AP Automation Services and Solutions for Small Business

Discover how AP automation services and accounts payable automation solutions help small businesses streamline workflows and improve financial efficiency.

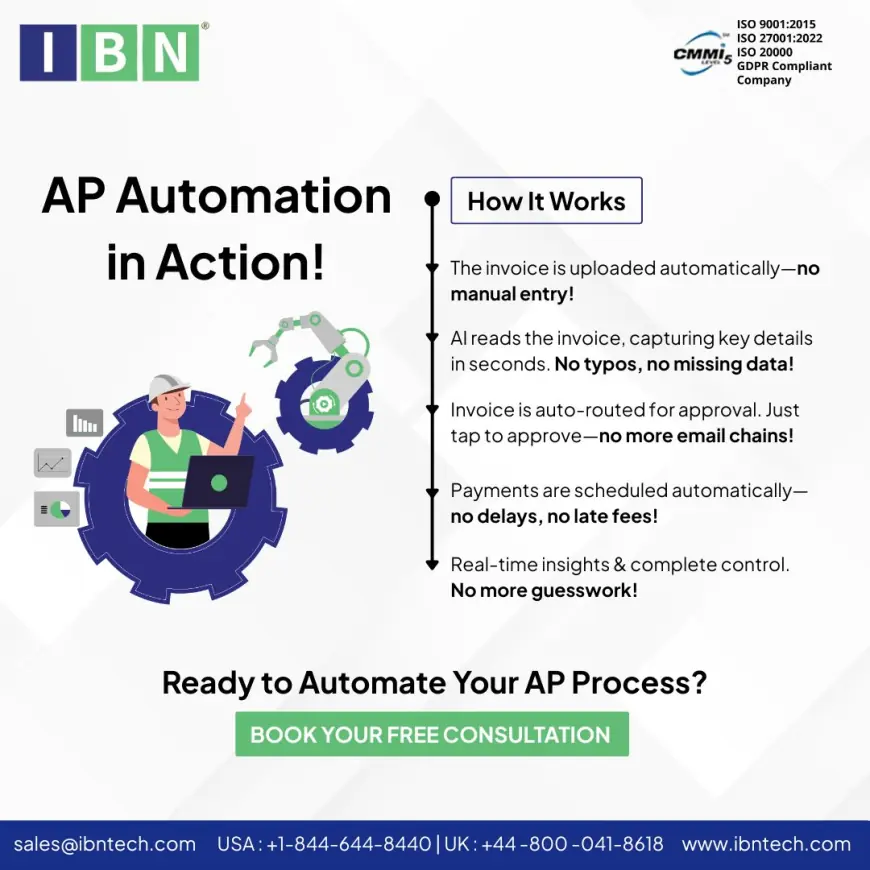

For small businesses, managing finances is often a delicate balancing act. Manual invoice processing, paper-based approvals, and frequent payment delays can consume valuable time and resources. As companies expand, these inefficiencies begin to directly impact vendor relationships and cash flow. To overcome these hurdles, many organizations are turning to AP automation services. These services streamline the accounts payable process by digitizing invoice capture, automating approvals, and enabling faster, more secure payments. For growing companies, the right tools are essential to handle increasing invoice volumes without overwhelming staff. This is where accounts payable automation for small business comes into play, offering tailored solutions to fit budget and scalability needs. By adopting the right accounts payable automation solutions, even small enterprises can gain the financial control, efficiency, and visibility once reserved for larger corporations.

Why Small Businesses Need AP Automation

Unlike large corporations with dedicated finance teams, small businesses often rely on lean teams to manage everything from bookkeeping to payments. This makes automation especially valuable.

Benefits of AP automation services for small businesses:

-

Time Savings: Automates repetitive tasks like data entry and invoice approvals.

-

Accuracy: Reduces human errors that often occur in manual entry.

-

Cost Efficiency: Cuts down processing costs per invoice.

-

Vendor Relationships: Ensures timely payments that strengthen trust.

-

Visibility: Provides real-time insights into cash flow and liabilities.

By eliminating bottlenecks, automation enables small business owners to redirect energy toward growth instead of paperwork.

Accounts Payable Automation for Small Business

Accounts payable automation for small business focuses on affordability, ease of use, and scalability. Small companies need solutions that don’t require heavy IT investment or complex integrations but still deliver meaningful results.

Key features include:

-

Cloud-Based Platforms: Accessible from anywhere, reducing IT costs.

-

Simple Integrations: Connect seamlessly with accounting tools like QuickBooks or Xero.

-

Automated Approvals: Speed up invoice validation and payment processes.

-

Customizable Workflows: Adapt to the unique approval chains of small firms.

By starting with these core features, small businesses can scale their systems as they grow.

Exploring Accounts Payable Automation Solutions

To make the most of automation, companies must evaluate available accounts payable automation solutions and select the right fit.

Considerations when choosing a solution:

-

Scalability: Will the system grow with your business?

-

Ease of Use: Is the interface user-friendly for a small finance team?

-

Cost Structure: Does the pricing model align with a small business budget?

-

Integration Capability: Can it connect with existing ERP or accounting software?

-

Support: Does the vendor offer reliable onboarding and training?

With multiple vendors in the market, selecting the right partner ensures that small businesses see a strong return on investment without overextending resources.

Real-World Impact

Consider a small e-commerce company processing hundreds of vendor invoices monthly. Before automation, invoices were often misplaced, approvals lagged for weeks, and payments incurred late fees. By adopting AP automation services, integrated with an affordable small business platform, the company reduced invoice cycle time by 60%, improved vendor satisfaction, and achieved better visibility into cash flow.

This example shows how accounts payable automation solutions transform financial operations, even at smaller scales.

Best Practices for Small Business AP Automation

To maximize benefits, small businesses should follow a structured approach:

-

Start Simple: Begin with invoice capture and approvals before expanding.

-

Choose Cloud Solutions: Lower costs and provide accessibility for remote teams.

-

Train Staff: Ensure employees are comfortable with the platform.

-

Track Metrics: Monitor invoice cycle time, error rates, and vendor satisfaction.

-

Plan for Growth: Select solutions that can handle future expansion.

The Future of AP Automation for Small Businesses

The future holds exciting possibilities for small businesses embracing automation. Artificial intelligence will bring smarter invoice matching and fraud detection, while mobile-first platforms will allow owners to approve payments on the go. Cloud-based accounts payable automation solutions will continue to level the playing field, giving smaller firms access to enterprise-grade capabilities. For small businesses, adopting automation today is not just about saving time it’s about preparing for long-term resilience and growth.

Conclusion

In an increasingly digital world, small businesses can’t afford to rely on outdated manual processes. AP automation services provide the tools to simplify workflows, save costs, and improve financial accuracy. By choosing the right accounts payable automation for small business, organizations can enjoy efficiency gains and foster stronger vendor partnerships. With modern accounts payable automation solutions, even small enterprises can achieve big results, gaining the agility and visibility needed to thrive in competitive markets.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0