India Plastic Packaging Market Overview: Trends, Growth & Future Outlook 2025-2033

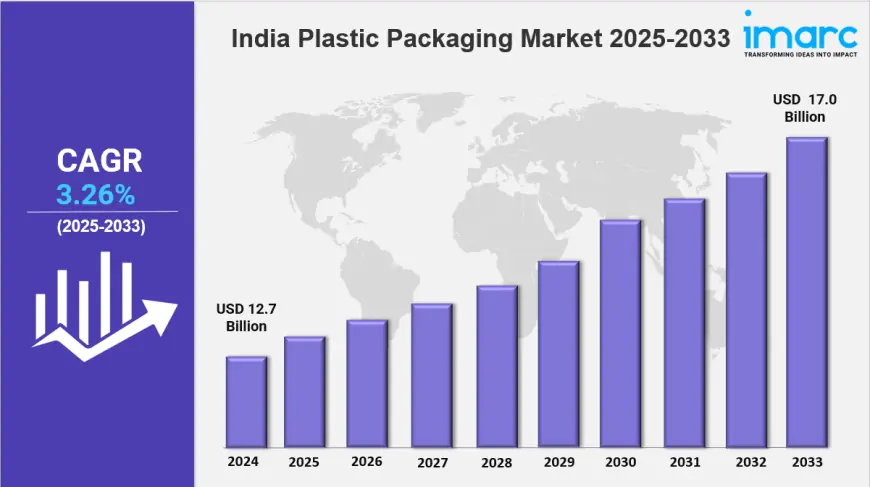

India plastic packaging market size reached USD 12.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 17.0 Billion by 2033, exhibiting a growth rate (CAGR) of 3.26% during 2025-2033.

Market Overview 2032

India plastic packaging market size reached USD 12.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 17.0 Billion by 2033, exhibiting a growth rate (CAGR) of 3.26% during 2025-2033. The market is expanding rapidly, driven by increasing demand for packaged and processed foods. Urbanization, rising disposable incomes, and a growing preference for convenience are key factors boosting the sector. Government support and advancements in processing technologies also contribute to its growth.

Key Market Highlights:

✔️ Strong market growth driven by increasing demand from food, beverage, and e-commerce sectors

✔️ Rising adoption of sustainable and recyclable plastic packaging solutions

✔️ Expanding innovations in lightweight, flexible, and biodegradable packaging materials

Request for a sample copy of the report: https://www.imarcgroup.com/india-plastic-packaging-market/requestsample

India Plastic Packaging Market Trends and Driver:

The emergence of e-commerce is a major factor driving the continuous growth of the plastic packaging industry in India. More customers are buying online as internet access and smartphone usage rise, which is driving up need for robust and effective packaging solutions. E-commerce companies need packaging that not only keeps goods safe in transportation but also makes their brand more visible. Custom packaging, such as rigid containers and flexible pouches that are suited to different product requirements, has become more popular as a result.

Plastic packaging remains popular due to its cost-effectiveness and convenience, driving continuous innovation in materials and design. Online grocery shopping is also contributing to market growth, as more consumers seek packaging that balances functionality with sustainability. In response, manufacturers are focusing on biodegradable and recyclable materials. The push for sustainability is shaping the future of the industry, requiring companies to align with both consumer preferences and regulatory guidelines.

In recent years, the Indian government has implemented stricter regulations to reduce plastic waste and encourage sustainable packaging solutions. New policies on single-use plastics have prompted manufacturers to rethink their strategies, leading to increased investment in recyclable and biodegradable alternatives. Many companies are adopting eco-friendly practices, such as using recycled materials and exploring plant-based plastics. This shift not only ensures compliance with regulations but also meets the growing consumer demand for environmentally responsible packaging.

Technological advancements are also playing a crucial role in shaping the India plastic packaging market. Innovations in manufacturing processes, such as blow molding and injection molding, are improving efficiency and product quality. The development of high-performance plastics with enhanced durability and barrier properties has further strengthened the market. Additionally, smart packaging technologies, including QR codes and RFID tags, are gaining traction. These technologies help brands engage consumers, provide product transparency, and streamline logistics and inventory management.

Looking ahead to 2024, the plastic packaging market in India is undergoing a transformation driven by consumer preferences, regulations, and technological advancements. Sustainability is at the forefront, pushing companies to develop eco-friendly alternatives to traditional plastics. Businesses are increasingly adopting lightweight yet protective packaging to meet the challenges of online retail while integrating smart technology for better consumer engagement. To stay competitive, companies must continue investing in research and development, ensuring their packaging solutions align with evolving environmental standards and market demands.

India Plastic Packaging Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Packaging Type:

-

Flexible Plastic Packaging

-

Rigid Plastic Packaging

Breakup by Product Type:

-

Bottles and Jars

-

Trays and Containers

-

Pouches

-

Bags

-

Films and Wraps

-

Others

Breakup by End User:

-

Food

-

Beverage

-

Healthcare

-

Personal Care and Household

-

Others

Breakup by Region:

-

North India

-

West and Central India

-

South India

-

East and Northeast India

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0