Leveraging AI and Automation in Accounts Payable Management Services for US Firms

accounts payable management services. With the rise of artificial intelligence (AI) and automation, companies are no longer limited to manual, time-consuming processes

In 2025, U.S. businesses are facing increasing pressure to manage costs, improve accuracy, and streamline financial operations. One area that has seen a major transformation is accounts payable management services. With the rise of artificial intelligence (AI) and automation, companies are no longer limited to manual, time-consuming processes. Instead, they are harnessing intelligent technologies that enhance efficiency, strengthen compliance, and provide real-time insights into financial data. But what exactly does AI mean for accounts payable (AP), and why should U.S. firms pay attention? Let’s explore how AI-driven automation is reshaping accounts payable management services and why it has become a game-changer for modern enterprises.

Why Accounts Payable Needs AI and Automation

Traditionally, AP processes have been manual and paper-heavy. From invoice collection and data entry to matching purchase orders and handling approvals, the workflow has often been slow and error-prone. This inefficiency leads to:

-

Missed payment deadlines and late fees

-

Inaccurate reporting due to human error

-

Fraud risks from lack of oversight

-

Limited visibility into cash flow

By integrating AI and automation into accounts payable management services, businesses can overcome these challenges. Intelligent systems not only speed up invoice processing but also learn from historical data to identify anomalies, detect fraud, and optimize payment cycles.

Key Benefits of AI-Driven Accounts Payable Management Services

1. Faster Invoice Processing

AI-powered AP automation eliminates the need for manual data entry. Optical character recognition (OCR) and machine learning extract key details from invoices instantly, reducing processing time from days to just hours or even minutes.

2. Enhanced Accuracy and Reduced Errors

Human error is one of the biggest challenges in AP. Automated systems validate data, cross-check invoices with purchase orders, and flag discrepancies automatically. This ensures accuracy and reduces costly mistakes.

3. Fraud Detection and Compliance

AI can analyze transaction patterns to spot unusual activities. This proactive monitoring strengthens compliance with U.S. regulations, reduces fraud risks, and helps businesses maintain secure, transparent financial practices.

4. Cost Savings and Better Vendor Relationships

Automation reduces labor costs while ensuring suppliers are paid on time. This builds stronger vendor relationships and opens the door to early-payment discounts.

5. Real-Time Cash Flow Insights

AI provides dynamic dashboards and reports, giving CFOs and finance teams instant access to financial data. Real-time visibility into accounts payable improves decision-making and strengthens cash flow management.

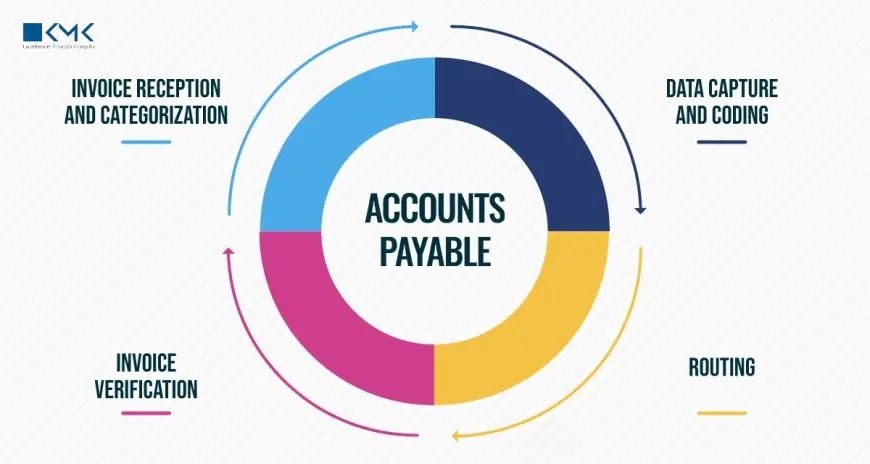

How AI and Automation Transform AP Processes

Invoice Capture and Data Entry

Instead of manually typing invoice details, AI tools scan, capture, and categorize information automatically. This improves accuracy and accelerates the process.

Automated Matching and Approval Workflows

AI-powered systems automatically match invoices with purchase orders and delivery receipts. Approvals can be routed digitally, with reminders and notifications that prevent bottlenecks.

Predictive Analytics for Smarter Decisions

AI doesn’t just process data—it interprets it. Predictive analytics can suggest the best time to pay suppliers, forecast cash flow needs, and even recommend strategies for improving working capital.

Continuous Improvement Through Machine Learning

Unlike static systems, AI solutions improve over time. The more data they process, the better they become at identifying errors, fraud risks, and opportunities for efficiency.

Why US Firms Are Adopting AI-Powered Accounts Payable

The U.S. business landscape in 2025 is fast-moving and competitive. CFOs and finance leaders are under pressure to balance efficiency with accuracy while navigating regulatory compliance. Accounts payable management services enhanced with AI offer the perfect solution.

Some of the main reasons U.S. firms are adopting AI-driven AP systems include:

-

Scalability – Automation adapts easily as businesses grow, supporting larger transaction volumes without adding headcount.

-

Regulatory compliance – U.S. firms must adhere to strict tax and reporting standards, and AI ensures accurate record-keeping and audit readiness.

-

Cost control – By reducing manual tasks, firms save money and redirect finance teams toward more strategic work.

Practical Steps for US Businesses to Implement AI in AP

If you’re considering upgrading your AP function, here’s a roadmap to get started:

-

Assess current AP workflows – Identify bottlenecks, manual tasks, and areas prone to error.

-

Choose the right provider – Partner with accounts payable management service providers that specialize in AI-powered automation.

-

Integrate with existing systems – Ensure the AP solution integrates seamlessly with ERP and accounting software.

-

Train your team – Help staff adapt by training them to use dashboards, analytics, and automated workflows.

-

Monitor and optimize – Continuously track performance metrics to ensure maximum efficiency and compliance.

Future Outlook: AI as the Standard in Accounts Payable

Looking ahead, AI will no longer be a “nice to have” but a standard in accounts payable management services. From predictive payment strategies to AI-powered auditing, businesses will rely on intelligent automation to stay competitive.

As regulations tighten and competition intensifies, U.S. firms that leverage AI will enjoy stronger financial agility, reduced risks, and more streamlined vendor management. Those that delay adoption may struggle with inefficiencies and compliance issues that put them at a disadvantage.

Final Thoughts

AI and automation are not replacing people in finance—they’re empowering them. By removing repetitive tasks, accounts payable teams can focus on strategy, compliance, and vendor relationships. For U.S. firms, investing in AI-powered accounts payable management services is no longer just about cost savings; it’s about building a smarter, more resilient financial ecosystem. In 2025 and beyond, the companies that embrace intelligent automation will lead the way in efficiency, compliance, and innovation. The question is: is your business ready to leverage AI in accounts payable?

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0