy and beef farming globally creates sustained need for airtight forage storage.

-

Awareness among farmers about minimizing spoilage and loss during fermentation is increasing.

-

Advanced multi-layer films offer stronger oxygen and moisture barriers, reinforcing adoption.

Opportunities

-

Expansion into emerging markets with growing livestock sectors presents new demand potential.

-

Innovation in improved film structures (e.g. 5‑ and 7‑layer variants) can capture premium share.

-

Eco‑friendly biodegradable or recyclable films may appeal to sustainability‑focused consumers.

-

Farmer education and demonstration programs can raise adoption of higher‑performance films.

Restraints

-

Fluctuating raw material costs, especially polymers like PE, pressure film pricing structures.

-

Limited recycling infrastructure challenges disposal and environmental acceptance of conventional films.

-

Alternative livestock feed preservation methods could reduce reliance on plastic-based films.

-

Resistance from cost-conscious smallholders may delay uptake of premium film options.

Trends

-

Shifting preference toward multi-layer films, particularly 3‑layer dominance, with growth in 5‑ and 7‑layer types.

-

Continued preference for LLDPE and LDPE resins, due to their proven performance in sealing silage.

-

Growth in grass silage usage as dairy and cattle sectors drive feed storage efficiency.

-

Expanding market share in North America, while Asia-Pacific shows rising interest.

Market Key Players:

- Maschinenfabrik Bernard KRONE GmbH & Co. KG

- Berry Global Inc.

- RKW Group

- Trioworld

- Joachim Behrens Scheessel Gmbh

- Rani Group

- Coveris

- Shandong Longxing Plastic Film Company

- BSK & Lakufol Kunststoffe GmbH

- Groupe Barbier

- GABRIEL-CHEMIE GROUP

- IRIS Polymers

- Bialpak

- DUO PLAST AG

- Silopak

- XINJIANG RIVAL TECH CO., LTD

Conclusion:

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0