Europe Pet Food Market 2025-2033 | Size, Share, Demand, Key Players Analysis and Forecast

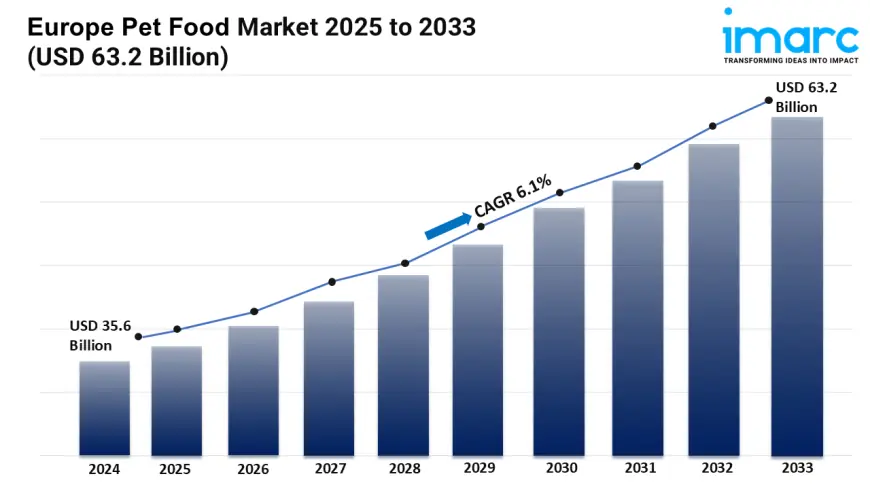

The Europe pet food market size reached USD 35.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 63.2 Billion by 2033, exhibiting a growth rate (CAGR) of 6.1% during 2025-2033.

Europe Pet Food Market Overview

Market Size in 2024: USD 35.6 Billion

Market Forecast in 2033: USD 63.2 Billion

Market Growth Rate: 6.1% (2025-2033)

According to the latest report by IMARC Group, the Europe pet food market size was valued at USD 35.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 63.2 Billion by 2033, exhibiting a CAGR of 6.1% from 2025-2033.

Europe Pet Food Industry Trends and Drivers:

The Europe pet food market is witnessing robust expansion, driven primarily by shifting consumer lifestyles and the rising trend of pet humanization. Increasing pet ownership across diverse demographics is enhancing demand for premium and specialized nutrition options tailored to distinct pet needs. Consumers are prioritizing health-conscious choices, pushing manufacturers to innovate with functional ingredients that support pet wellness, including probiotics, vitamins, and natural additives. This focus on quality nutrition is encouraging the development of plant-derived and animal-derived ingredient blends, ensuring balanced diets that cater to specific dietary sensitivities and preferences. Alongside product innovation, sustainability considerations are gaining prominence, with environmentally friendly sourcing and packaging becoming pivotal factors in consumer decision-making. The expansion of the market is also reinforced by the growing adoption of varied product formats such as dry food, wet and canned variants, as well as snacks and treats, providing pet owners with a broad spectrum of feeding options. This product diversification is responding to the evolving demands of both dogs and cats, the primary pet segments, while also addressing the needs of smaller niche categories within the pet ecosystem. Consequently, these developments are shaping a dynamic market landscape poised for steady growth over the forecast period.

The distribution landscape of the Europe pet food market is undergoing significant transformation, with e-commerce emerging as a dominant channel facilitating convenient access and personalized shopping experiences. Online stores are capitalizing on expanding internet penetration and mobile device usage, offering extensive product assortments and subscription services that boost customer retention. Simultaneously, traditional retail formats such as supermarkets, hypermarkets, and specialty stores maintain relevance by leveraging in-store promotions and loyalty programs to engage consumers. The coexistence of offline and online channels is encouraging omnichannel strategies among key players, optimizing market penetration and ensuring consistent brand visibility across platforms. Regional distribution preferences are also influencing channel growth; Western European countries are witnessing accelerated e-commerce adoption, whereas Southern and Eastern European markets continue to blend conventional retail with digital expansion. Furthermore, premium products are increasingly being marketed through specialty stores that emphasize quality and tailored advice, while mass products dominate supermarkets and hypermarkets. This strategic distribution evolution is underpinning enhanced market accessibility and driving consumer convenience, thus fostering sustained market development throughout Europe.

Geographical factors are playing a critical role in shaping the Europe pet food market’s growth trajectory, with countries like Germany, France, and the United Kingdom leading demand due to mature pet ownership cultures and higher disposable incomes. These regions are prioritizing premiumization and product innovation, supported by robust regulatory frameworks ensuring food safety and quality standards. Meanwhile, Southern and Eastern European countries are emerging as promising markets, benefiting from rising urbanization, increasing pet adoption rates, and expanding retail infrastructures. Consumers in these regions are gradually embracing premium and health-oriented pet food, supported by growing awareness campaigns and education on pet nutrition. Cross-border trade and pan-European collaborations are facilitating efficient supply chains, enhancing product availability and diversity. Additionally, tailored marketing campaigns reflecting regional preferences and pet care traditions are enhancing consumer engagement and loyalty. This regional heterogeneity is fostering a resilient and adaptive market environment, promoting long-term growth opportunities for stakeholders. Collectively, these factors are contributing to a vibrant Europe pet food market, characterized by innovation, accessibility, and increasing consumer sophistication across multiple countries and segments.

Download sample copy of the Report: https://www.imarcgroup.com/europe-pet-food-market/requestsample

Europe Pet Food Industry Segmentation:

The report has segmented the market into the following categories:

Breakup by Pet Type:

- Dog Food

- Cat Food

- Others

Breakup by Product Type:

- Dry Pet Food

- Wet and Canned Pet Food

- Snacks and Treats

Breakup by Pricing Type:

- Mass Products

- Premium Products

Breakup by Ingredient Type:

- Animal Derived

- Plant Derived

Breakup by Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

Breakup by Country:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Europe Pet Food Market News:

- April 30, 2024: General Mills announced the procurement of European pet food brand Edgard & Cooper. This purchase suits the company’s accelerate strategy emphasizing improving their core businesses, global platforms, and domestic brands to advance further in sustainable development and give value to investors. Also, Edgard & Cooper is famous for its organic and eco-friendly method for pet food with projected retail sales of around 100 million euros in 2023 throughout 13 markets.

- April 10, 2024: Nestle announced that it will build a new factory for pet food in Italy. For this, the company will invest 472 million euros in Mantua and is planned to open by 2027.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=9491&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0