How Cloud Accounting Migration Can Transform Your US Business Finances

migrating to cloud accounting has become more than a trend; it’s a strategic necessity. From real-time access to financial data to streamlined compliance, cloud migration offers transformative benefits that traditional accounting systems cannot match.

In today’s digital-first economy, financial management is no longer just about keeping records—it’s about making smarter decisions faster. For small and medium-sized enterprises (SMEs) in the United States, migrating to cloud accounting has become more than a trend; it’s a strategic necessity. From real-time access to financial data to streamlined compliance, cloud migration offers transformative benefits that traditional accounting systems cannot match. So, how exactly can cloud accounting migration reshape your business finances? Let’s explore this step by step.

Why US Businesses Are Moving to the Cloud

If you’re wondering why so many American SMEs are migrating to cloud accounting, consider the challenges businesses face today:

-

Manual processes slow down decision-making.

-

On-premises software comes with heavy maintenance costs.

-

Financial data is scattered across spreadsheets and disconnected systems.

-

Security risks rise when relying on outdated tools.

Cloud-based accounting solves these issues by providing:

-

Accessibility: Work from anywhere with internet access.

-

Scalability: Adjust easily as your business grows.

-

Security: Enterprise-grade encryption and backups.

-

Integration: Seamless syncing with CRM, payroll, and other tools.

In short, migrating to the cloud helps US businesses become more agile, cost-efficient, and data-driven.

The Business Case for Migrating to Cloud Accounting

Still debating if it’s the right move? Here’s what cloud accounting can do for your finances:

-

Real-Time Financial Insights

With cloud platforms, financial reports update instantly. Instead of waiting for month-end closes, CFOs and managers can make informed decisions on cash flow, budgets, and forecasts in real-time. -

Cost Reduction

Migrating to cloud accounting reduces hardware expenses, IT maintenance costs, and license renewal headaches. Most providers work on a subscription basis, so you only pay for what you use. -

Improved Collaboration

Teams, accountants, and external auditors can access the same data simultaneously, eliminating version-control issues and delays. -

Stronger Compliance and Security

US businesses must comply with federal and state tax regulations. Cloud solutions automate updates and reduce compliance risks, while advanced encryption ensures sensitive data stays protected.

Step-by-Step Path to Cloud Migration

Migrating to cloud accounting might sound complicated, but with the right approach, it’s manageable. Here’s a roadmap for US SMEs:

1. Evaluate Your Needs

-

Identify your current pain points (manual entries, outdated software, limited reporting).

-

Decide what features you need—multi-user access, integration with e-commerce, automated reporting, etc.

2. Choose the Right Cloud Platform

Popular choices in the US include QuickBooks Online, Xero, and NetSuite. Each caters to different business sizes and needs, so evaluate based on scalability, budget, and integrations.

3. Prepare Data for Migration

-

Clean your financial records to avoid transferring errors.

-

Standardize chart of accounts and reconcile old transactions.

4. Work with an Expert (Optional but Recommended)

Many US SMEs partner with accounting firms or IT consultants specializing in migrating to cloud accounting. This reduces risks and ensures smooth data transfer.

5. Test and Train

-

Run trial migrations to check accuracy.

-

Train staff to use dashboards, reports, and integrations effectively.

6. Go Live and Monitor

After full migration, monitor workflows and optimize settings to ensure maximum efficiency.

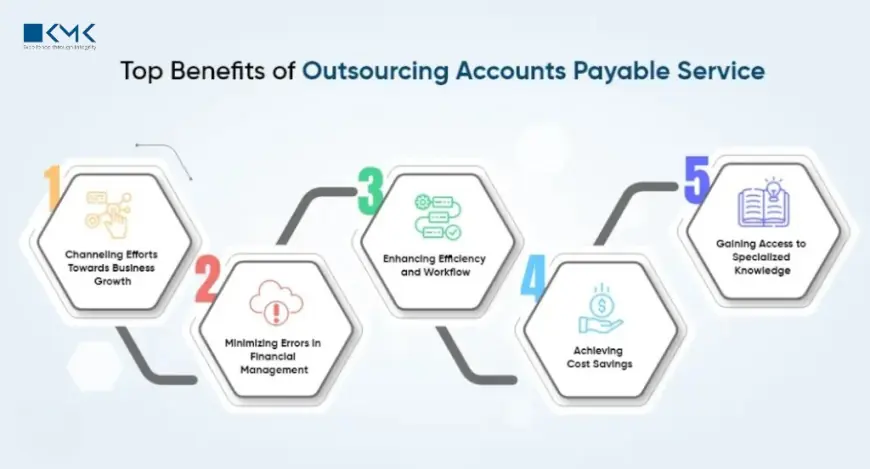

Key Benefits for US SMEs After Migration

Once the migration is complete, the transformation is evident. Businesses report improvements such as:

-

Faster Month-End Closes: Tasks that once took weeks can now be completed in hours.

-

Smarter Cash Flow Management: Automated alerts for overdue invoices and better tracking of vendor payments.

-

Data-Driven Growth: With predictive analytics and forecasting, SMEs can plan expansion confidently.

-

Remote Work Compatibility: Essential in today’s hybrid work culture.

Common Concerns About Cloud Accounting Migration

“What if my data gets lost?”

Cloud vendors use regular backups and disaster recovery systems. In many cases, your data is safer in the cloud than on local servers.

“Is cloud accounting too expensive?”

While there are subscription fees, the reduction in IT overhead, compliance penalties, and inefficiency often offsets the cost.

“Will my team struggle to adapt?”

Modern platforms are designed to be intuitive. With training, employees usually adapt quickly, and many even prefer cloud-based systems for their simplicity.

Future of Business Finance in the Cloud

The US market for cloud-based financial solutions is expected to grow exponentially. For SMEs, migrating to cloud accounting means future-proofing operations. As AI and automation continue to integrate into these platforms, tasks like invoice processing, tax calculations, and financial forecasting will become even more streamlined. Businesses that act now will gain a competitive advantage in efficiency, compliance, and financial strategy.

Final Thoughts

For US SMEs, the question isn’t whether to move to the cloud but how soon. By migrating to cloud accounting, you not only modernize your finance function but also unlock new opportunities for growth, efficiency, and profitability. Cloud migration is no longer just a technical upgrade—it’s a financial transformation. And for American businesses aiming to stay competitive, now is the right time to make the switch.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0