Mixed Bed Ion Exchange Market Boost Growth 2033

According to the Market Statsville Group (MSG), the Global Mixed Bed Ion Exchange Market size is expected to project a considerable CAGR of 8.3% from 2024 to 2033.

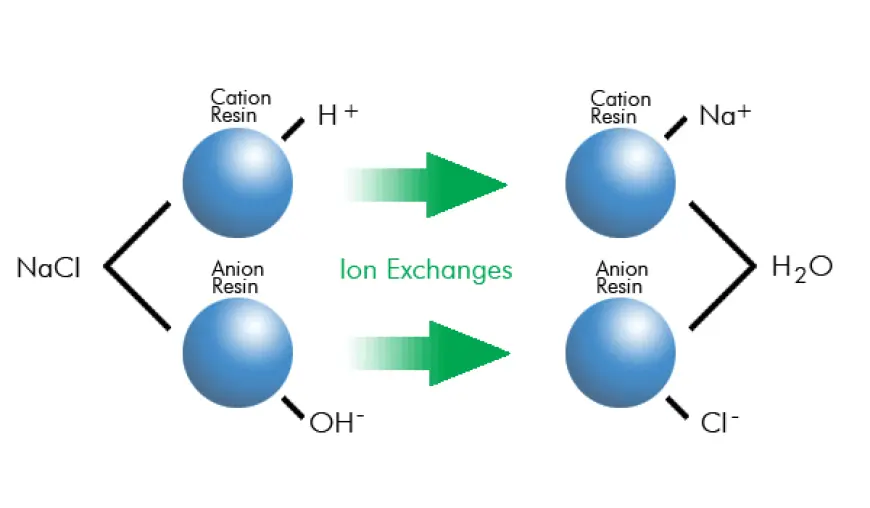

Increased demand for ultrapure water from applications such as power generation, pharmaceuticals, electronics, and food and beverage explains the rise of the mixed bed ion exchange market. Owing to the effectiveness of mixed bed systems in low conductivity and high removal of contaminants with the use of both cationic and anionic resins, systems work effectively for applications requiring pure water on a high scale. This is mainly because the market is driven by various factors, such as advancement in resin technology, increasing regulatory emphasis on water quality, and the global push for sustainable practices in water treatment. Further, industrialization, particularly in emerging economies, increases the demand for such systems to deal with the increasing demand for water treatment needs. Growth however is limited by issues such as high initial costs and maintenance requirements. The significant market players are now focusing on the innovation of product and strategic alliances in order to increase efficiency and decrease their operational costs. In a broad analysis, the market is likely to grow steadily as new companies opt for high-purity water solutions.

Request Sample Copy of this Report: https://www.marketstatsville.com/request-sample/mixed-bed-ion-exchange-market?utm_source=free&utm_medium=harsh

Scope of the Global Mixed Bed Ion Exchange Market

The study categorizes the Mixed Bed Ion Exchange market based on Product Type, Applications, Distribution Channels, End-Users Industries at the regional and global levels.

By Product Type Outlook (Sales, USD Million, 2019-2033)

- Gel Mixed Bed Resins

- Macroporous Mixed Bed Resins

By Application Outlook (Sales, USD Million, 2019-2033)

- Water Deionization

- Demineralization

- Condensate Polishing

- Other Specialized Applications

By Distribution Channels Outlook (Sales, USD Million, 2019-2033)

- Direct Sales

- Distributors & Wholesalers

- Online Retail

By End-Users Outlook (Sales, USD Million, 2019-2033)

- Power Generation

- Electronics & Semiconductors

- Pharmaceuticals

- Food & Beverage

- Chemicals

- Water & Wastewater Treatment

- Others

By Region Outlook (Sales, USD Million, 2019-2033)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Italy

