Commercial Property Insurance Market Dynamics: Risk Management and Future Growth Insights

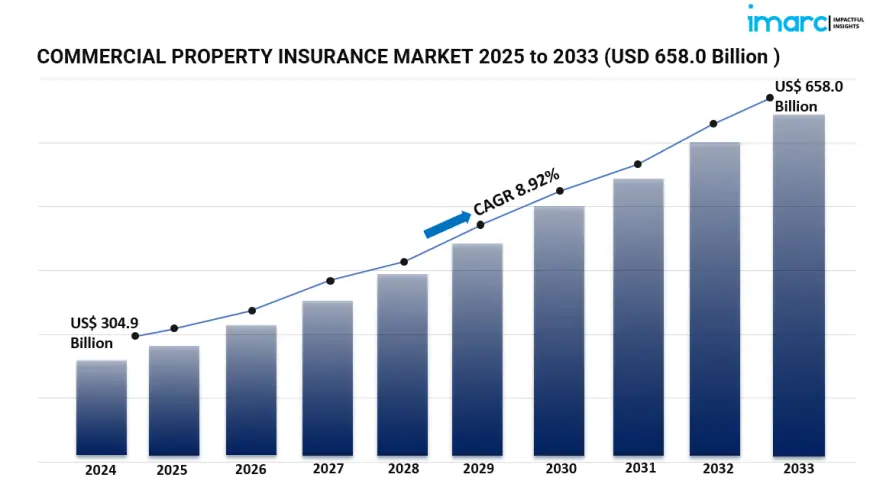

The global commercial property insurance market was valued at USD 304.9 billion in 2024 and is projected to reach USD 658.0 billion by 2033, registering a strong CAGR of 8.92% during 2025-2033. Market growth is being fueled by the rising ownership of commercial properties, the increasing impact of natural disasters, thefts, and frauds, as well as the rapid digitalization of the insurance industry.

Study Assumption Years

-

Base Year: 2024

-

Historical Years: 2019-2024

-

Forecast Years: 2025-2033

Commercial Property Insurance Market Key Takeaways

-

The market will expand from USD 304.9 billion in 2024 to USD 658.0 billion by 2033, advancing at a CAGR of 8.92%.

-

Europe currently leads the industry, supported by its booming real estate sector and the strong presence of major insurers offering comprehensive coverage options.

-

The rising frequency of natural disasters, thefts, and fraud incidents has accelerated demand for robust property insurance solutions.

-

Digital transformation in the insurance sector is improving underwriting, risk assessment, and customer experience, boosting adoption.

-

Growing awareness of risk management is driving SMEs to invest in commercial property insurance to protect business assets.

Request a sample copy of the report here: https://www.imarcgroup.com/commercial-property-insurance-market/requestsample

Market Growth Factors

The expansion of global commercial property ownership is one of the core drivers of market growth. As businesses continue to scale operations and acquire assets, the demand for insurance protection against potential risks increases. This is particularly prominent in industrialized and densely populated regions, where new commercial developments are rapidly emerging.

The higher frequency of natural disasters such as floods and earthquakes, alongside theft and fraud cases, has further emphasized the importance of coverage. Criminal activity targeting businesses has also heightened the need for insurance policies against burglary, robbery, and other perils. As risks escalate, organizations are prioritizing enhanced protection, thereby fueling demand for commercial property insurance.

In addition, the digitalization of the insurance sector has revolutionized risk assessment, underwriting, and policy customization. The adoption of AI-driven platforms and digital interfaces enables insurers to deliver tailored solutions and improve customer engagement. These technological advancements are not only attracting new clients but also ensuring better retention of existing customers, supporting consistent market growth.

Market Segmentation

By Type

-

Buildings Insurance – Coverage for damages to the physical structure of commercial properties.

-

Contents Insurance – Protection for business assets, including equipment and inventory.

-

Flood Insurance – Specialized policies against damages caused by flooding.

-

Earthquake Insurance – Coverage designed to safeguard businesses against earthquake-related losses.

-

Others – Tailored insurance products addressing specific risks.

By Enterprise Size

-

Small and Medium-sized Enterprises (SMEs) – Insurance plans customized for smaller businesses with limited asset portfolios.

-

Large-Scale Enterprises – Comprehensive protection designed for corporations with significant assets.

By Application

-

Open Perils – Policies covering a broad range of risks unless specifically excluded.

-

Named Perils – Policies covering only the risks explicitly mentioned in the contract.

Breakup by Region

-

North America (United States, Canada)

-

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

-

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

-

Latin America (Brazil, Mexico, Others)

-

Middle East and Africa

Regional Insights

Europe remains the leading regional market for commercial property insurance. Growth is supported by an expanding real estate sector and the presence of top-tier insurance providers offering diverse and comprehensive coverage. Businesses in the region are increasingly adopting insurance to safeguard against both natural disasters and financial risks. Additionally, SMEs across Europe are showing greater awareness of risk management, which is strengthening demand for property insurance.

Recent Developments & News

The industry has experienced notable technological integration, with AI and blockchain being increasingly applied to enhance underwriting efficiency and improve fraud detection mechanisms. Insurers are also leveraging digital platforms to streamline policy issuance and claims management, ensuring greater transparency and efficiency for customers. Furthermore, the growing impact of climate change-related risks has encouraged insurers to design innovative coverage solutions tailored to emerging challenges, supporting continued market expansion.

Key Players

-

Aegon Life Insurance Company Limited

-

Allianz SE

-

Aviva plc

-

Axa S.A.

-

Insureon (HUB International Limited)

-

Nationwide Mutual Insurance Company

-

Prudential Financial Inc.

-

State Farm Mutual Automobile Insurance Company

-

The Hartford Financial Services Group Inc.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=5396&flag=C

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0