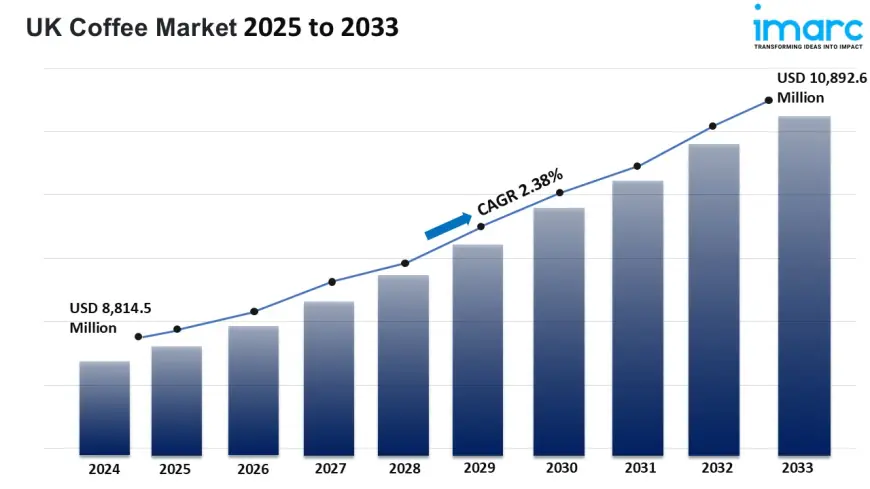

UK Coffee Market Grows at 2.38% CAGR to USD 10.89 Billion

UK Coffee Market Overview

Market Size in 2024: USD 8,814.5 Million

Market Forecast in 2033: USD 10,892.6 Million

Market Growth Rate 2025-2033: 2.38%

The UK coffee market size reached USD 8,814.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 10,892.6 Million by 2033, exhibiting a growth rate (CAGR) of 2.38% during 2025-2033.

UK Coffee Market Trends and Drivers:

The UK coffee market is gaining momentum. Shifts in how people live and a growing love for specialty brews are fueling growth. Urban food services also play a key role. Coffee isn't just for cafés anymore. Many people now drink it on the go. Quick service restaurants (QSRs) and convenience stores help meet this demand. These places are always adding new coffee options. They offer artisanal blends, sustainably sourced beans, and premium drinks. This appeals to the discerning consumers in the UK. More people care about wellness now. They want organic, decaffeinated, and low-acid options. This demand is growing product choices. This trend is boosting both online and offline retail spaces. As a result, new market entrants and established brands have more opportunities.

Consumer preferences are driving market growth. More British coffee drinkers now want premium Arabica, gourmet pods, and cold brew. Advanced brewing tech and personalized vending are making products easier to access. Also, ready-to-drink formats are becoming more popular. At the same time, the retail scene is changing. Supermarkets, hypermarkets, and online stores are now showcasing new coffee products more. This helps brands connect with more customers. More working professionals are changing demand. Also, millennials and Gen Z are shifting their spending habits. Home-brewing culture, boosted by pandemic habits, is still strong. This trend drives sales of ground coffee, whole beans, and brewing gear in the UK.

In the region, England leads in coffee consumption. This is because it has many urban centers and a lot of cafés, coworking spaces, and hospitality chains. Scotland, Wales, and Northern Ireland are keen on specialty formats and sustainable sourcing. This trend is backed by a lively local roasting community and the growth of café culture.

Key drivers of this trend are:

- Rising disposable incomes.

- A shift in consumer focus to experiential beverages.

- The influence of global coffee trends.

Market players are taking advantage of these trends. Not possible to remove the adverb. The UK’s lively retail scene and savvy coffee drinkers are driving steady growth in the market.

UK Coffee Market News

July 2025: Costa Coffee announced a 10% increase in sales, driven by demand for premium coffee beans and innovative drinks, including Nitro Cold Brews and sustainable coffee capsules. The company aims to expand its market share in the ready-to-drink (RTD) coffee sector.

June 2025: The UK Specialty Coffee Association (SCA) reported a 15% increase in specialty coffee consumption from 2024, with a rise in high-quality, ethically sourced beans. Demand for organic and fair-trade coffee surged as more consumers prioritize sustainability.

March 2025: Starbucks launched an expansion initiative to open 100 new stores across the UK by 2027. The brand is tapping into the growing demand for gourmet coffee, focusing on experiential cafes and upscale offerings.

February 2025: A report by Mintel revealed that 42% of UK adults now drink coffee daily, with younger consumers (Gen Z and Millennials) increasingly opting for premium, cold brew, and iced coffee drinks. Coffee chains are adapting to these preferences with new product launches.

January 2025: The UK coffee market was valued at £4.2 billion in 2024, with rapid growth in the RTD segment, which has seen a 19% increase in sales. This growth is driven by convenience, health trends, and innovative flavor options in pre-brewed coffee drinks.

November 2024: Pret A Manger announced a 20% increase in coffee subscriptions in 2024, following a shift towards convenience-driven consumption. The chain now has over 500,000 coffee subscribers in the UK.

For an in-depth analysis, you can refer sample copy of the report:

https://www.imarcgroup.com/uk-coffee-market/requestsample

UK Coffee Market Industry Segmentation:

Source Insights:

- Arabica

- Robusta

Type Insights:

- Instant Coffee

- Ground Coffee

- Whole Bean

- Others

Process Insights:

- Caffeinated

- Decaffeinated

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Ask Our Expert & Browse Full Report with TOC & List of Figure:

https://www.imarcgroup.com/request?type=report&id=24932&flag=C

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Browser our other report

United Kingdom Office Furniture Market Size, Share

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0