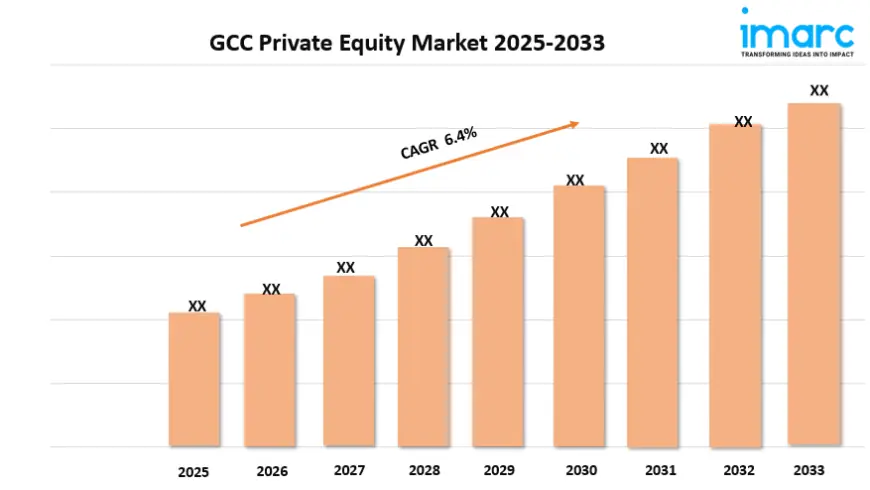

GCC Private Equity Market Trends, Growth, and Forecast 2025-2033

UAE cheese market size reached USD 450.04 Million in 2024. The market is projected to reach USD 703.57 Million by 2033, exhibiting a growth rate (CAGR) of 5.09% during 2025-2033.

GCC Private Equity Market Overview

Market Size in 2024: USD 4.2 Billion

Market Size in 2033: USD 7.6 Billion

Market Growth Rate 2025-2033: 6.4%

According to IMARC Group’s latest research publication, “GCC Private Equity Market Report by Fund Type (Buyout, Venture Capital (VCs), Real Estate, Infrastructure, and Others), and Country 2025-2033", the GCC private equity market size reached USD 4.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 7.6 Billion by 2033, exhibiting a growth rate (CAGR) of 6.4% during 2025-2033.

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Grab a sample PDF of this report: https://www.imarcgroup.com/gcc-private-equity-market/requestsample

GCC Private Equity Market Trends & Drivers:

One of the biggest forces behind the GCC private equity market’s steady climb is bold government reform and a push to diversify economies beyond oil. Vision-driven initiatives, such as Saudi Arabia’s Vision 2030 and the UAE’s innovation funds, are putting a spotlight on sectors like healthcare, tech, logistics, and renewable energy. Governments are rolling out supportive policies, investment incentives, and regulatory upgrades that make it easier for private capital to flow into the region. Major projects and policy shifts are also opening the door for more privatization of state assets, which is fuelling private equity participation across new industries and stacked growth pipelines.

Another big trend catching everyone’s eye is the increasing participation of sovereign wealth funds and global asset managers, plus the rise of family offices becoming true institutional players. With mammoth funds like BlueFive’s new $2 billion GCC private equity pool targeting large-cap deals across healthcare, technology, and hospitality, the market has become far more international and sophisticated. These players bring in not just money, but access to global talent and investment best practices, making the GCC a serious contender on the world stage. There’s also a surge in cross-border co-investments, and a growing appetite for deals in mid-market and growth-stage companies.

Finally, capital is pouring into alternative and innovative sectors like fintech, digital health, and logistics parks, driven by a young, tech-savvy population and new government schemes that lower risk for investors. Programs like Saudi Arabia’s Kafalah and the UAE’s Innovation Fund provide grants and guarantees to start-ups, while regional financial hubs are streamlining regulations for easier investment. Private equity activity in the GCC is no longer just about traditional buyouts; it’s about fueling entrepreneurship, funding disruptive ideas, and opening new avenues for value—and that’s turning the region into a magnet for both local and international investors eyeing attractive returns.

How AI is Reshaping the Future of GCC Private Equity Market

AI is quickly transforming the GCC private equity landscape, with nearly 75% of businesses in the region already using generative AI tools in at least one function—outpacing global adoption averages by a solid margin. Massive government-backed funds like Abu Dhabi’s $25 billion MGX initiative and Saudi Arabia’s $40 billion planned AI investment are just the tip of the iceberg, drawing global partners such as Microsoft and Nvidia into the ecosystem. Sovereign wealth funds and family offices are backing AI-driven companies in fintech, digital health, and logistics, while national strategies ensure regulation and infrastructure keep pace. This surge of capital, energy, and government support is making AI not just a buzzword, but a real driver of smarter deals and new value in private equity.

The GCC private equity market forecast offers insights into future opportunities and challenges, drawing on historical data and predictive modeling.

GCC Private Equity Industry Segmentation:

The report has segmented the market into the following categories:

Fund Type Insights:

- Buyout

- Venture Capital (VCs)

- Real Estate

- Infrastructure

- Others

Country Insights:

- Saudi Arabia

- UAE

- Qatar

- Bahrain

- Kuwait

- Oman

Recent News and Developments in GCC Private Equity Market

- June 2025: Co-investment activity is redefining the private equity playbook in the GCC, with nearly 80% of regional investors planning to boost allocations and almost half now dedicating over 20% of assets under management to private equity. There’s a noticeable turn away from traditional fund structures as family offices and sovereign funds opt for more direct control, lower fees, and greater deal selection power through joint investments and separately managed accounts.

- June 2025: Fintech innovation is surging across the Gulf, with Bahrain leading the region as a fintech hub and making headlines as the first GCC country to license Binance and partner with Mastercard for crypto-backed prepaid cards. Fintech startups are democratizing access to private capital through platforms like Sarwa and Stake, while luxury real estate deals in Dubai increasingly accept cryptocurrency as payment, reflecting the region’s tech-forward investment culture.

- July 2025: Private equity capital is flowing into digital infrastructure and green energy projects across Saudi Arabia and the UAE, propelling the region’s ambition to lead in sustainable development. Data center occupancy rates have hit record highs, generating returns above 11% and outpacing traditional real estate. International investment firms are also launching dedicated funds for the GCC, attracted by government reforms like 100% foreign ownership and large-scale net-zero initiatives.

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St., Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0