How SAP Bookkeeping Services Help Large Teams Stay Audit-Ready

In today’s fast-paced business world, managing financial data accurately and efficiently is more critical than ever. For companies using SAP as their enterprise resource planning (ERP) system, SAP bookkeeping services are becoming an essential part of maintaining clean, compliant, and actionable financial records. But what exactly are SAP bookkeeping services? And more importantly, does your business really need them?

Let’s dive into what these services entail, why they matter, and how they can transform your financial operations.

Understanding SAP and Its Role in Bookkeeping

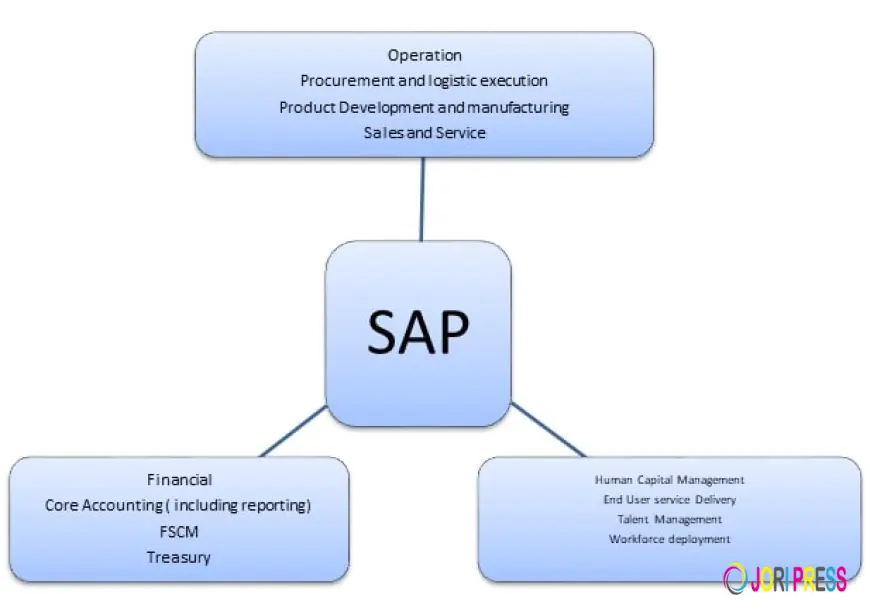

SAP is one of the world’s leading ERP systems, widely adopted by medium and large enterprises to manage everything from supply chains and human resources to finance and accounting. Within SAP’s vast ecosystem, bookkeeping plays a crucial role. It involves recording all financial transactions—such as invoices, payments, payroll, and expenses—in a systematic and organized way.

SAP bookkeeping services refer to the specialized support and management of these financial records within the SAP environment. Unlike traditional bookkeeping, which may use standalone accounting software or spreadsheets, SAP bookkeeping integrates deeply with other business processes, providing a comprehensive and real-time financial picture.

What Do SAP Bookkeeping Services Include?

SAP bookkeeping services cover a range of tasks tailored to ensure your financial data is accurate, timely, and compliant:

1. Transaction Recording and Data Entry

This is the foundation of bookkeeping — accurately recording sales, purchases, receipts, and payments in SAP’s financial modules. Experts ensure that each transaction is categorized correctly, linked to the right cost centers or projects, and reflects the actual business activity.

2. Accounts Payable and Receivable Management

Managing invoices, payments to vendors, and collections from customers is a time-sensitive task. SAP bookkeeping services streamline these processes to ensure cash flow remains healthy and financial records are up-to-date.

3. Bank Reconciliations

Reconciling bank statements with SAP’s recorded transactions helps detect discrepancies early, preventing errors and fraud. Regular bank reconciliations are a key part of SAP bookkeeping services.

4. Payroll and Expense Management

SAP bookkeeping services often extend to managing payroll entries and reimbursing employee expenses accurately, ensuring compliance with tax laws and company policies.

5. Financial Reporting Preparation

Bookkeeping within SAP supports generating accurate financial statements, such as balance sheets, profit and loss statements, and cash flow reports. These reports are essential for internal decision-making, audits, and regulatory compliance.

6. Compliance and Audit Support

SAP bookkeeping experts ensure that financial records meet local accounting standards and regulations, making audits smoother and reducing the risk of penalties.

