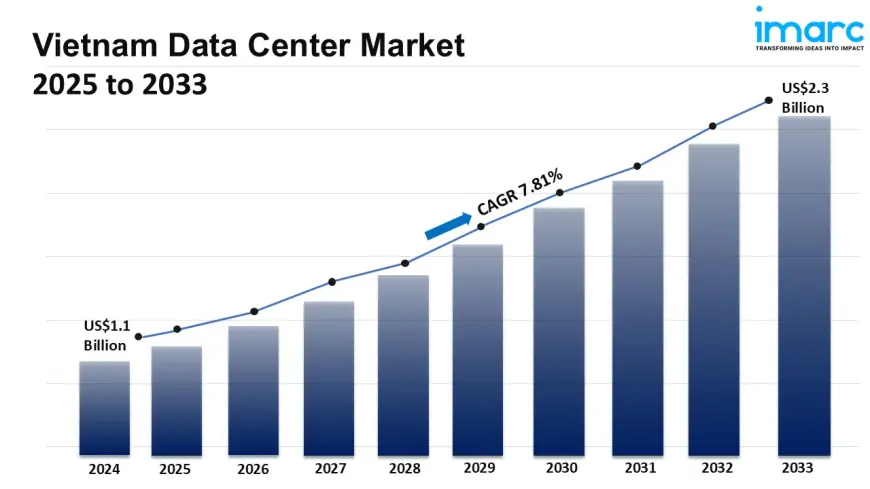

Vietnam Data Center Market Size, Growth, Trends and Forecast 2025-2033

Vietnam data center market size reached USD 1.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.3 Billion by 2033, exhibiting a growth rate (CAGR) of 7.81% during 2025-2033.

Vietnam Data Center Market Overview

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Size in 2024:USD 1.1 Billion

Market Forecast in 2033:USD 2.3 Billion

Market Growth Rate (2025-33): 7.81%

Vietnam data center market size reached USD 1.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.3 Billion by 2033, exhibiting a growth rate (CAGR) of 7.81% during 2025-2033. Increasing internet penetration, rising demand for cloud services, availability of skilled workforce, the implementation of favorable government policies, and rapid urbanization represent some of the key factors driving the market.

For an in-depth analysis, you can refer sample copy of the report: https://www.imarcgroup.com/vietnam-data-center-market/requestsample

Vietnam Data Center Market Trends and Drivers:

The Vietnamese data center market is currently booming, largely thanks to the rapid rise of hyperscale cloud services and the country's fast-growing digital economy. Major global players like AWS, Microsoft Azure, and Google Cloud Platform are making significant strides by setting up local operations and forming partnerships to grab a piece of the pie as businesses undergo their digital transformations. This growth is further fueled by hefty investments in local tech companies, the rise of Over-The-Top (OTT) media services, and the increasing complexity of e-commerce platforms that demand strong, low-latency infrastructure. The government's strong commitment to building a digital society, highlighted by initiatives like the National Digital Transformation Program and the early stages of AI strategy development, is creating a thriving environment that needs a lot of computational power and storage. At the same time, strict data sovereignty laws, particularly the Personal Data Protection Decree (PDPD), are pushing both multinational corporations and local businesses to keep their data processing and storage within Vietnam, which is driving the demand for high-capacity, carrier-neutral facilities that can support hyperscale operations. All these factors together ensure that the demand for wholesale and hyperscale colocation will continue to grow at a rapid pace.

Vietnam's data center scene is really evolving, marked by major upgrades in infrastructure and a smart shift towards diversifying locations beyond the usual hotspots. While Ho Chi Minh City (HCMC) still holds the crown as the main hub, Hanoi is quickly catching up, thanks to government support and better connectivity. What's exciting is that secondary markets like Da Nang are stepping into the spotlight, fueled by investments in new submarine cable landings—think APG and AAE-1 cables—that boost international bandwidth. Plus, there’s a stronger domestic fiber backbone and the creation of specialized industrial parks with improved power setups tailored for critical operations. Existing players are stepping up their game by modernizing older facilities to handle higher power densities (often over 10kW per rack), adopting advanced cooling methods (liquid cooling is on the rise), and enhancing physical security to meet the Tier III and IV standards that hyperscalers and enterprises expect. At the same time, a fresh wave of purpose-built, carrier-neutral facilities is hitting the market, backed by significant investments from international data center experts, local telecom powerhouses like Viettel, VNPT, and FPT, as well as real estate developers. This surge is not only boosting the total available IT capacity but also ramping up competition and improving service quality across the nation.

Sustainability has quickly moved from being a minor issue to a fundamental part of strategy that influences investment, design, and operations in Vietnam's data center industry. With the dual challenges of skyrocketing energy use due to rapid digitalization and growing demands from global clients and regulators for environmental accountability, operators are stepping up to incorporate green solutions. This means taking a comprehensive approach: actively working on optimizing Power Usage Effectiveness (PUE) through innovative cooling methods like free cooling, evaporative systems, and liquid cooling, as well as securing renewable energy on a large scale through Power Purchase Agreements (PPAs) that tap into Vietnam's abundant solar and wind resources, and generating renewable energy on-site whenever possible. Energy resilience is also crucial, prompting investments in advanced backup power systems, including efficient UPS technologies, large-scale battery energy storage systems (BESS), and the exploration of alternative fuels such as hydrotreated vegetable oil (HVO) for generators. Additionally, meeting international sustainability certifications like LEED and ISO 50001 is becoming a significant factor in attracting hyperscalers committed to net-zero goals. This proactive approach is not just a reaction to current pressures; it’s increasingly seen as vital for managing long-term operational costs, reducing regulatory risks tied to carbon emissions and energy efficiency, and keeping the market appealing for ongoing international investment in a world that prioritizes ESG considerations.

Vietnam Data Center Market Industry Segmentation:

Data Center Size Insights:

- Large

- Massive

- Medium

- Mega

- Small

Tier Type Insights:

- Tier 1 and 2

- Tier 3

- Tier 4

Absorption Insights:

- Non-Utilized

- Utilized

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Ask Our Expert & Browse Full Report with TOC & List of Figure: https://www.imarcgroup.com/request?type=report&id=16707&flag=C

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0