How Technology Is Transforming Offshore Bookkeeping Services

The accounting industry is evolving faster than ever. Client expectations are increasing, compliance regulations are tightening, and competition is becoming more intense. For many accounting firms, growth means taking on more clients, expanding service offerings, and improving turnaround times. But scaling traditionally requires hiring more local staff — and that comes with high costs, long recruitment cycles, and operational challenges.

This is where offshore bookkeeping services for accounting firms are changing the game.

Instead of expanding locally, firms are now leveraging offshore teams to scale efficiently, reduce overhead costs, and improve service delivery — all without compromising quality.

Let’s explore how offshore bookkeeping makes this possible.

The Challenge of Scaling an Accounting Firm

When accounting firms grow, bookkeeping is often the first function that becomes overloaded. As client numbers increase, so do transaction volumes, reconciliations, reporting requirements, and compliance tasks.

Hiring locally may seem like the logical solution. However, it comes with:

-

High salary and benefit costs

-

Office space and infrastructure expenses

-

Recruitment and training time

-

Employee turnover risks

-

Seasonal staffing challenges during tax periods

For small and mid-sized firms especially, these costs can slow down profitability and limit expansion.

What Are Offshore Bookkeeping Services?

Offshore bookkeeping services for accounting firms involve partnering with a skilled accounting team located in another country. These professionals handle bookkeeping tasks remotely, working as an extension of your in-house team.

Services typically include:

-

Bank and credit card reconciliations

-

Accounts payable and receivable management

-

General ledger maintenance

-

Financial statement preparation

-

Payroll processing support

-

Month-end and year-end closing assistance

The offshore team works using secure cloud-based accounting software such as QuickBooks, Xero, Sage, or NetSuite, ensuring seamless collaboration.

1. Scale Without Increasing Fixed Costs

One of the biggest advantages of offshore bookkeeping is cost efficiency.

Hiring locally means fixed monthly expenses — salaries, insurance, benefits, hardware, software licenses, and office space. Offshore teams operate at a significantly lower cost structure while maintaining high-quality standards.

This allows accounting firms to:

-

Take on more clients without increasing overhead

-

Improve profit margins

-

Invest savings into marketing and growth

-

Offer competitive pricing to clients

Instead of worrying about payroll expansion, firms can focus on revenue generation.

2. Access to Skilled Bookkeeping Talent

Finding experienced bookkeepers locally can be challenging, especially during peak seasons. Offshore bookkeeping providers specialize in serving accounting firms, meaning their teams are already trained in international accounting standards and software platforms.

This provides:

-

Immediate access to qualified professionals

-

No long recruitment cycles

-

Reduced training costs

-

Faster onboarding

With offshore bookkeeping services for accounting firms, you gain a ready-to-deploy team that understands workflows and deadlines.

3. Flexibility During Tax Season

Tax season is one of the most stressful periods for accounting firms. Workloads increase dramatically, and temporary local hiring often becomes expensive and inefficient.

Offshore bookkeeping offers scalability on demand. Firms can:

-

Increase offshore team size during busy seasons

-

Reduce workload during slower months

-

Avoid paying year-round salaries for seasonal staff

This flexibility ensures your firm maintains efficiency without overextending resources.

4. Improved Turnaround Time

Time zone differences can actually work in your favor. When managed properly, offshore teams can complete bookkeeping tasks overnight, allowing your in-house team to review and deliver reports faster.

This leads to:

-

Faster client responses

-

Quicker financial reporting

-

Better client satisfaction

-

Stronger retention rates

In a competitive market, speed and accuracy make a significant difference.

5. Focus on High-Value Advisory Services

Bookkeeping is essential, but it is often time-consuming and operational in nature. By outsourcing routine bookkeeping tasks, accounting firms free up internal resources to focus on higher-value services such as:

-

Financial advisory

-

Tax planning

-

Business consulting

-

Strategic CFO services

This shift from transactional work to advisory roles increases revenue potential and strengthens long-term client relationships.

Offshore bookkeeping services for accounting firms allow your core team to work on growth-oriented tasks rather than repetitive data entry.

6. Enhanced Data Security and Compliance

Many accounting firms worry about data security when considering offshore solutions. However, reputable offshore bookkeeping providers use:

-

Secure cloud-based platforms

-

Encrypted data transfers

-

Restricted access controls

-

Non-disclosure agreements

-

Compliance with international security standards

With proper vetting, offshore bookkeeping can be just as secure — if not more secure — than traditional setups.

7. Faster Business Expansion

When you remove hiring limitations, your growth potential expands. Offshore bookkeeping enables firms to onboard new clients quickly without worrying about staffing constraints.

This means you can:

-

Expand into new industries

-

Serve international clients

-

Increase service capacity

-

Launch new accounting packages

Growth becomes opportunity-driven rather than resource-limited.

8. Competitive Advantage in the Market

Firms using offshore bookkeeping services for accounting firms often operate leaner and more efficiently than competitors relying solely on local staff.

This allows them to:

-

Offer competitive pricing

-

Deliver faster turnaround times

-

Maintain consistent quality

-

Improve profitability

In today’s competitive accounting landscape, operational efficiency is a major differentiator.

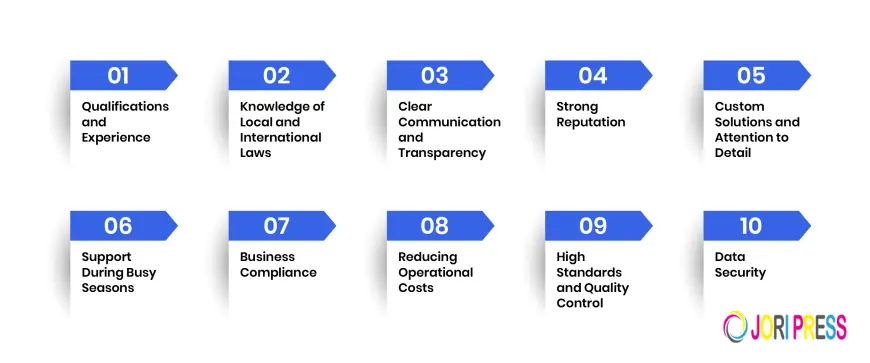

How to Successfully Implement Offshore Bookkeeping

To maximize benefits, accounting firms should:

-

Choose a provider with experience serving CPA firms

-

Start with a pilot project

-

Use cloud-based accounting tools

-

Establish clear communication protocols

-

Monitor KPIs and quality standards

A structured approach ensures smooth integration and long-term success.

Final Thoughts

Scaling an accounting firm no longer requires expanding office space or hiring large local teams. With the right strategy, offshore bookkeeping services for accounting firms provide a cost-effective, flexible, and efficient path to growth.

By reducing operational burdens, improving turnaround times, and freeing up internal resources, offshore bookkeeping empowers accounting firms to focus on what truly matters — delivering value, building client trust, and driving long-term profitability.

In a world where efficiency determines success, offshore bookkeeping is not just an outsourcing trend — it’s a strategic growth solution.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0