How to Check UTR Number: A Comprehensive Guide

we will explain what is UTR number, the full form of UTR, and provide detailed steps on how to check UTR number.

When dealing with financial transactions, especially in banking, one often comes across the term UTR number. Understanding and knowing how to check your UTR number is crucial for tracking the status of your transactions. In this comprehensive guide, we will explain what is UTR number, the full form of UTR, and provide detailed steps on how to check UTR number.

What is UTR Number?

UTR stands for Unique Transaction Reference. This is a unique identifier assigned to each financial transaction made through NEFT (National Electronic Funds Transfer) and RTGS (Real-Time Gross Settlement) systems in India. It helps both the banks and the customers to track and identify a particular transaction.

Full Form of UTR

The full form of UTR is Unique Transaction Reference. As the name suggests, this number is unique for each transaction, making it easy to trace any specific transaction within the banking system.

Why is UTR Number Important?

The UTR number is crucial for:

-

Tracking the status of your transaction.

-

Resolving disputes related to payments.

-

Providing proof of payment.

Now, let's move on to the main topic: how to check UTR number.

How to Check UTR Number

1. Via Bank Statement:

-

Log in to your online banking account.

-

Navigate to the 'Account Statement' or 'Transaction History' section.

-

Locate the specific transaction. The UTR number is usually mentioned in the transaction details.

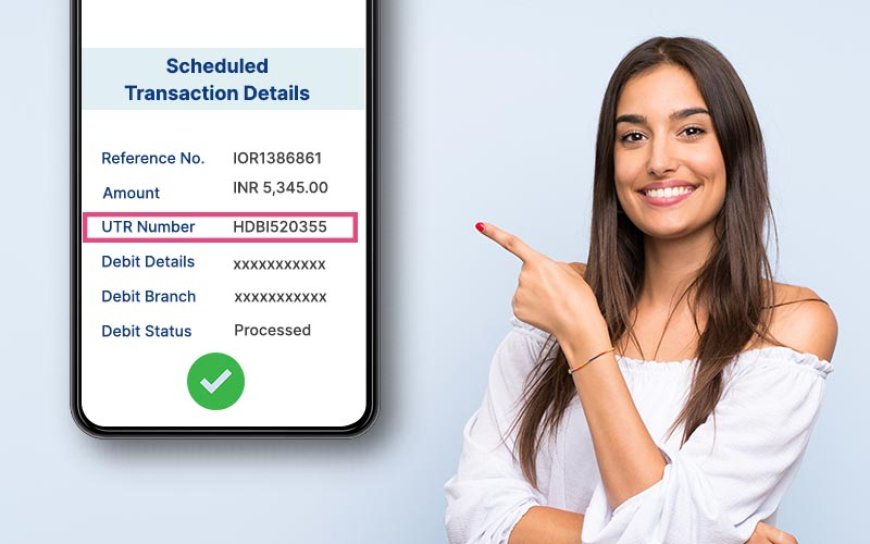

2. Using Mobile Banking Apps:

-

Open your bank’s mobile banking app.

-

Go to the 'Transaction History' section.

-

Select the transaction you want to check. The UTR number will be displayed along with other transaction details.

3. Through SMS or Email Notifications:

-

Many banks send SMS or email notifications for transactions. The UTR number is often included in these notifications.

-

Check your recent messages or emails from your bank to find the UTR number.

4. By Contacting Customer Support:

-

If you cannot find the UTR number through the methods mentioned above, you can contact your bank’s customer support.

-

Provide them with the transaction details such as the date, amount, and account number, and they will assist you in retrieving the UTR number.

Conclusion

Understanding what a UTR number is and knowing how to check UTR number is essential for anyone involved in regular financial transactions. It not only helps in tracking payments but also ensures transparency and accountability in your banking activities. Always keep a record of your UTR numbers for future reference and easy dispute resolution.

By following this guide, you should now be well-equipped to find and use your UTR number efficiently. If you have any more questions or need further assistance, feel free to reach out to your bank’s customer support. Happy banking!

Feel free to reach out if you need any further information or assistance on this topic!

Visit : https://supremeforex.com/