How to Choose the Right Offshore Accounting Service Provider for Your U.S. Firm

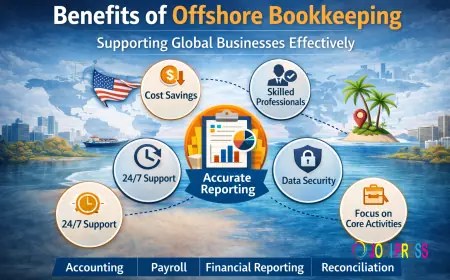

As U.S. accounting firms continue to seek greater efficiency and scalability, offshore services for accounting firms have emerged as a strategic solution. With the right provider, offshoring accounting services can reduce costs, enhance turnaround times, and allow your in-house team to focus on high-value tasks. But how do you choose the right offshore accounting partner? In this guide, we’ll walk you through the essential factors U.S. firms should evaluate when selecting an offshore provider—so your offshoring strategy drives real growth in 2025 and beyond.

Why U.S. Firms Are Turning to Offshore Accounting Services

Before diving into the selection process, let’s answer a key question:

Why are so many CPA firms outsourcing accounting work offshore?

Here are a few reasons:

-

Cost Efficiency: Offshore providers offer skilled accounting labor at lower hourly rates.

-

Scalability: Offshore teams help firms handle seasonal workload spikes without hiring locally.

-

Focus on Core Competencies: U.S. CPAs can redirect their energy from data entry and reconciliation to client advisory and strategic planning.

-

24-Hour Operations: Time zone differences can translate into faster turnarounds and “overnight” processing.

However, these benefits only materialize if you choose the right provider.

1. Understand Your Firm’s Needs First

Ask yourself:

-

Do you need support with bookkeeping, tax preparation, payroll, or auditing?

-

Is the goal to reduce cost, expand capacity, improve quality—or all three?

-

Will offshoring be a short-term strategy or a long-term extension of your team?

Knowing exactly what you need helps filter out providers who aren’t aligned with your firm’s goals. Custom-fit solutions always outperform one-size-fits-all services.

2. Evaluate Experience with U.S. Accounting Standards

This is non-negotiable.

A provider must have a proven track record of working with U.S. GAAP, IRS guidelines, and state-specific tax laws. Look for certifications like:

-

Experience with QuickBooks, Xero, NetSuite, or Sage Intacct

-

Familiarity with Form 1040, 1120, 1065, and sales tax filings

-

Hands-on knowledge of U.S. payroll laws and compliance

Pro Tip: Ask for U.S. client case studies and sample work to verify competency.

3. Review Their Data Security and Compliance Practices

Can you trust them with your clients’ financial data?

Security and compliance are paramount when offshoring accounting services. The provider should have:

-

ISO 27001 or SOC 2 compliance

-

Multi-layered cybersecurity protocols

-

Secure file-sharing platforms and cloud-based accounting systems

-

Confidentiality agreements (NDAs) and secure internal workflows

Don't hesitate to ask:

“How do you protect sensitive client information?”

4. Assess Communication and Collaboration Tools

Good offshore partners work as a seamless extension of your local team.

You’ll need regular updates, easy access to assigned accountants, and transparency throughout the engagement. Ask:

-

How often will we have check-ins?

-

What collaboration tools do you use? (e.g., Slack, Teams, Trello, Zoom)

-

Is there a dedicated account manager or team leader?

Effective communication bridges the time zone gap. Don’t compromise here.

5. Look for Flexibility and Scalability

Your firm’s needs will evolve—especially during tax season, audits, or year-end close. Choose a provider that:

-

Offers on-demand scalability

-

Can handle special projects or niche accounting tasks

-

Has a trained backup team to ensure no disruption during leave or attrition

You want a partner who grows with you.

6. Check References and Reviews

Nothing beats real-world feedback.

Ask for at least 2–3 references from U.S.-based accounting firms. Prepare questions like:

-

“How responsive is their team?”

-

“Were there any issues with data accuracy or deadlines?”

-

“How has offshoring impacted your firm's productivity or margins?”

Additionally, check online reviews or testimonials to validate their credibility and reputation.

7. Understand Their Pricing Model

Transparent pricing helps you measure ROI clearly. Offshore providers may charge:

-

Hourly rates

-

Monthly retainers

-

Per-task/project fees

Watch out for hidden charges like setup fees, rush-hour surcharges, or tech platform licensing. Ideally, the provider should offer a custom quote based on scope and clear SLAs for accountability.

8. Prioritize Cultural Fit and Ethics

While this may seem secondary, cultural alignment can significantly affect working relationships. Ensure the provider:

-

Understands U.S. business etiquette

-

Respects timelines, holidays, and communication preferences

-

Treats your clients and their data with professional care

If you’re planning a long-term relationship, cultural synergy matters more than you think.

Red Flags to Avoid

Here are some signs to proceed with caution:

-

Vague responses about data security

-

No U.S. references or testimonials

-

Poor communication or long response times

-

Lack of clear SLAs or deliverables

-

Overpromising on capabilities without proof

Final Thoughts: Offshore the Smart Way

The right offshore services for accounting firms can help U.S. CPAs and bookkeeping firms cut costs, grow faster, and remain competitive. But success depends on choosing the right partner. By focusing on experience, security, communication, scalability, and cultural fit—you'll find a provider who delivers real value, not just cheap labor. Remember: It’s not about outsourcing work. It’s about building a reliable offshore extension of your team.

FAQs: Choosing Offshore Accounting Services

Q: Is offshoring accounting services secure for U.S. firms?

A: Yes—if you choose a provider with strong data protection policies, certifications, and secure systems.

Q: What services can I offshore?

A: Bookkeeping, tax prep, payroll processing, AR/AP management, reconciliation, and audit support.

Q: Will I lose control of my accounting processes?

A: Not if the provider works transparently and integrates with your existing workflow and tools.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0