Global Factoring Market Trends 2025-2033: Driving Financial Flexibility for SMEs Worldwide

MARKET OVERVIEW

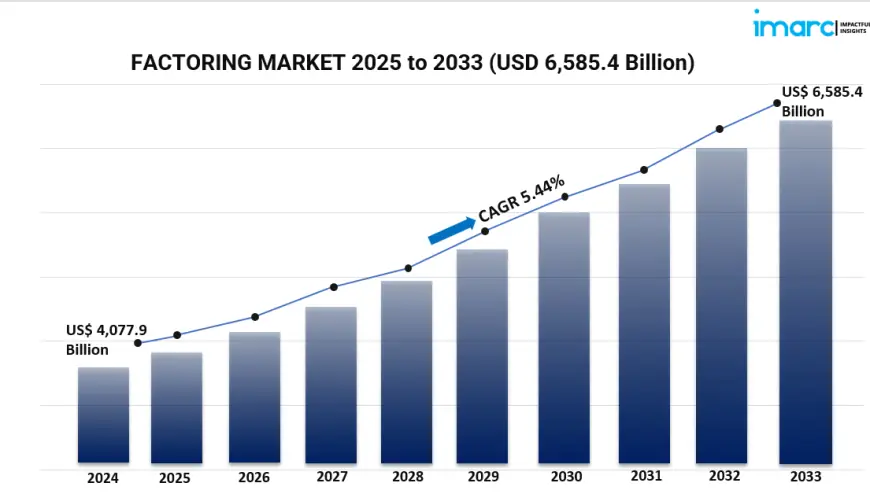

The global factoring market reached approximately USD 4,077.9 billion in 2024 and is projected to surge to USD 6,585.4 billion by 2033, reflecting a solid CAGR of 5.44%. This growth is fueled by increasing demand for alternative financing, heightened global trade, blockchain-enabled transaction security, and regulatory frameworks supporting factoring services—offering businesses faster cash flow and reduced credit risk.

STUDY ASSUMPTION YEARS

-

BASE YEAR: 2024

-

HISTORICAL YEARS: 2019–2024

-

FORECAST YEARS: 2025–2033

FACTORING MARKET KEY TAKEAWAYS

-

The market expanded from USD 4,077.9 billion (2024) to USD 6,585.4 billion (2033) at a 5.44% CAGR.

-

Europe leads regionally, supported by structured regulations and robust trade finance.

-

Domestic factoring holds greater market share than international.

-

Large enterprises dominate usage, but SMEs are rapidly adopting receivables financing.

-

Manufacturing is the leading application segment, driven by working-capital needs.

-

Emerging blockchain and cryptocurrency platforms are enhancing transaction security and speed.

-

Regulatory backing across countries is strengthening market legitimacy and adoption.

Request for a sample copy of this report: https://www.imarcgroup.com/factoring-market/requestsample

MARKET GROWTH FACTORS

1. Alternative Financing & Trade Expansion

Business are turning to factoring to control cash flow and lower credit risk as world trade volumes grow. By turning receivables into instant cash, factoring provides quick liquidity that lets companies finance operations without conventional borrowing. Amid volatile economies, factoring offers dependable access to working capital, hence this is quite priceless. By outsourcing receivables management, businesses may concentrate on core activities and boost scalability and financial ratios.

2. Technological Integration & Blockchain Security

The factoring scene is changing as a result of technological advancement including platforms like blockchain and cryptocurrency. These systems speed up transaction verification, therefore lowering fraud, and allow for clear, safe invoice processing. AI-driven credit risk scoring and digital platforms more simply provide access for companies of all sizes. These developments are drawing a more varied customer base and boosting scalability, efficiency, and trust in factoring services .

3. Regulatory Support & Risk Mitigation

Through favorable legislation and licensing systems, governments and agencies are progressively promoting factoring. Standardized regulations help new market participants to onboard more easily, lower counterparty risk, and improve consumer protection. Combined with rising financial literacy and awareness programs, incentives and compliance guidelines encourage SMEs to use invoice financing. Regulatory support is turning factoring into a conventional, reliable alternative-financing option.

MARKET SEGMENTATION

-

Breakup by Type

-

International factoring: Financing cross-border receivables, reducing foreign trade risk.

-

Domestic factoring: Managing local receivables with faster processing and compliance.

-

Breakup by Organization Size

-

Small and Medium Enterprises: Growing adoption due to easier access, faster liquidity.

-

Large Enterprises: Dominant users leveraging economies of scale and deep financial networks.

-

Breakup by Application

-

Transportation: Helps businesses manage delayed payments due to logistics cycles.

-

Healthcare: Supports billing cycles with extended insurance payment timelines.

-

Construction: Manages long project durations and deferred client payments.

-

Manufacturing: Leads usage due to extended B2B payment terms and working-capital needs.

-

Others: Includes retail, technology, and services requiring receivables financing.

-

Breakup by Region

-

North America (United States, Canada)

-

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

-

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

-

Latin America (Brazil, Mexico, Others)

-

Middle East and Africa

REGIONAL INSIGHTS

Europe commands the largest share of the global factoring market in 2024, propelled by strong trade finance infrastructure, supportive regulations, and digital adoption. High SME penetration and sophisticated bank-fintech collaboration enhance market depth. These factors position Europe for steady expansion through 2033 .

RECENT DEVELOPMENTS & NEWS

Recent trends highlight an increased adoption of blockchain platforms in factoring to automate verification and secure transactions. The rise of fintech-led marketplaces is enabling SMEs to access receivables financing quicker and more transparently. Major financial institutions are forming alliances with fintech firms to digitize invoice processing. These shifts reflect a move toward faster, safer and more accessible factoring—enhancing working-capital solutions for businesses globally ().

KEY PLAYERS

-

Aldermore Bank PLC

-

Banco Santander S.A.

-

BNP Paribas

-

Deutsche Factoring Bank GmbH & Co. KG

-

Eurobank

-

KUKE Finance S.A.

-

Mizuho Factors, Limited

-

RTS Financial Service Inc.

-

SBI Factors Limited

-

Société Générale S.A.

-

The Southern Bank Company Inc.

For deeper segmentation, country-level analysis, or custom data scenarios, feel free to ask our analyst team : https://www.imarcgroup.com/request?type=report&id=2563&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0