Emerging Trends in Specialty Insurance: Risk Coverage, Product Innovation & Growth Forecast

Specialty Insurance Market Overview

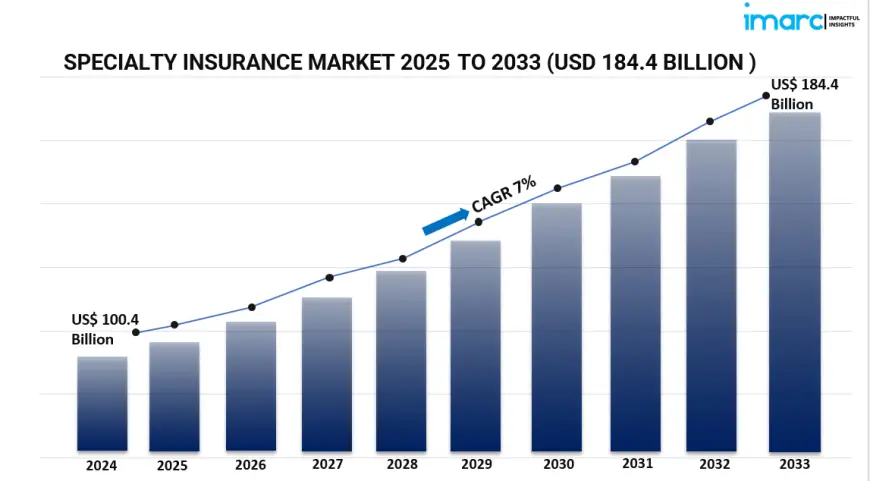

The global specialty insurance market reached a value of USD 100.4 billion in 2024 and is anticipated to climb to USD 184.4 billion by 2033, expanding at a CAGR of 7% over the forecast period (2025–2033). The increasing complexity of industry-specific risks, advancements in healthcare technologies, and growth in both residential and commercial construction are key contributors to market expansion. Specialty insurance provides customized coverage for niche and high-risk areas typically excluded from standard insurance policies, including sectors like marine, aviation, entertainment, and professional liability.

Study Assumption Years

Base Year: 2024

Historical Years: 2019–2024

Forecast Years: 2025–2033

Specialty Insurance Market Key Takeaways

- Market Size & Growth: The market was valued at USD 100.4 billion in 2024 and is projected to reach USD 184.4 billion by 2033, growing at a CAGR of 7% during 2025–2033.

- Dominant Segment: Marine, Aviation, and Transport (MAT) insurance dominates due to high-value assets and greater risk exposure in these domains.

- Distribution Channels: Brokers lead the market by offering expert guidance and tailored insurance options to match unique requirements.

- End Users: Businesses form the primary end-user group, driven by the need for insurance addressing unconventional and complex risks.

- Regional Leader: Europe holds the largest market share, bolstered by strong industrial foundations and advanced regulatory systems.

- Technological Advancements: The integration of AI, machine learning, blockchain, and IoT is revolutionizing risk evaluation and enhancing policy customization.

Request for a sample copy of this report: https://www.imarcgroup.com/specialty-insurance-market/requestsample

Market Growth Factors

1. Technology-Driven Risk Assessment and Innovation

Specialty insurance is changing because of sophisticated technologies like artificial intelligence, machine learning, and blockchain. These tools let more precise risk assessment and bespoke policy creation by means of improved data analysis. To identify possible hazards and spot patterns, artificial intelligence and machine learning are used to examine large datasets. By giving accurate coverage options, blockchain and IoT enable clear and secure transaction systems, which not only simplify activities but also raise consumer happiness.

2. Regulatory Support and Strategic Collaborations

Strong legal systems, especially in Europe, have helped to create a clear and consumer-friendly specialist insurance environment. These rules promote all-encompassing risk reduction strategies and creativity. Moreover, more mergers, acquisitions, and alliances between insurance companies have broadened product lines and stretched geographical reach. Such partnerships let insurers more successfully scale their activities and meet changing client needs.

3. Rising Demand from Emerging Risks

Businesses are exposed to more risks that ordinary insurance plans fail to fully address. Specialty insurance is in demand as a result of new hazards including cyberattacks, climate-related liabilities, and specific professional risks. Higher demand for data breach and cyber liability insurance has followed from, among other things, the increasing incidence of cyberattacks. Because of climate-induced hazards, sectors like agriculture, energy, and real estate are also depending on specialized insurance. Market growth is fueled by rising understanding of the demand for focused protection.

Market Segmentation

By Type

- Marine, Aviation, and Transport (MAT):

- Marine Insurance: Covers damage or loss involving ships, cargo, terminals, and transport systems.

- Aviation Insurance: Provides protection for aircraft-related damages and legal liabilities.

- Political Risk and Credit Insurance: Offers coverage against financial losses stemming from political events like currency inconvertibility, political unrest, or expropriation.

- Entertainment Insurance: Tailored coverage for events such as film productions, live concerts, and media ventures.

- Art Insurance: Protects art collections, galleries, and museums from damage or loss.

- Livestock and Aquaculture Insurance: Offers risk coverage for livestock or aquatic life loss due to disease or mortality.

- Others: Includes various specialized products for distinct, high-risk scenarios.

By Distribution Channel

- Brokers: Insurance intermediaries who connect clients to tailored products from multiple providers.

- Non-Brokers: Direct-selling channels like insurance firms that distribute products without intermediary support.

By End User

- Business: Enterprises requiring insurance solutions for unique operational risks not covered by standard products.

- Individuals: Clients needing niche insurance services for personal assets or high-risk activities, such as art or luxury item protection.

Breakup by Region

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Regional Insights

Europe remains the leading market for specialty insurance, thanks to its well-established industrial base and regulatory emphasis on comprehensive risk management. The region’s proactive approach to adopting modern technologies and developing sophisticated insurance products continues to drive growth and innovation in the sector.

Recent Developments & News

The specialty insurance landscape is evolving with the integration of big data analytics and AI-driven underwriting methods. These technologies improve accuracy in evaluating complex risks and support personalized policy structures. Furthermore, there is an increasing focus on environmental liability insurance, indicating heightened awareness of climate-related exposures. Such developments signal a shift towards more dynamic and customized insurance offerings.

Key Players

- American International Group Inc.

- Assicurazioni Generali S.P.A.

- Axa XL (Axa S.A)

- Hiscox Ltd.

- Manulife Financial Corporation

- Mapfre S.A.

- Munich Reinsurance Company

- Nationwide Mutual Insurance Company

- RenaissanceRe Holdings Ltd.

- Selective Insurance Group Inc.

- The Hanover Insurance Group Inc.

- Zurich Insurance Group Ltd.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=5085&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0