India Adhesives and Sealants Market Share, Trends, Growth and Outlook 2025–2033

Adhesives and Sealants Market - India

Market Statistics

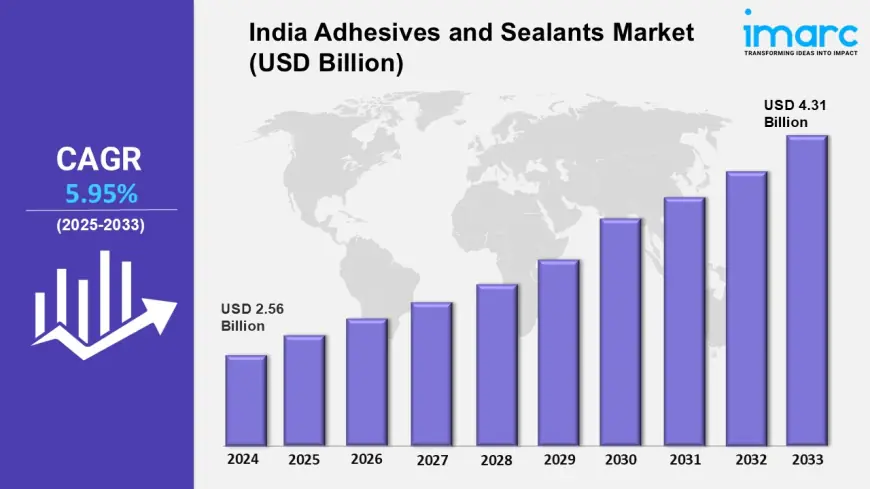

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Size in 2024: USD 2.56 Billion

Market Size in 2033: USD 4.31 Billion

Market Growth Rate (CAGR) 2025-2033: 5.95%

According to IMARC Group's report titled "India Adhesives and Sealants Market Report and Forecast 2025-2033," the market reached USD 2.56 billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.31 billion by 2033, exhibiting a growth rate (CAGR) of 5.95% during 2025-2033.

Download sample copy of the Report: https://www.imarcgroup.com/india-adhesives-and-sealants-market/requestsample

India Adhesives and Sealants Market Trends and Drivers:

- India adhesive and sealants market is also experiencing high growth, driven by the rapid industrialization pace, urban infrastructure expansion, and growing emphasis on light yet tough materials in end-use applications.

-

In essence, growth across the automotive, construction, packaging, and electronics sectors is driving overall demand for high-performance bonding products that are tough and flexible.

-

Moreover, with the shifting automobile market towards electric vehicles and light-weight automobile components, manufacturers are opting more and more for structural adhesives rather than traditional mechanical fasteners to optimize fuel efficiency and crash resistance.

-

Also, the widespread e-commerce sector is propelling the application for security and value packs, thereby spurring the higher use of hot-melt and pressure-sensitive adhesives.

-

Apart from that, growing applications of green building and energy-efficient building are favoring use of sealants in insulation, waterproofing, and joint sealing.

-

Apart from that, growth in real estate and infrastructural developments under government initiatives like Smart Cities Mission and Housing for All is also further boosting demand for adhesives and sealants in construction, especially in tiling, flooring, and plumbing applications.

-

In addition, increasing demand from consumers for aesthetically pleasing interiors and modular furniture is propelling the use of adhesives in woodwork, laminates, and decorative panels.

-

Additionally, advances in adhesive formulation technology, including water-based, solvent-free, and UV-curable adhesives, are offering eco-friendly and safer alternatives for industrial as well as consumer goods.

-

In addition, expansion of the electronics manufacturing sector under Make in India and PLI schemes is creating a greater need for specialty adhesives to be employed in semiconductors, smartphones, and display panels.

-

Besides this, heightened health and hygiene awareness after the pandemic has led to higher usage of medical-grade adhesives and sealants in healthcare equipment and wearable devices.

-

Moreover, a growing move towards organized retailing and DIY behavior in urban households is increasing the demand for ready-to-use adhesives in repair and home improvement applications.

-

Also, enhanced brand promotion and improved accessibility through online platforms are facilitating deeper penetration of tier 2 and tier 3 cities.

-

Overall, the interacting effects of sectoral growth, trends towards sustainability, product innovation, and positive government policies are converting the India adhesives and sealants market into a dynamic and high-potential segment of the chemicals and materials domain.

India Adhesives and Sealants Industry Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest India adhesives and sealants market share. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments.

Adhesive Type Insights:

- Acrylic

- PVA

- Polyurethanes

- Styrenic Block Copolymers

- Epoxy

- EVA

- Others

Sealant Type Insights:

- Acrylic

- Silicone

- Polyurethane

- Butyl

- Others

Technology Insights:

- Water-Based

- Solvent-Based

- Hot Melt

- Reactive

- Others

Application Insights:

- Paperboard and Packaging

- Building and Construction

- Transportation

- Leather and Footwear

- Furniture

- Others

Regional Insights:

- North India

- South India

- East India

- West India

Request for customization: https://www.imarcgroup.com/request?type=report&id=29649&flag=C

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0