High-Performance Fibers Market Growth Drivers and Opportunities

The global high‑performance fibers market stood at approximately USD 15.4 billion in 2022, with forecasts projecting it to grow to around USD 34.7 billion by 2032, expanding at a compound annual growth rate (CAGR) of 8.7% between 2023 and 2032.

Report Overview:

The global high‑performance fibers market stood at approximately USD 15.4 billion in 2022, with forecasts projecting it to grow to around USD 34.7 billion by 2032, expanding at a compound annual growth rate (CAGR) of 8.7% between 2023 and 2032.

The fibers valued for their strong wear resistance, non‑conductivity, and thermal stability play a vital role in composite materials used in aerospace, defence, electronics, and sports equipment. Their hi‑tech qualities, particularly high strength‑to‑weight ratios, make them ideal replacements for heavier traditional materials like metals and plastics.

A significant share of the market growth can be attributed to rising demand in sectors needing lightweight yet durable materials. Industries such as automotive and aerospace increasingly demand fibers that reduce fuel consumption without sacrificing performance. Technological advances in manufacturing (including 3D printing and nanotech) and the move toward innovative, eco‑friendly fibers are also gaining momentum.

Key Takeaways:

-

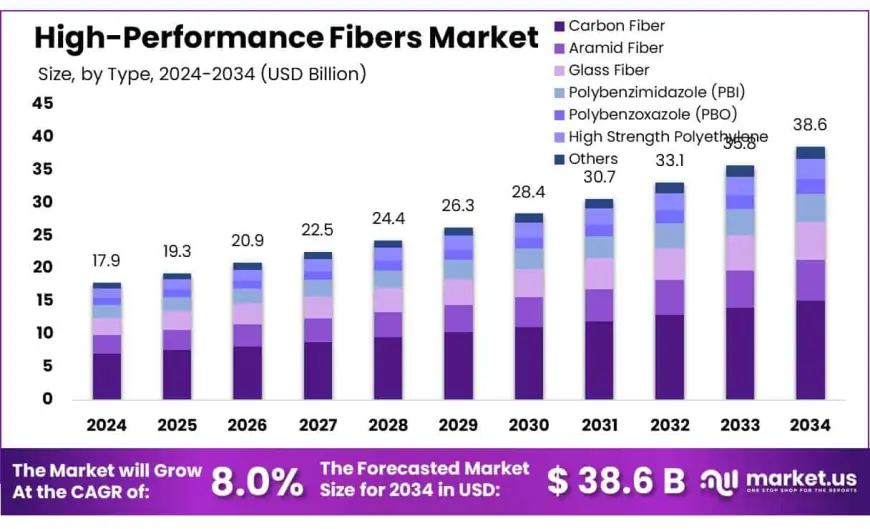

- The global high-performance fibers market was valued at US$ 17.9 billion in 2024.

- The global high-performance fibers market is projected to grow at a CAGR of 8.0% and is estimated to reach US$ 38.6 billion by 2034.

- Among types, carbon fibers accounted for the majority of the market share at 39.20%.

- By category, virgin accounted for the largest market share of 87.3%.

- By end-use, aerospace & defense accounted for the majority of the market share at 46.9%.

- Asia Pacific is estimated as the largest market for high-performance fibers with a share of 46.2% of the market share.

![]()

Download Exclusive Sample Of This Premium Report:

https://market.us/report/high-performance-fibers-market/free-sample/

Key Market Segments:

By Type

- Carbon Fiber

- Ultra-high Modulus

- High Modulus

- Intermediate Modulus

- Low Modulus

- High Tenacity

- Aramid Fiber

- Para-aramid

- Meta-aramid

- Glass Fiber

- Polybenzimidazole (PBI)

- Polybenzoxazole (PBO)

- High Strength Polyethylene

- Others

By Category

- Virgin

- Recycled

By End-use

- Aerospace & Defense

- Automotive & Transportation

- Sporting Goods

- Building & Construction

- Others

Drivers:

The global demand for high-performance fibers is being pushed forward by industries that require materials with exceptional strength, durability, and lightweight properties. In sectors like aerospace, defense, and automotive, there’s an ongoing need for components that can reduce overall weight without compromising on structural integrity or safety.

The fibers provide exactly that strong tensile resistance and heat stability while being lighter than metals. With electric vehicles becoming more common, the use of high-performance fibers in body panels, interiors, and safety components is only going to rise. Their value is not just in performance, but also in helping industries meet fuel-efficiency and emission reduction targets.