- France

- UK

- Spain

- Poland

- Russia

- The Netherlands

- Norway

- Czech Republic

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Malaysia

- Thailand

- Singapore

- Australia & New Zealand

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Colombia

- Rest of South America

- The Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Northern Africa

- Rest of MEA

Direct Purchase Report: https://www.marketstatsville.com/buy-now/mixed-bed-ion-exchange-market?opt=3338&utm_source=free&utm_medium=harsh

Gel Mixed Bed Resins segment accounts for the largest market share by Product Type

Based on the Product Type, the market is divided into Gel Mixed Bed Resins, Macroporous Mixed Bed Resins. Gel Mixed Bed Resins are the dominant segment of the Mixed Bed Ion Exchange Market. The reason for this is to ensure their high efficiency and wide usage in applications requiring ultrapure water, such as electronics manufacturing, pharmaceuticals, and power generation. Gel resins have a homogeneous structure; hence they offer faster ion exchange rate capacity and higher ion removal critical to the quality demanded by the industries requiring high purity and consistent water quality. They are also cheaper than macroporous resins. The above advantages make the resins a favorite for large-scale industrial applications compared to macroporous resins. The production and regeneration of gel resins are easier compared to macroporous resins, which means reduced operational complexities and maintenance costs. Macroporous resins have an added advantage of durability and resilience in harsher chemical conditions than gel resins. In markets where high purity is more important than extreme durability, the gel resins remain at the top. The overall efficiency, along with being low in cost and highly suitable for ultra-pure applications, makes gel mixed bed resins a top-of-the-market reserving.

Asia-Pacific accounted for the largest market share by Region

Based on the regions, the global market of Mixed Bed Ion Exchange has been segmented across North America, Europe, the Middle East & Africa, South America, and Asia-Pacific. The Asia-Pacific dominates the Mixed Bed Ion Exchange market. This is supported by rapidly industrially developing countries such as China, India, South Korea, and Japan. These countries have incredible growth opportunities in electronics, pharmaceuticals, and power generation sectors, all of which need highly pure water. Therefore, the need for effective water treatment technologies is growing. A huge manufacturing infrastructure for semiconductors in Asia Pacific is also a leading factor for this market. Increased awareness towards the environment and policies implemented by the government regarding sustainable usage of water are motivating businesses to adopt high-tech purification methods- mixed bed ion exchange. Infrastructure investment and favorable government policies help businesses adhere to stringent standards for water quality, which in turn contributes to the increase in market growth. Increasing demands for consumer goods within a large population in the region are also compelling various industries to shift their focus toward proper management practices about water usage, making the Asia Pacific market the largest for mixed bed ion exchange systems.

Competitive Landscape: Global Mixed Bed Ion Exchange Market

The global Mixed Bed Ion Exchange Market is highly competitive. Each of the important players - DuPont, Thermax Limited, Evoqua Water Technologies, and Lanxess, among others- focus on a spectrum of technological innovations, product development, and strategic partnerships to strengthen themselves in this market. The increased demand for ultrapure water solutions in the power, electronics, and pharmaceuticals industries has led them to vie for these increased demands.

Major players in the global Mixed Bed Ion Exchange market are:

- DuPont

- H2O Innovation

- Aqua Solutions And Equipments

- ResinTech

- SUEZ

- Purolite

- Thermax

- Ion Exchange

- Other Major Players

Request For Report Discount: https://www.marketstatsville.com/table-of-content/mixed-bed-ion-exchange-market

Recent Development

- In September 2023, Lanxess launched a new mixed-bed resin for ultra-pure water in the production of semiconductors. The content of metals such as iron, zinc, and sodium is extremely lower in the new UltraPure 1296 MD PLUS compared to the widely established Lewatit UltraPure 1296 MD mixed bed.

- In September 2023, DuPont announced the availability of its first product specifically to make green hydrogen; DuPont™ AmberLite™ P2X110 Ion Exchange Resin. To aid in the production of hydrogen from water, this newly introduced ion exchange resin is designed for electrolyzer loop-specific chemistry.