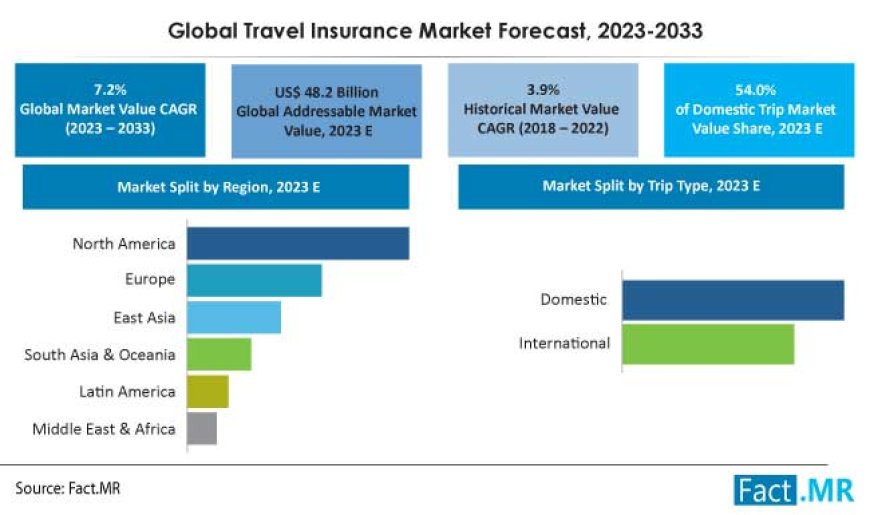

Travel Insurance Market is Anticipated to Rise at a CAGR of 7.2% during the forecast period 2023–2033

The global travel insurance market is valued at US$ 48.2 billion in 2023 and is expected to reach US$ 96.6 billion by 2033, growing at a rapid CAGR of 7.2% over the next decade.

In 2022, the global insurance market was valued at US$ 5 trillion and is anticipated to double its value within the next ten years. Key drivers of this expansion include digital transformation, a growing emphasis on personalized premiums, and the integration of advanced technologies such as Artificial Intelligence (AI), the Internet of Things (IoT), and automation.

Download Sample Copy of This Report@ https://www.factmr.com/connectus/sample?flag=S&rep_id=8102

The demand for travel insurance is closely tied to the travel industry’s performance. Travel insurance companies cover various travel-related risks, including the loss of passports, baggage, and money. They also offer coverage for customer-canceled bookings. Additionally, these companies provide essential services such as assisting customers with insurance claims and locating hospitals during emergencies.

To enhance current travel insurance platforms, service providers are adopting cutting-edge technologies such as artificial intelligence (AI), data analytics, and machine learning with GPS. These advancements are leading to significant profit generation. To meet client expectations and improve their services, many travel insurance companies are also strengthening their partnerships with insurers. These upgrades aim to enhance the overall customer experience.

Additionally, market players are integrating Blockchain technology to streamline the claims process. Blockchain will automate touchpoints from the First Notice of Loss/First Notification of Loss to claim payments, facilitating hassle-free claims processing and improved client engagement. This integration is expected to drive market expansion during the forecast period.

Country-wise Insights

United States to Hold Leading Share of Global Market

The travel insurance market in the United States is highly fragmented, driven by a substantial volume of business travel. The high demand for travel-related insurance services in the country results from this business travel activity. U.S. travel insurance companies offer comprehensive coverage, including protection against luggage loss, medical emergencies, natural calamities, and other business travel-related risks.

Looking for A customization report click here@ https://www.factmr.com/connectus/sample?flag=RC&rep_id=8102

Competitive Landscape

Key players in the travel insurance market include Allianz Travel Insurance, Travelex Insurance Services, World Nomads Travel Insurance, Tata AIG General Insurance, Seven Corners, HTH Travel Insurance, Generali Global Assistance, IMG Travel Insurance, AXA Assistance USA, Berkshire Hathaway Travel Protection, Nationwide Insurance, Aviva, AA Travel Insurance, Staysure, Virgin Money Travel Insurance, Cover For You, and Flexicover Travel Insurance.

The market is highly fragmented, featuring a mix of established companies and many new entrants. Increased awareness about travel insurance and the ease of accessing these services online are contributing to a highly competitive environment.

Segmentation of Travel insurance Industry Survey

By Coverage Type :

Single Trip

Annual/Multiple Trip

By Trip Type :

Domestic

International

By End-use Application :

Individual

Group

By Region :

North America

Latin America

Europe

East Asia

South Asia & Oceania

Middle East & Africa

swatichaudhari

swatichaudhari