Latin America Digital Banking Market Outlook 2025-2033

According to the latest report by IMARC Group, titled “Latin America Digital Banking Market: Key Players, Growth Drivers & Forecast 2025-2033”, the report offers a comprehensive analysis of the industry, which comprises insights on the Latin America digital banking market size. The report also includes competitor and regional analysis, and contemporary advancements in the market.

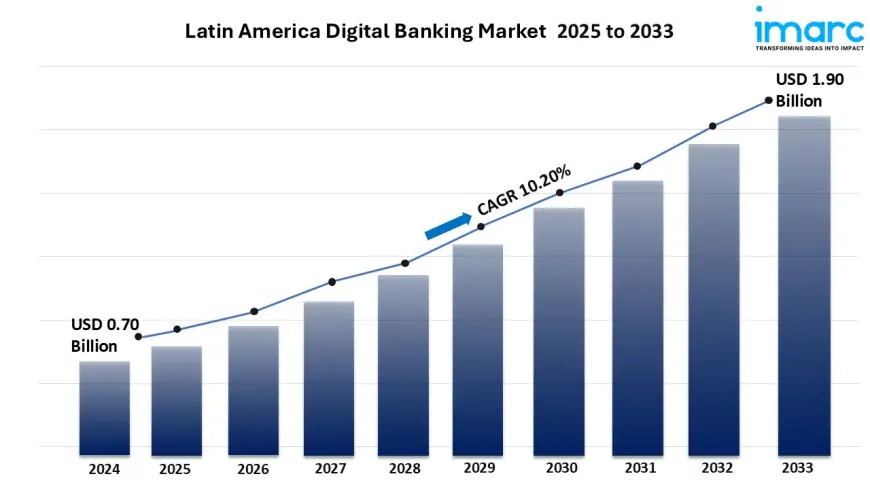

The Latin America digital banking market size was valued at USD 0.70 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 1.90 Billion by 2033, exhibiting a growth rate (CAGR) of 10.20% during 2025-2033.

Request Free Sample Report:

https://www.imarcgroup.com/latin-america-digital-banking-market/requestsample

Rising Digital Adoption and Financial Inclusion Efforts

-

Expansion of mobile internet and digital infrastructure is boosting digital banking adoption across Latin America.

-

Consumers increasingly rely on:

-

Mobile apps

-

Online platforms for transactions, bill payments, and finance management

-

-

Banks are responding by:

-

Digitizing operations

-

Launching user-friendly apps

-

Integrating AI-driven personalization

-

-

Push for financial inclusion in rural/semi-urban areas spurs:

-

Digital payment innovation

-

Remote onboarding processes

-

Fintech Ecosystem Growth and Open Banking Adoption

-

Latin America’s fintech ecosystem is accelerating digital banking growth.

-

Brazil and Mexico lead in:

-

Digital wallets

-

Neobanks

-

Crypto-linked accounts

-

-

Open banking regulations support:

-

Data sharing between institutions

-

Personalized financial products

-

-

Digital-only banks and non-traditional players are gaining market share by offering:

-

Low-cost, tech-savvy services

-

Security Enhancements and Cloud-Based Banking Solutions

-

Rising cybersecurity concerns drive investment in:

-

Biometric authentication

-

Encryption

-

AI-powered fraud detection

-

-

Cloud-based banking is enabling:

-

Scalable infrastructure

-

Lower IT costs

-

Improved service availability

-

-

Digital-first operations enhance:

-

Customer satisfaction

-

Operational efficiency

-

Competitive pricing

-

Market Segmentation:

Services Insights:

- Non-Transactional Activities

- Information Security

- Risk Management

- Financial Planning

- Stock Advisory

- Transactional

- Cash Deposits and Withdrawals

- Fund Transfers

- Auto-Debit/Auto-Credit Services

- Loans

Deployment Type Insights:

· On-Premises

· On Cloud

Application Insights:

- Sales and Marketing

- Broadcast and Publishing

- Others

Technology Insights:

- Internet Banking

- Digital Payments

- Mobile Banking

Industries Insights:

- Media & Entertainment

- Manufacturing

- Retail

- Banking

- Healthcare

Regional Insights:

- Brazil

- Mexico

- Argentina

- Columbia

- Chile

- Peru

- Others

Explore the Full Report with Charts, Table of Contents, and List of Figures:

https://www.imarcgroup.com/latin-america-digital-banking-market

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a leading market research and consulting company that offers management strategy and market research worldwide. The company assists clients in entering and expanding into new markets by providing business strategies, product feasibility, and competitive benchmarking.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No: +91-120-433-0800

USA: +1-631-791-1145

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0