Europe Self Storage Market Growth, Outlook, Demand, Key Player Analysis and Opportunity 2025-2033

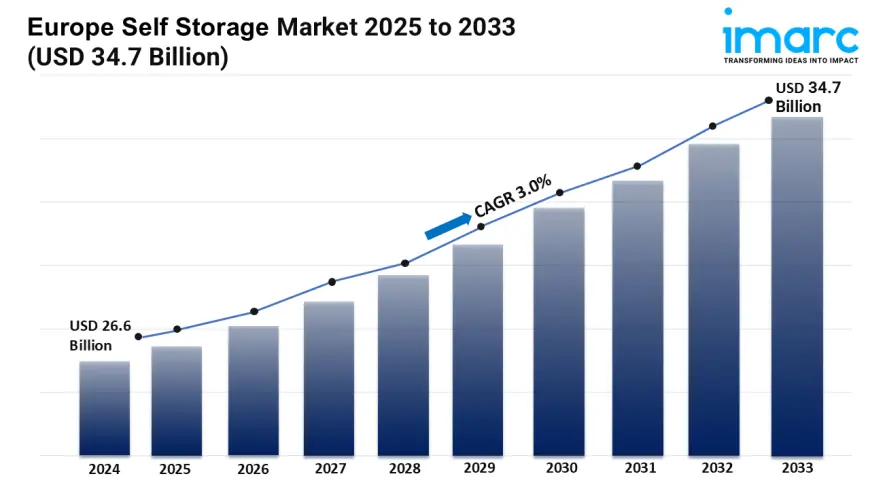

The Europe self storage market size was valued at USD 26.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 34.7 Billion by 2033, exhibiting a CAGR of 3.0% during 2025-2033.

Europe Self Storage Market Overview

Market Size in 2024: USD 26.6 Billion

Market Forecast in 2033: USD 34.7 Billion

Market Growth Rate: 3.0% (2025-2033)

According to the latest report by IMARC Group, the Europe self storage market size was valued at USD 26.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 34.7 Billion by 2033, exhibiting a CAGR of 3.0% from 2025-2033.

Europe Self Storage Industry Trends and Drivers:

As urbanization, digital trade, and changing residential patterns generate ongoing need for flexible space solutions, the Europe self storage market is gradually growing. To negotiate the difficulties of limited metropolitan living space, brief relocations, and excess inventory, both people and companies are becoming more reliant on safe, accessible storage units. Consumer searches for practical means to maximize their surroundings without giving up personal belongings or business operations as metropolitan areas keep growing in population and real estate prices keep going up. From seasonal storage for residential customers to long-term inventory management for business owners and e-retailers, this is fueling the popularity of storage facilities with several unit sizes. The market is confirming its allure among a number of groups, including students, remote employees, expats, and young families searching for safe temporary extensions of their living area, as providers add 24/7 access, climate control, and digital bookings.

Particularly as SMEs and online vendors give cheap warehouse alternatives above conventional logistics models, commercial end-users are also driving momentum across the Europe self storage sector. Small companies are increasingly employing local storage units to simplify distribution and lower operating overhead as last-mile delivery services and e-commerce grow. With scalable units, flexible contracts, and bundled value-added services like package reception and digital inventory tracking, this trend is persuading facility operators to expand their selections. Growing mobile app and automated access control usage is improving operating efficiency and convenience, enabling users to remotely control their storage and minimizing their need on local personnel. Hybrid work models are also affecting corporate need for modular storage that aids workspace reconfigurations, office refurbishment, or equipment downsizing. Beyond conventional applications, these changing use cases are broadening the market and presenting self storage as an adaptive option incorporated in both personal and professional schedules.

With its densely urban scenes, developed storage facilities, and culturally embedded downsizing habit, the United Kingdom is now dominating the regional market. Limited in-home space and increasing rental costs are driving London, Manchester, and Birmingham inhabitants to embrace small living solutions backed by off-site storage. Middle-income families and entrepreneurs are now giving storage access first priority over home development, especially in cities like Berlin and Munich, therefore driving market growth in Germany. France is seeing consistent expansion thanks to increasing demand from students, overseas professionals, and boutique shops in Paris and Lyon, for instance. With storage becoming more commonplace in digital-first lifestyles and urban planning systems, southern European nations including Spain and Italy are undergoing a change in view. Together, these national trends are creating a varied, innovation-driven self-storage environment where digital integration, customer-focused services, and urban closeness are always adding value and fostering long-term market growth across Europe.

Download sample copy of the Report: https://www.imarcgroup.com/europe-self-storage-market/requestsample

Europe Self Storage Industry Segmentation:

The report has segmented the market into the following categories:

Analysis by Storage Unit Size:

- Small Storage Unit

- Medium Storage Unit

- Large Storage Unit

Analysis by End Use:

- Personal

- Business

Regional Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

- Shurgard Self Storage SA

- Safestore Holdings PLC

- Self Storage Group ASA

- WP Carey Inc.

- SureStore Ltd

- Big Yellow Group PLC

- Access Self Storage

- Lok'nStore Limited

- Lagerboks

- 24Storage

- Casaforte

- Pelican Self Storage

Latest News and Developments:

- April 2025: Shurgard opened its first self-storage facility in Stuttgart, with 1,000 units ranging from 1.5 to 22.5 sqm. The EUR 17.1 million facility addressed the growing demand for premium storage. Shurgard also expanded its German presence, with several new projects reportedly planned in major cities.

- February 2025: Heitman acquired a majority stake in Servistore, a Swedish self-storage operator, which operates 31 sites across 14 cities. The acquisition aimed to enhance Servistore's technology-led, unmanned operations and expand its market leadership. Heitman manages over 600 self-storage assets globally.

- December 2024: PGIM Real Estate and Pithos Capital launched a joint venture in France to acquire and reposition self-storage assets. The venture, operating under the Zebrabox brand, aimed to develop and convert properties, and secured six assets as of December 2024.

- April 2024: SpaceGenie, a German self-storage company, opened its first facility in Hassloch, Germany. The company planned to expand with six more locations in the near-term and acquire 11 additional sites.

- April 2024: Shurgard acquired a UK-based Lok'nStore in a GBP 378 million deal, effectively doubling its presence in the UK. Lok'nStore operated 43 self-storage centers in England and Wales.

- January 2024: Ardian acquired a majority stake in Costockage, the leading self-storage marketplace in France. Costockage operates 10 centers and a digital platform enabling storage rentals from professionals and individuals. This acquisition supports Ardian's strategy to diversify into self-storage, a growing sector in France. Ardian will leverage its expertise to expand Costockage’s footprint, focusing on real estate acquisitions and transforming distressed properties. The deal aims to enhance Costockage’s offerings and capitalize on the growing demand for self-storage in France.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=6270&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0