Rising Need for Compliance and Efficiency Fuels Contract Lifecycle Management Software Market

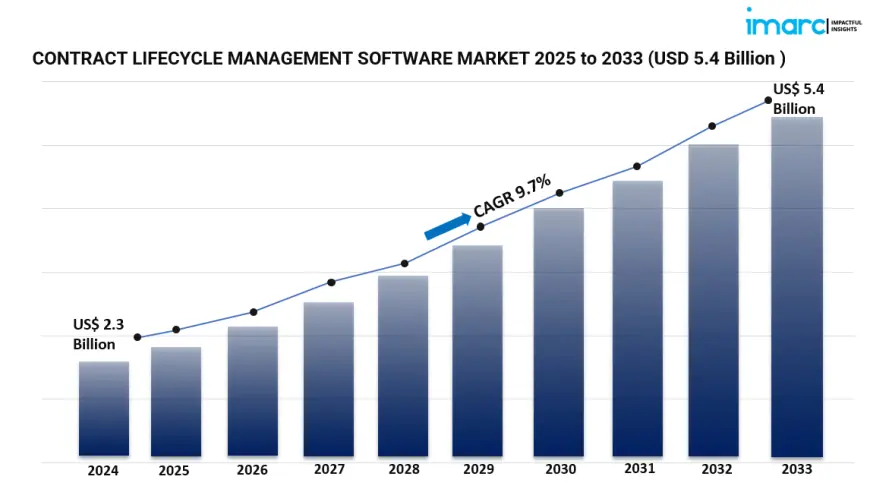

The global contract lifecycle management software market is poised for significant growth, with projections indicating an increase from USD 2.3 billion in 2024 to USD 5.4 billion by 2033, reflecting a compound annual growth rate (CAGR) of 9.7% during 2025-2033. This expansion is driven by the escalating complexity of contracts involving multiple stakeholders and variables, coupled with a growing emphasis on streamlining contract-related tasks to enhance productivity and reduce costs. The integration of advanced technologies like artificial intelligence (AI) and machine learning (ML) into CLM software is further facilitating market growth by automating contract analysis and improving decision-making processes.

Study Assumption Years

-

Base Year: 2024

-

Historical Years: 2019-2024

-

Forecast Years: 2025-2033

Contract Lifecycle Management Software Market Key Takeaways

-

Market Size and Growth: The CLM software market reached USD 2.3 billion in 2024 and is expected to grow to USD 5.4 billion by 2033, exhibiting a CAGR of 9.7% during 2025-2033.

-

Deployment Model: Cloud-based solutions dominate the market, offering improved flexibility, scalability, and accessibility, particularly favored by small and medium-sized enterprises (SMEs).

-

CLM Offerings: Licensing and subscription models hold the largest market share, providing legal permissions and regular payments for software access, promoting transparency and accountability in contractual relationships.

-

Enterprise Size: Large enterprises represent the leading market segment, requiring advanced and feature-rich CLM solutions to manage high volumes of complex contracts and compliance requirements.

-

Industry Application: The manufacturing industry exhibits a clear dominance in the market, leveraging CLM software to manage supplier contracts, track compliance, and optimize procurement processes.

-

Regional Performance: North America leads the market, driven by a robust regulatory environment and the presence of large enterprises requiring advanced CLM solutions.

Request for a sample copy of this report: https://www.imarcgroup.com/contract-lifecycle-management-software-market/requestsample

Market Growth Factors

1. Technological Advancements in CLM Software

The inclusion of technologies like artificial intelligence (AI) and machine learning (ML) into the solutions will greatly affect the development of all CLM software. Thanks to artificial intelligence and machine learning, systems like contract drafting, review, and authorization are now more and more automated, therefore increasing accuracy and efficiency. Moreover, natural language processing improves the ability of the program to understand contract documents and extract the necessary crucial information, therefore lowering manual intervention. For instance, Conga debuted a new AI-enabled CLM solution built on the Conga Platform in June 2024 that may communicate with any CRM, ERP, or purchasing platform after incorporating artificial intelligence capabilities into CLM items. With the aim of lowering supplier cost by means of decreasing contract formation-to-closure cycle time and therefore minimizing risk, this new function helps to provide possibilities for market expansion.