Why Is SAP Bookkeeping Different From Traditional Bookkeeping?

While traditional bookkeeping typically involves simpler systems or standalone software, SAP bookkeeping is integrated into a complex ERP environment. This integration offers several advantages:

- Real-Time Data Access: SAP provides instant visibility into financial transactions as they happen, enabling faster decision-making.

- Cross-Departmental Integration: Since SAP links finance with operations, procurement, and sales, bookkeeping isn’t isolated. It reflects the full business process, reducing errors.

- Customization and Scalability: SAP can be tailored to fit complex organizational structures, multiple subsidiaries, currencies, and tax jurisdictions — making bookkeeping more sophisticated and accurate.

- Automation: SAP supports automating many bookkeeping tasks, reducing manual errors and freeing up staff for higher-level analysis.

Who Provides SAP Bookkeeping Services?

SAP bookkeeping services can be delivered in different ways:

1. In-House SAP Bookkeeping Team

Large companies often have dedicated in-house teams familiar with SAP’s modules, handling bookkeeping internally. This approach offers control but comes with high staffing and training costs.

2. Outsourced SAP Bookkeeping Services

Many businesses now choose to outsource bookkeeping to specialized firms that understand SAP. These providers offer expertise, scalability, and cost efficiencies without sacrificing quality.

3. Hybrid Models

Some companies blend both approaches, with internal teams managing strategic tasks while outsourcing routine data entry and reconciliations.

Does Your Business Need SAP Bookkeeping Services?

If you’re wondering whether your business could benefit from SAP bookkeeping services, here are some key considerations:

1. Are You Using SAP or Planning to Implement It?

If your company uses SAP ERP or is planning to adopt it, professional bookkeeping within SAP is essential to unlock its full potential.

2. Is Your Financial Data Complex or Growing?

As your company grows, so does the volume and complexity of transactions. SAP bookkeeping services help keep this data organized, accurate, and audit-ready.

3. Do You Face Challenges With Manual Errors or Delays?

Manual bookkeeping can be error-prone and slow. If you experience frequent errors, late reporting, or reconciliation issues, SAP bookkeeping services can automate and streamline these processes.

4. Are You Expanding Into Multiple Markets or Currencies?

SAP excels in handling multi-currency and multi-jurisdictional financials. Expert bookkeeping services ensure compliance and accurate reporting across borders.

5. Do You Need Faster Financial Reporting?

Timely financial reports are critical for strategic decisions. SAP bookkeeping services enable faster month-end closes and real-time insights.

Benefits of Using SAP Bookkeeping Services

Here’s why many businesses choose to invest in SAP bookkeeping services:

✅ Improved Accuracy and Compliance

Professional SAP bookkeeping minimizes errors and ensures adherence to local and international accounting standards.

✅ Cost and Time Savings

Outsourcing or using specialized SAP bookkeeping services reduces overhead, training time, and reliance on manual processes.

✅ Scalability and Flexibility

SAP bookkeeping services can scale with your business, adapting to increased transaction volume or new business units.

✅ Better Financial Visibility

Integrated bookkeeping provides real-time data that supports strategic planning, budgeting, and forecasting.

✅ Audit Preparedness

Well-maintained SAP bookkeeping makes audits less stressful and reduces the risk of penalties.

How to Choose the Right SAP Bookkeeping Service Provider

If you decide to explore SAP bookkeeping services, consider these factors:

- Experience with SAP ERP: Look for providers with proven expertise in SAP financial modules.

- Industry Knowledge: Providers familiar with your sector will understand unique accounting challenges.

- Technology Integration: Ensure they use modern tools and can integrate smoothly with your existing SAP environment.

- Scalability: Choose services that can grow with your business needs.

- Support and Communication: A responsive team that provides clear reporting and open communication is vital.

Conclusion

SAP bookkeeping services represent a powerful tool for businesses seeking to enhance financial accuracy, efficiency, and compliance within their ERP systems. Whether you run a multinational enterprise or a fast-growing mid-sized company, leveraging these services can reduce manual errors, speed up reporting, and provide clearer financial insights.

If your business is using or moving to SAP, investing in specialized bookkeeping services is no longer just a luxury — it’s a strategic necessity. By doing so, you ensure your financial data works for you, empowering smarter decisions and supporting sustainable growth.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0