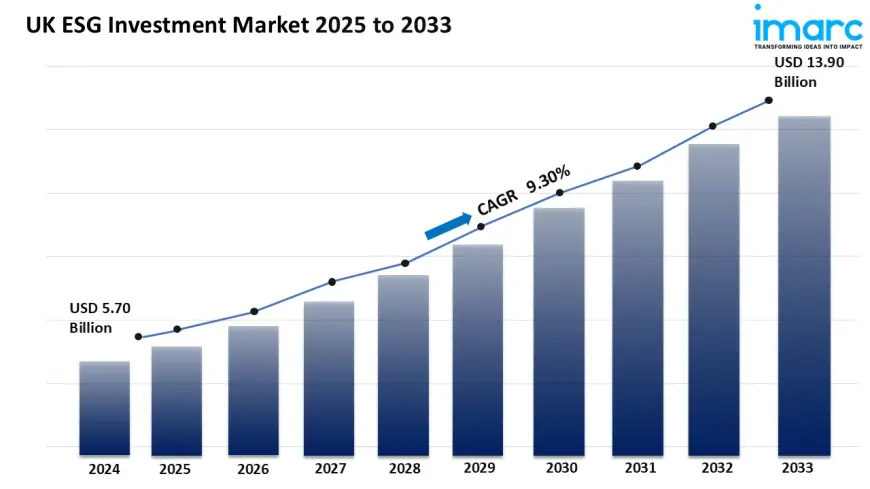

Future Outlook: UK ESG Investment Market Size, Share & Growth Drivers 2025-2033

According to the latest report by IMARC Group, titled “UK ESG Investment Industry Report: Market Size, Share, 2025–2033”, the report offers a comprehensive analysis of the industry, which comprises insights on the UK ESG investment market size. The report also includes competitor and regional analysis, and contemporary advancements in the market.

The UK ESG investment market size reached USD 5.70 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 13.90 Billion by 2033, exhibiting a growth rate (CAGR) of 9.30% during 2025–2033.

Request Free Sample Report:

https://www.imarcgroup.com/uk-esg-investment-market/requestsample

Rising Regulatory Compliance and Institutional Adoption

The ESG investment market in the UK is being shaped significantly by tightening sustainability regulations and frameworks. Regulatory bodies such as the Financial Conduct Authority (FCA) and initiatives like the UK's Green Finance Strategy are pushing institutional investors to incorporate ESG criteria into their portfolios. Pension funds, insurance firms, and asset managers are aligning their investment approaches with ESG principles to manage long-term risk and enhance returns.

Shift in Consumer Preferences and Corporate Accountability

Modern investors, especially millennials and Gen Z, are demanding transparency and ethical accountability from financial institutions and corporations. There is increasing scrutiny on businesses’ carbon footprints, social responsibility efforts, and governance practices. This trend is prompting a shift toward ESG-compliant funds and sustainability-linked financial products that align with long-term societal and environmental goals.

Integration of Technology and ESG Analytics

Technology is playing a vital role in enabling the growth of ESG investing. Advanced data analytics, artificial intelligence, and ESG ratings are empowering investors with real-time insights into companies' environmental and social performance. Fintech platforms and investment advisory services are incorporating ESG scoring models to help clients build responsible portfolios. This digital transformation is enhancing trust and participation in ESG funds.

Growing Corporate Transparency and Reporting Standards

The increasing adoption of standardized ESG disclosure frameworks, such as the Task Force on Climate-related Financial Disclosures (TCFD) and the Sustainability Accounting Standards Board (SASB), is fostering greater corporate transparency. UK-based companies are progressively embedding ESG reporting into their annual statements, which allows investors to assess sustainability performance more effectively. This trend is encouraging greater investor confidence and capital inflow into ESG-aligned assets.

UK ESG Investment Market Segmentation:

Type Insights:

· ESG Integration

· Impact Investing

· Sustainable Funds

· Green Bonds

· Others

Investor Type Insights:

- Institutional Investors

- Retail Investors

- Corporate Investors

Application Insights:

- Environmental

- Social

- Governance

- Integrated ESG

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

Explore the Full Report with Charts, Table of Contents, and List of Figures:

https://www.imarcgroup.com/uk-esg-investment-market

Key Highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a leading market research and consulting company that provides strategic insights and data-driven solutions. We assist clients in identifying market opportunities, navigating competitive challenges, and achieving sustainable growth.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No: +91-120-433-0800

USA: +1-631-791-1145

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0