How Healthcare Companies Benefit from AP Process Outsourcing

Managing finances efficiently has become a top priority for businesses aiming to stay competitive in 2026. One area seeing major transformation is Accounts Payable (AP). Companies of all sizes are now turning to AP process outsourcing to streamline operations, cut costs, and improve financial control.

But what exactly is AP process outsourcing, and why is it becoming the preferred choice for modern businesses? Let’s break it down.

What Is AP Process Outsourcing?

AP process outsourcing is when a business delegates its accounts payable functions to a third-party service provider. Instead of handling invoices, vendor payments, reconciliations, and approvals in-house, companies rely on specialized outsourcing firms with trained accounting professionals and advanced technology.

Typical AP tasks that are outsourced include:

- Invoice receipt and data entry

- Invoice verification and matching (2-way/3-way matching)

- Vendor management

- Payment processing

- Expense tracking

- AP reporting and reconciliation

By outsourcing these repetitive yet critical tasks, businesses can focus more on growth, strategy, and customer experience rather than back-office paperwork.

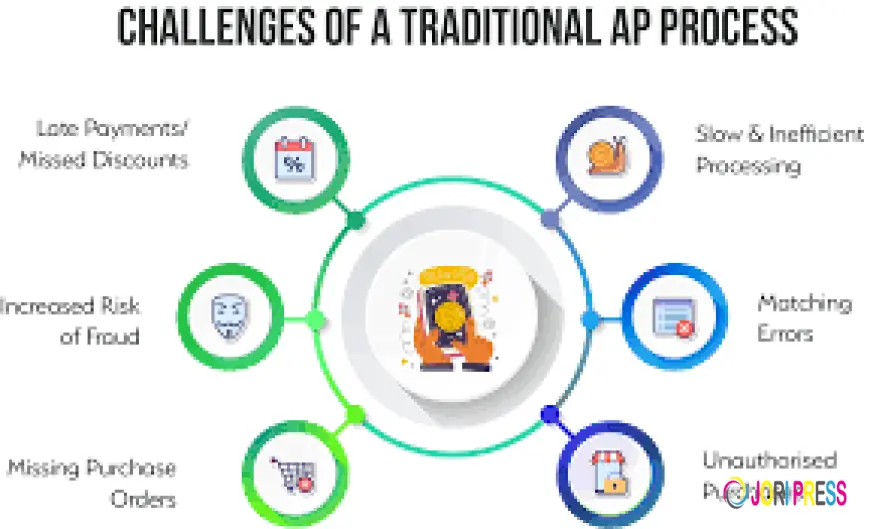

Why AP Is a Challenge for Many Businesses

Accounts payable may seem straightforward, but it can quickly become overwhelming, especially for growing companies.

Common AP challenges include:

- High invoice volumes causing delays

- Manual data entry errors

- Missed payment deadlines and late fees

- Duplicate or fraudulent invoices

- Lack of real-time financial visibility

- Overworked internal finance teams

When AP processes are inefficient, it directly impacts vendor relationships, cash flow management, and overall financial health. This is why businesses are rethinking the traditional in-house AP model.

Why Businesses Are Switching to AP Process Outsourcing in 2026

1. Cost Reduction Without Compromising Quality

One of the biggest reasons companies outsource AP is cost savings. Maintaining an in-house AP team involves salaries, benefits, office space, training, and software investments. Outsourcing providers already have skilled teams and systems in place, allowing businesses to pay only for the services they use.

In 2026, with rising operational costs, businesses are actively looking for ways to reduce overhead while maintaining high-quality financial processes — and AP outsourcing delivers exactly that.

2. Improved Accuracy and Fewer Errors

Manual invoice processing is highly prone to errors. A small mistake in data entry can lead to overpayments, duplicate payments, or disputes with vendors.

Outsourced AP providers use automation tools, OCR (Optical Character Recognition), and AI-driven validation systems to minimize errors. They also follow standardized workflows and multiple verification steps to ensure accuracy. The result? Cleaner books and fewer costly mistakes.

3. Faster Invoice Processing

Delayed invoice approvals and payments can strain vendor relationships and even lead to supply chain disruptions. Outsourcing firms operate with dedicated teams and defined turnaround times, ensuring invoices are processed quickly and efficiently.

Faster processing also allows businesses to take advantage of early payment discounts, which directly improves profitability.

4. Better Cash Flow Management

With real-time AP reporting and improved visibility into outstanding payables, businesses can make smarter cash flow decisions. Outsourcing partners provide regular dashboards and financial insights that help companies:

- Track upcoming payment obligations

- Plan working capital more effectively

- Avoid last-minute cash shortages

In 2026, data-driven decision-making is essential, and outsourced AP services support this with accurate and timely financial information.

5. Access to Advanced Technology

Many small and mid-sized businesses cannot afford to invest in high-end AP automation software. Outsourcing providers already use cloud-based accounting platforms, invoice automation systems, and secure document management tools.

By outsourcing, businesses get access to enterprise-level technology without heavy upfront investment. This improves efficiency while keeping processes modern and scalable.

6. Scalability for Growing Businesses

As a company grows, invoice volumes increase. Hiring and training new staff every time the workload rises is both expensive and time-consuming.

AP process outsourcing offers flexible scalability. Whether invoice volumes double during peak seasons or reduce during slow periods, outsourcing providers can quickly adjust resources to match business needs. This flexibility is a major reason startups and fast-growing companies are switching to outsourced AP models.

7. Stronger Vendor Relationships

Timely and accurate payments build trust with suppliers. When AP processes are delayed or error-prone, vendor relationships suffer.

Outsourced AP teams ensure:

- On-time payments

- Quick resolution of invoice queries

- Proper record-keeping

This leads to better supplier partnerships, improved negotiation power, and smoother business operations overall.

8. Reduced Risk and Better Compliance

Financial fraud and compliance issues are growing concerns in 2026. Professional AP outsourcing firms follow strict internal controls, approval workflows, and audit trails. They also stay updated with changing tax regulations and financial compliance requirements.

This reduces the risk of fraud, duplicate payments, and regulatory penalties — something that many small internal teams struggle to manage alone.

9. More Time for Strategic Work

When internal finance teams are buried in invoice processing, they have little time left for financial planning, forecasting, or business analysis.

By outsourcing AP, companies free up their in-house experts to focus on:

- Budgeting and forecasting

- Financial strategy

- Performance analysis

- Business growth initiatives

This shift from transactional work to strategic finance is a key reason businesses are modernizing their AP operations.

The Future of AP Is Outsourced and Automated

In 2026, businesses are no longer viewing accounts payable as just a back-office function. It is now seen as a strategic process that impacts cash flow, vendor relationships, and overall financial stability.

AP process outsourcing combines skilled professionals, smart technology, and streamlined workflows to deliver efficiency, accuracy, and cost savings. Whether it’s a startup looking to scale or an established company aiming to optimize operations, outsourcing AP is proving to be a smart and future-ready decision.

Final Thoughts

AP process outsourcing is not just a cost-cutting tactic — it’s a move toward smarter financial management. With automation, expert oversight, and scalable support, businesses can eliminate inefficiencies and gain better control over their finances.

That’s exactly why more organizations are making the switch in 2026 — and why AP outsourcing is becoming a core part of modern finance operations.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0