2. Regulatory Compliance and Risk Mitigation

Two elements driving the market are increased complexity of contracts resulting from legislative changes and a greater emphasis on lowering the legal risk. To more effectively manage the ever-increasing regulatory demands and compliance responsibilities, groups utilize CLM tools. Automating some contract management operations with the CLM software reduces bureaucratic chores and quickens contract cycles, therefore improving the general efficiency of these goods and enables businesses to concentrate on strategic initiatives.

3. Rise in Adoption of Cloud-Based Solutions

The growth of the CLM software-Mart is driven by the expanding acceptance of cloud networking capability. Cloud CLM solutions enable businesses to assess their financial impact more easily by providing a subscription or pay-as-you-go service with little-to-none upfront expense. This means that smaller companies, which may lack funds for humorous maintenance of on-premises systems, may readily get CLM solutions. Apart from this, cloud solutions are well known for their scalability and availability, allowing companies to manage contracts from anywhere online.

Market Segmentation

Breakup by Deployment Model:

-

Cloud-Based: Offers improved flexibility, scalability, and accessibility from anywhere with an internet connection, increasingly adopted by SMEs for cost-effective, subscription-based models.

-

On-Premises: Provides organizations with complete control over their CLM systems, preferred by enterprises with stringent data security and compliance requirements.

Breakup by CLM Offerings:

-

Licensing and Subscription: Involves legal permissions granted to use software or services, with regular payments for access, ensuring efficient management of licensing and subscription agreements.

-

Services: Encompasses additional support services related to CLM software, including implementation, training, and maintenance, aiding organizations in optimizing their contract management processes.

Breakup by Enterprise Size:

-

Large Enterprise: Characterized by significant resources and extensive operations, requiring advanced CLM solutions to manage high volumes of complex contracts and compliance requirements.

-

Small and Medium Enterprise: Smaller organizations seeking cost-effective, scalable CLM solutions to streamline contract management without substantial upfront investments.

Breakup by Industry:

-

Automotive: Utilizes CLM software to manage supplier contracts, track compliance, and optimize procurement processes in a complex supply chain environment.

-

Electrical and Electronics: Employs CLM solutions to handle intricate contracts and ensure compliance with industry-specific regulations.

-

Pharmaceutical: Adopts CLM software to manage contracts related to research, development, and distribution while maintaining regulatory compliance.

-

Retail and E-Commerce: Leverages CLM solutions to manage supplier agreements, track product lifecycles, and optimize logistics operations.

-

Manufacturing: Rapidly adopts CLM software to manage complex supply chains, supplier contracts, and procurement needs.

-

BFSI: Implements CLM solutions to manage a vast array of contracts, ensuring compliance with financial regulations and mitigating risks.

-

Others: Includes various industries utilizing CLM software to streamline contract management processes and enhance operational efficiency.

Breakup by Region:

-

North America (United States, Canada)

-

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

-

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

-

Latin America (Brazil, Mexico, Others)

-

Middle East and Africa

Regional Insights:

North America currently dominates the contract lifecycle management software market, supported by the presence of major enterprises and a strong focus on digital transformation and compliance. The region’s well-established IT infrastructure, coupled with early adoption of cloud-based and AI-powered solutions, continues to propel demand. Moreover, regulatory complexity in sectors like BFSI and pharmaceuticals further boosts the necessity for advanced CLM solutions across the region.

Recent Developments & News:

A notable trend in the CLM software space is the integration of AI to enhance operational efficiency. For instance, in June 2024, Conga launched a new CLM solution embedded with AI functionalities on the Conga Platform. This innovation enables faster contract lifecycle completion, reduces supplier costs, and minimizes risk. Additionally, it supports seamless integration with popular CRM, ERP, and procurement systems. This development represents a broader market shift toward intelligent contract management, further accelerating digital transformation across industries.

Key Players:

-

Wolters Kluwer N.V.

-

IBM Corporation

-

Icertis, Inc.

-

SAP SE

-

BravoSolution SPA

-

Contracked BV

-

Contract Logix, LLC

-

Coupa Software Inc

-

EASY SOFTWARE AG

-

ESM Solutions Corporation

-

Great Minds Software, Inc.

-

Koch Industries, Inc.

-

Ivalua Inc

-

Optimus BT

-

Oracle Corporation

-

Symfact AG

-

DocuSign, Inc

-

Newgen Software Technologies Limited

-

Zycus Infotech Private Limited

-

Corcentric LLC (Determine)

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=1177&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0