Additionally, technological progress has made it easier for industries to integrate these fibers into advanced composite materials. From protective clothing to fiber-reinforced parts in aircraft and electronics, their application scope is expanding.

Governments and manufacturers are also investing in research and innovation to develop better fiber manufacturing methods, including nanotechnology and additive manufacturing. This not only boosts performance but also helps cut down production costs over time. In essence, the growing number of end-use cases across industries is keeping demand strong and consistent.

Opportunities:

As the world focuses more on sustainability and innovation, new opportunities are emerging for manufacturers of high-performance fibers. One major area is the development of eco-friendly or recyclable fibers. With many industries trying to meet stricter environmental regulations and consumer demand for sustainable materials, there’s a real need for fiber types that can be reused or have a lower environmental impact.

Companies working on biodegradable or bio-based high-performance fibers could tap into a growing, lucrative segment. This could also help reduce reliance on synthetic or petroleum-based materials, which are often costly and resource-intensive.

Another promising opportunity lies in expanding into emerging economies where industries such as construction, transportation, and electronics are growing rapidly. These regions are increasingly looking for cost-effective but high-performing materials for infrastructure projects and product manufacturing. If fiber manufacturers can offer multi-functional, customizable solutions, they could access new revenue streams beyond traditional industrial use.

Restraints:

Despite the growing demand, one of the biggest restraints for the high-performance fibers market is the high cost of production. Manufacturing these fibers often involves complex processes and expensive raw materials, which makes them less accessible to small or mid-sized companies.

Even though their long-term benefits may justify the cost, the upfront investment remains a hurdle for mass adoption. For industries operating on tight budgets or looking for affordable solutions, this cost barrier may push them to opt for cheaper alternatives like modified plastics or advanced metals, even if those don’t offer the same performance.

Additionally, the availability and sourcing of key raw materials can pose risks. Certain fibers require rare or limited resources, and any disruption in the supply chain whether due to geopolitical issues, environmental regulations, or natural disasters can significantly impact production timelines and pricing.

Furthermore, the lack of standardized quality measures in some parts of the world can hinder international trade or adoption in critical applications like aerospace or defense. These factors collectively make it challenging for the industry to scale efficiently without investing heavily in innovation and diversification of raw material sources.

Trends:

One of the most noticeable trends in the high-performance fibers market is the increasing move towards lightweight composite materials. Industries are shifting away from metals in favor of fiber-based components that deliver the same, if not better, performance while reducing weight. This is especially true in aerospace and electric vehicles, where every kilogram saved can translate into better efficiency and lower emissions.

The rise of carbon fiber and aramid fiber in manufacturing advanced parts highlights the shift toward more efficient, high-strength solutions. These trends are also fueling demand for hybrid composites that combine various fiber types for optimized performance.

At the same time, there’s a clear trend toward incorporating smart features into fiber materials. From temperature-regulating fibers in clothing to electromagnetic shielding in electronics, high-performance fibers are being engineered for specific applications. Wearable technology, medical textiles, and military gear are seeing innovations where fibers are no longer passive materials but active components of the product’s function.

Also, additive manufacturing (3D printing) and nanotechnology are opening new frontiers in design flexibility and customization. As the need for high-performance yet multifunctional materials grows, fibers that can adapt and evolve with product demands will remain at the center of market innovation.

Market Key Players:

- Toray Industries, Inc.

- Dupont

- Teijin Limited

- TOYOBO MC Corporation

- Kolon Industries, Inc.

- Huvis Corp.

- AGY

- Zoltek

- Owens Corning

- Hexcel Corporation

- KUREHA CORPORATION

- Yantai Tayho Advanced Materials Co.,Ltd

- Mitsubishi Chemical Corporation

- Avient Corporation

- Bally Ribbon Mills

- Honeywell International Inc.

- China Jushi Co., Ltd.

- Solvay S.A.

- Sarla Performance Fibers Limited

- Other Key Players

Conclusion:

Asia‑Pacific led by China, India, South Korea, and Japan remains the powerhouse of market growth, underpinned by strong manufacturing and innovation ecosystems .Looking ahead, success hinges on balancing innovation with cost efficiency. The promise of PBI and other specialty fibers underscores the industry’s strategic importance in high‑tech verticals.

Meanwhile, challenges around material cost and alternative solutions mean keeping a steady focus on process optimisation and new fiber platforms especially those that align with sustainability goals. In sum, this remains a vibrant, evolving market an essential pillar of tomorrow’s advanced materials landscape.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0